I know why you clicked on this article. 2023 was a defining year for what we like to call ‘equity research.’

Everyone from The Economist to Bloomberg to Reuters spoke about a decline in this branch of the finance business, and some even used words like ‘bloody,’ which are sure to scare you. Provided you are weaker of heart, of course.

Different articles noisily clamoured about the disappearance of ‘sell-side analysts,’ and that is enough to scare away anyone who wanted to get into this business in the first place.

But the truth is that there are still some 10,000 analysts out there that work in brokerages, investment banks, boutique research firms, and even more who work as freelancers.

This is the modern world, after all.

So I decided to write a comprehensive guide on the nature of equity research.

What it is, why you should choose it, how to prepare for an interview, salary expectations, how you can get an internship, and everything in between.

All the info you need is right here, in a single place, in this exhaustive guide in equity research.

What Is Equity Research?

Equity research or ER is seen as a division in a sell-side or buy-side firm. As the name suggests, it handles the investigation that both the firm and all its clients need. But what does this mean exactly?

As an equity researcher, it is your job to provide a very detailed analysis of a company, a sector, or an entity.

You will pass on the information you gathered to investors who will use it to decide where their funds should go to.

You can provide the same services to investment banks or Private Equity firms who will assess different companies as far as mergers go.

Types of Equity Research

In general, you have two types of equity research analysts:

- Sell-side equity research analysts – they build models that will project the financials of a company.

But they also perform qualitative analysis since they meet in person with suppliers, customers, and competitors. - Buy-side equity research analysts – their work is relatively similar to the one performed by their colleagues.

The only difference is that they focus on the best performers that the market has to offer. Their portfolio is also more extensive, seeing in that they follow more companies and in much more detail.

Read the complete guide on How to Become an Equity Research Analyst.

Why Equity Research? Is it Important?

At the beginning of this piece, I noted the steady treacle of articles you might have pointed out in the niche media about equity research, especially in 2020.

With that in mind, I think it’s essential that, in this climate, we ask ourselves one question. Why equity research? Is it important? Is it still relevant?

The short answer – yes. But you didn’t come here for quick responses, and this is a guide, so let me put it like this.

In this field, information is the most valuable thing you can own. Everyone relies on it.

Investors need it to know where their money should go; traders depend on it to see if they should exit or enter a particular position while bankers and other corporate financiers need it to participate in different transactions or to value companies.

As you might have already imagined, all this trove of information has to come from a specific, reliable source.

These are the divisions dedicated to researching the most pressing matters, either inside each company or a single, independent financial unit. The division is, of course, called Equity Research.

You need to use primary and secondary research methods to conduct your equity research.

Equity Research vs. Investment Banking

Both are exciting fields that can be very rewarding if done correctly. But which one is a better fit for you? Here are some key points to help you decide.

- Equity research looks into all the liabilities and assets of an entity. It creates financial reports that will attract users to invest or not.

Investment banking will provide financial services to companies who want to raise capital. - As an equity research analyst, you have to do fundamental analysis, create valuation models, and reports. As an investment banker, you have to prepare pitch books and information memorandums.

- You will work at the front end as an investment banker, but at the back end as an equity research analyst.

- The difference in salary will be steep as well. Investment bankers are usually paid more than equity research analysts.

- Your skillset has to be different, as follows.- investment banker skills – mathematics and financial skills, written and oral communication skills, accounting.

- equity research analyst skills – analytic mindset, research skills, fast decision-making process.

Here’s the guide on key differences between equity research and investment banking.

Equity Research Jobs

One of the most frequently asked questions when it comes to equity research is what are the exit opportunities. In other words, what career choices do you have if you go for this line of the financial world? Here are your options.

- Equity Research Associate – in case you joined a firm as one, you will have the chance to move higher up the hierarchy and become the Senior Analyst.

The next top positions after that are Head of Research as well as Head of Equities. - Private Equity Analyst – this is mainly the domain of sell-side analysts who investigate private companies in terms of investments.

From here on out, you can move up to Private Equity Fund Manager. - Buy-Side Analyst – if you want to work for a Mutual Fund. You will have to cover the position of a Fund Manager as well, at least for a while.

- Investment Banker – as difficult as this might sound, equity research analysts sometimes make a move toward being an investment banker if they began their career as a sell-side analyst. But remember, it won’t be easy!

What Does an Equity Research Analyst Do?

The Analyst is usually at a lower level than the Equity Research Associate, whom I’m going to cover as well for you in this extensive guide.

But for now, let’s look at the Analyst, whose job is to support the Associate in every way possible.

Therefore, as an Equity Research Analyst, you have to prepare the reports based on a company’s financial statements. Analyze the revenue, the costs, and the risks they face.

But you will also have to do most of the research, as the name of your job suggests.

This means gathering enough information to build a cohesive financial model that will then be used to establish the financial position of a company.

The output of the model you create will have to contain a recommendation on whether or not to buy or sell with a return starting from the current price.

All the assumptions made in this way always differ from one equity analyst to the other, which means your reports will be entirely personal as well.

Equity Research Reports – Types and Definition

In several paragraphs above, I mentioned that one of the main tasks of both the equity research analyst and of the equity research associate is to produce reports.

For the company you work for or for the client who has asked for them. But what does that mean exactly?

Allow me to provide you with a definition and a classification for better understanding.

When you write or build an equity research report, here is what sections it should contain. Here’s the detailed equity research report guide.

The financial information and valuation

In this section, write about the company’s income statement and how it will perform, add the balance sheet, the valuation, and the cash flow. Please note that you should never build this section on its own.

Build a financial model in Excel first. This valuation should come as an output of your work there.

Company update

Include here all the relevant, recent information about the company that you can find while you perform the research.

For example, you can add their annual or quarterly results, changes in management, new contracts they might have had in recent months, and every other new piece of information you deem valuable enough for this report.

Investment thesis

Write a summary of why you believe the stock will behave the way you think it will (over or underperform). Say why you think it will reach the specific price you are forecasting now.

This is where your skills in communication that I’ve mentioned earlier will come into play. Since this is the part of the equity research report, everyone will be most interested in, make sure it’s well written and compelling!

If you also have to make an oral presentation based on it, rehearse it a few times!

The recommendation

This part is as straightforward as they get. It’s the part where you make an assessment – buy, sell, or hold.

Talk about the shares in your targeted company and make sure to include a price in your recommendation.

Disclaimers and risks

Write in a summary of all the risks that come with investing in the stock you have targeted.

However, don’t get lost in the details because, when it comes to equity research reports, these risk lists are more like standard lists, which turn into legal disclaimers.

Types of Equity Research Reports

The steps I covered above speak more about the standard or classic equity research report.

However, that doesn’t mean it’s the only one you will come across, or you will be asked to perform. Here are some other types.

- Industry reports – general updates about a handful of companies belonging to a niche sector of a market.

- Initiating coverage – this is a lengthy report that stretches more than 100 pages that you will have to write when a particular company starts releasing stock for the first time.

- Quarterly results – as the name suggests, this is the report you produce every quarter showing the company’s earnings during that period. Insert here any updates the company has gone through during said time.

- Top picks – this will be a list of the top picks of the company as well as the returns they target.

- Flash reports – very small, only one or two pages in size, these reports talk about new releases or other such timely events the company is going through.

Equity Research Analyst Jobs – Where Will I Get Hired?

As an equity research analyst, it’s crucial to know the fields you will be working in. The more details you know about them, the more chances you have of getting hired. But remember – this is most likely a position you will have to work for and get promoted for!

Some sectors of the market that hire equity research analysts are as follows:

- Mutual funds

- Stock brokerage

- Banks

- Wealth management firms

- Credit rating firms

- KPOs

- Database firms

- Media companies

Equity Research Analyst Skills

- Fantastic at financial ratio analysis – Yes, we are now entering accounting grounds, but you will need to be able to master SEC filings and communicate them via an Excel spreadsheet.

- Financial modeling – this involves valuation tools that you will need to use daily.

- Fantastic communication skills – both in writing and orally, since you must publish your reports on a schedule and then communicate them to other team members.

- Very strong with Excel – since you have to produce your analysis as fast and as accurate as it is humanly possible, the number one thing you must do is learn how to save time. Excel will become your best friend for pulling charts and models in no time at all.

Equity Research Analyst Salary

We have arrived at the part you’ve probably been waiting for since the beginning, in case you haven’t scrolled down looking for it.

And that’s fine. Being an equity research analyst is a difficult job, and you should want to be rewarded correctly for it. So let’s talk about money.

A survey that can be found on Glassdoor.com states that the average salary for an equity research analyst is $94, 000.

However, you should know that, in reality, the wages are somewhat lower. Most companies don’t pay that much.

At the low end, this job will bring you some $65, 000 while a top tier position can score you up to $158, 000.

Most firms that hire equity research analysts these days are private equity firms.

The majority of them are now located in New York City, but you will also be able to find some in other cities such as San Francisco, Chicago, or Boston.

What Does an Equity Research Associate Do?

The Analyst is not the only job you can perform in this field. You can also work as an equity research associate. So here are some details that you will find useful.

As an equity research associate, your position differs from that of an analyst, seeing as you will need at least three years of experience in this field or a similar one.

As far as tasks go, you will have to verify the data comprised of financial models, update them, and prepare all the valuation models.

If there are requests from clients, they will fall under your responsibility as well. They can include tasks such as detailed industry analysis or data research.

But you will also have to prepare Equity Research Reports that include results, events, and other such types of data.

During the day, an Equity Research Associate participates in meetings and takes calls from clients about the stocks you are currently covering.

Equity Research Associate Jobs – Where Will I Get Hired?

Associates work in roughly the same type of companies as the analysts do, just as outlined above.

Therefore, apply for a job with a stockbroker, bank, KPO, wealth management firm, or credit rating firm, and you should be able to find the position you covet.

Equity Research Associate Skills

- Perform research – this means statistical data, financial reports, and news from the industry that will help you create reports.

- Security analysis – use your research as well as the financial models you can create to produce valuable investment analysis.

- Deliver financial models – your financial models have to show projections of the profit on investments over a specified period.

- Come up with investment ideas – unlike the equity research analyst; you will also have to make plans and recommendations to your clients that will generate profit for their companies and help them grow over time.

Equity Research Associate Salary

According to payscale.com, the average salary for an equity research associate is $72,734.

This might look like less than what GlassDoor has down for an equity research analyst, which is a position lower than this one. And you’re right.

However, as a research associate, you can also earn a yearly bonus, which, according to the same source, can come up to $15, 000, as well as close to $2, 500 in profit sharing.

Equity Research Resume

Before I give you all the details you need on how to build your equity research analyst resume and make it stand out, there is something I need to mention here.

The role of Analyst, be it a senior or junior one, is a position you need to advance to. In other words, you most likely won’t be able to access it straight out of your Master’s program or your undergraduate’s.

What you need to do is apply for a job with a strong resume, stay in that position for a few years, depending on the circumstances, and then make your way up to the level of Equity Analyst.

Well, if your company has an opening for it. This is the second thing you need to know at this point.

Most people in the industry state that it can be somewhat problematic to go up the hierarchy if you stay at the same company or bank.

The reason is that most Equity analysts don’t quit their jobs out of their own volition. As a result, there won’t be an opening for you to move up.

Therefore, if you want to advance past your current post, move to a different company or bank. And with the move, go up a position. But for this, you will need a strong resume. So let’s see what that entails.

As usual, when it comes to a good resume, it’s not the formatting the matters, but rather what you write in it. You know, the old substance over form.

The format will be simple enough to get through. For example, here is a good sample of an equity research analyst resume; you can use courtesy of myperfectresume.com.

So let’s talk about content. The number one thing you should outline in your resume is your objectives.

Write a catchy objective statement at the top of your resume that will get their attention.

Use the company’s name for a more direct and personal approach.

If you are sending more than one resume, try to make each objective statement as personalized as possible for every bank or company you are applying to.

Remember – copy-paste is not the way to go here!

Here are some examples of objective statements to guide you.

- Detail-oriented Analyst with five years’ experience in the industry, exceptional research, problem-solving, and analytical skills looking to find a position as an Equity Research Analyst with Company (insert name here).

- Looking for an Equity Research Analyst position with Company (insert name here) that will allow me to use persuasive communication, research, analysis, and technical skills.

- An analytical person with more than 10 years’ experience in the field, looking for a position at Company (insert name here) to develop critical thinking, research skills, and Excel proficiency.

Equity Research Interview Questions

We’ve covered the resume, so what comes next if you have sent in a strong application that managed to get you noticed? You have secured an interview! Take a step back and congratulate yourself, because like I explained a little way above, this is no small feat.

The best thing to do is to start preparing as soon as possible. Chances are there will be quite a few candidates for the same position since there won’t be many outside hires. Therefore, you need to shine and show them you are perfect for this position.

Here are some questions you might be asked during the interview.

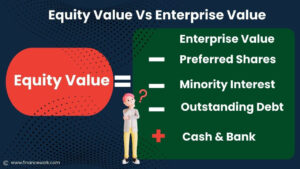

- What is the difference between enterprise value and equity value?

- Tell me the most common ratios you use to analyze a company.

- What is financial modeling? Why do you think it’s useful for equity research?

- Can you perform a discounted cash flow analysis?

- Tell me what free cash flow to equity is.

- Please define the earning season.

- Can you tell me about the ‘restricted list?’ Does it affect the way you do your work?

- Tell me the difference between Trailing PE and Forward PE.

- If you had $10 million as a portfolio manager, what would you invest it in?

- Which one is better, EBIT, or EBITDA?

Please remember that these are just a few examples I gave here just so that you can get an idea of what goes on during the interview.

However, they can ask you any other question of the same nature they see fit, so be prepared!

Learn more about Equity Research Analyst Interview Questions and Answers.

Equity Research Firms

You now know how to create your resume, how to prepare for an interview, and how to ace it. But where do you apply?

I have a list of the top equity research firms and details on each of them so that you can make an informed decision.

- JP Morgan Chase and Co.

- Bank of America Merrill Lynch

- Barclays Capital

- Credit Suisse

- Citigroup

- Goldman Sachs

- Alliance Bernstein L.P

- Morgan Stanley

- UBS

- Nomura Holding Inc.

JP Morgan Equity Research

Registered in 1895 and the 6th biggest bank today, JP Morgan is the giant of the list by far. It is also the most significant investment bank in America and the place to work if you’re trying to excel at stock acquisitions.

It will prove to be a great office space for every beginner who wants to learn new tricks of the trade but also for more seasoned analysts who wish to sharpen their nails, so to say.

Goldman Sachs Equity Research

16% of Goldman Sachs’ revenues come exclusively from lending accounts and investment. One of the things you will love the most at Goldman Sachs is their office culture.

They have the right name for treating their employees well and creating a positive atmosphere for everyone.

Goldman Sachs has some 32 000 employees working for them all over the world, and they consider this to be their best asset.

Morgan Stanley Equity Research

At well over a staggering 60, 000 employees, Morgan Stanley now has offices in some 42 countries around the world.

In 2008, they opened the Morgan Stanley Investment Bank and had taken over quite a several companies since then. However, they have had their share of controversies over time regarding customer miss guidance.

Bank of America Merrill Lynch Equity Research

One of the most exciting things about them is that they have both individual clients and governmental ones.

The Bank of America acquired its other half Merrill Lynch in 2009, and since then, they have been centering their business around their clients.

Equity Research Internship

If you’ve already tried searching for an equity research internship on LinkedIn, for example, you might have noticed something.

That there are not that many. The reason is that equity research doesn’t produce such a high turnover. So who will offer you one?

- Elite boutique banks

- Bulge-bracket banks

- Middle-market banks

- Asset management firms the likes of Fidelity and Vanguard

- Independent research firms such as Bernstein, Redburn, Green Street Advisors, Arete Research, Agency Partners, or Telsey.

What Does an Equity Research Intern Do?

If you have been the lucky winner of one of the rare equity research internships, it’s time to get ready. Start by reading exactly what you will be doing.

Note: Please understand that even for an internship position in the equity research field, you will still have to be licensed.

You will also be working full time at the bank or company who was kind to give you an internship. These are the tasks they will appoint to you.

- Create equity research reports.

- Communicate with clients and other third parties.

- Research market and industry data.

- Make a summary of the news and the most recent events your company went through for the entire company.

- Update the valuation data and all the lists of public companies that are comparable.

- Contribute to valuations and statement models.

- Contribute to initiating coverage reports.

How Do I Get an Equity Research Internship?

There are a few practical things you can do if you want to secure an internship with an equity research company.

- Submit your resume or application online if the company or bank has such an option.

- Use networking for unofficial positions. It will be more likely to work better if you already know someone who works inside the bank or company.

- Research professionals on sites such as LinkedIn and email them about your intentions. You can also find their info on Bloomberg, FactSet, or Capital IQ.

- If you do not have any experience in the field, do not attach any materials written by yourself to your resume or pitches. This includes models or sample reports.

- Include such stock pitches in the shape of a quick test if you are sure you have the experience necessary to do it.

Here’s the complete guide on equity research internships.

So what’s the conclusion?

As you can see from this exhaustive guide on the field of equity research, there is a lot to unpack. You are especially taking into account everything that has been happening lately.

This ultimately means that this branch of the industry is a living one that you need to keep up with at all times.

Whether you find an internship, a position in a bank, or as a freelancer, keep your eyes on the fluctuations of the market and start learning as soon as possible.

Why not begin with this guide? It has everything you need in one place!