Are you struggling to break into one of the lucrative careers in asset management?

There’s no better time to get up to speed if you are.

Change in the asset management industry is now accelerating at an exponential rate. Recent studies indicate that if current growth is sustained, the industry’s penetration rate (managed assets as a proportion of total client assets) will expand from 39.6% in 2016 to 42.1% by 2025.

What does that tell us?

There is a massive demand for resources in asset management careers—job opportunities.

That’s why, if you want to work in asset management, it’s vital that you at least know the basics of navigating through the industry dynamics.

That’s why, in this article, I set out on a journey to guide you through the intricacies of asset management careers.

Before we get there, let’s take a look at what asset management is.

What Is Asset Management?

Asset management is developing, maintaining, operating, and selling the assets belonging to an individual or a company most efficiently or cost-effectively possible.

You will also hear asset management referred to as wealth or why asset management is. We commonly use this term in finance when discussing an individual or a firm that manages another individual’s or company’s wealth or assets on their behalf.

Asset Management: Overview

Asset management is the systematic approach of overseeing and controlling an individual’s assets to maximize their value and optimize their utilization.

Asset management firms administer the investment money of their clients to achieve a financial objective within specific guidelines of the investment pool.

Assets include:

- Physical or tangible assets such as properties, vehicles, and personal belongings.

- Intangible assets like investments, savings accounts, and intellectual property.

- Various financial instruments include pensions, retirement, hedge, or simple mutual funds.

Assets management can be done using various financial vehicles like:

- Derivatives

- Options

- Futures

- Equity scrips of securities

Depending on the client’s objectives and risk appetite, asset managers manage the mutual funds and ensure that their financial goals are achieved.

What principles do asset managers use?

Asset management has three fundamental principles that asset managers use. They include:

#1. The “Failure Modes” Principle – not all assets fail similarly.

#2. The “Probability” Principle – not all assets of the same age fail simultaneously.

#3. The “Consequence” Principle – not all failures have the same consequences.

Asset managers utilize the fundamentals of asset management to achieve favorable outcomes for their clients.

Asset managers can effectively navigate the financial landscape and deliver positive results by adhering to fundamental principles and employing strategic practices.

What’s the goal of asset management?

Let’s clarify here…

Asset management aims to enhance an individual’s overall performance and efficiency by ensuring that assets are acquired, maintained, and disposed of strategically and cost-effectively.

This involves various activities, including planning, procurement, operation, maintenance, and disposal.

Recently, technology has become an invaluable tool in individual asset management. Various software applications and online platforms are available to track and monitor investments, budgeting, and financial planning.

The Best asset management software options of 2023

- Best overall: ManageEngine AssetExplorer

- Best for small to medium businesses: InvGate Assets

- Best for custom reporting: Ivanti IT Asset Management

- Best value: Asset Panda

- Best for mobile applications: MMSoft Pulseway

- Best for tracking physical assets: GoCodes

These tools provide asset managers with the following metrics, empowering them to make informed decisions and take control of the financial future of their clients:

- Real-time insights

- Goal tracking

- Financial analysis

Simple? Let’s discuss more about this in the next section.

How Does Asset Management Work?

In this section, you will learn how asset management works using retirement funds as an example.

What is a retirement fund?

Retirement funds are a substantial pool of money that individuals contribute to throughout their working years to secure their financial future during retirement.

Let’s use an example from retirement funds to put this into perspective.

Let’s consider Blackstone’s retirement fund scheme. Given the company’s large employee base, the monthly contributions to this retirement fund will be significant.

One of the downsides of holding such a considerable amount of money is that economic factors such as inflation and deflation can impact the mutual fund’s value and lead to its depreciation.

To prevent financial harm, retirement funds need to be invested in financial markets to enhance their value, ensuring a reliable source of income for retirees.

That’s where asset management firms play a crucial role in this process by strategically investing the funds across different asset classes.

- Through thorough quantitative and qualitative analysis, researchers identify promising stocks, commodities, or government bonds likely to be appreciated over time.

- Then, the portfolio management team considers the investment preferences of the retirement fund client and creates a risk profile based on those preferences.

- Subsequently, asset managers invest the funds and monitor their growth over a specific period.

This is the day-to-day operation of an asset management firm regarding retirement funds; the same is true for all other assets.

They aim to maximize returns and secure a financially stable future for retirees through prudent investment decisions and careful monitoring.

Sounds interesting?

Now that you’ve understood how asset management works let’s take a quick look at what an asset management company is.

What Is an Asset Management Company?

As explained in the above section, investors spend all their time and effort figuring out how to make money from their existing money.

But they don’t have time and hold on; they’re not experienced enough to manage their wealth. That is where asset management firms come into the picture.

What do asset management companies do?

An AMC will direct the investor’s capital into distinct investments such as the following link:

All investments are handled according to a process or an investment management mandate formulated internally to make a profit.

One of the questions I get the most concerning AMC is:

Why does AMC work primarily with big companies and wealthy individuals?

The answer is simple enough, and it will help you pick out your client base in the future.

Providing the same services to smaller investors at a satisfying price would be challenging.

A prominent investor will always have a private account with an asset management company.

Cash goes from the client’s account into that of the asset management firm. In some exceptional cases, they may even use what we call a third-party custodian.

After that, the portfolio manager’s job is to handle the portfolio using his power of attorney. As simple as that!

You’ll realize that asset management firms do not exist in isolation; some experts must pull the strings behind the scenes. In the next section, I’ll reveal who these guys are.

What Is an Asset Manager?

We have answered the question that most of you want answered.

We’ve already discussed the field in itself and the company, but what exactly does the asset manager person represent?

Here we go.

The simplest way to understand the concept of an asset manager is to think of him as a custodian of all money on behalf of clients.

Or what we would call, in better terms, —assets.

This person has studied investments and, of course, assets themselves.

So, I can comfortably say that they can:

- Assess the wealth of your assets

- Show you what to do with them

- Where to invest them and how to do it

But they are also able to identify if there are any risks in those investments as well as any gains you might draw from them.

The asset manager has a lot of experience and can tell you precisely the following:

- How certain assets will perform on the market

- What you can expect from them

- How they will grow over time, or if they will grow at all

An asset manager is a guardian who looks out for your best interests.

This is how you have to think about this job. And this is how you have to present yourself to your clients.

What Does an Asset Manager Do?

Now let me tell you a story.

Have you ever heard the parable of the Master who had three servants? Relax a little and enjoy.

“There was once a Master who had three servants. He gave them all some money and instructed them to take care of it.

The first servant went to the market and tried to make something out of the money but failed.

The second servant also tried to win more but lost it all.

Seeing the other two fail and lose everything, the third servant buried his money in the sand to keep it safe.

In the end, the Master punished one of the servants for failing.

Who do you think it was?

The servant who buried the money in the sand”.

Why?

The moral here is that you can only make money if you try to grow it somehow.

Of course, you might fail a few times, but in the end, you will get there. A good asset manager will learn to put in the effort needed to accumulate more and grow the money.

That’s what an asset manager does. They take money from clients and organizations and invest it in the market to make a profit.

Please note that I’m not saying asset management is about investing money anyhow—as long as you have done something, be it.

Working as an asset manager involves leveraging your knowledge and skills in finance, assets, and markets to bring out the best value of an asset on behalf of your clients.

Have you ever read “Never Split The Difference” by Chris Voss? If you haven’t, you better do because the same principles in his book about negotiation apply in this field too.

Asset managers use this kind of knowledge when they enter the market.

This brings us to the next important question when discussing asset management careers.

How Do Asset Managers Make Money?

So, how exactly do asset managers make money? There are two main ways. Let’s explore!

#1. Management fees

Management fees are a primary source of income for asset managers.

Asset management firms typically charge their clients a management fee based on a percentage of the total assets under management (AUM).

This fee compensates the firm for the following:

- Expertise

- Research

- Ongoing management of the client’s portfolio

The percentage can vary depending on the size of the investment and the complexity of the assets being managed.

Let’s use figures to expound more.

The ongoing charge fee (OCF) for managing the client’s portfolio takes a percentage of the total assets. For example, a fund of $100 million with an OCF of 0.8% would charge $800,000 in fees.

Sometimes this can be a tiered structure, and fees may decrease as the business grows.

#2. Performance fees

In addition to management fees, asset managers may also earn performance fees or incentive fees. These fees are based on the investment performance of the client’s portfolio, usually measured against a benchmark or predetermined target.

Suppose the portfolio outperforms the specified benchmark or achieves a certain level of return. In that case, the asset manager may be entitled to a share of the profits as an incentive fee.

Performance fees align the interests of the asset manager with the client’s goals, as they are rewarded for generating positive investment returns.

For example, suppose a fund aims to outperform the Financial Times Stock Exchange (FTSE) 100 index by 2% annually. In that case, any return above this 2% target can be subject to a performance fee of 20%.

So, should the strategy outperform the FTSE 100 by 6% (which exceeds the target by 4%), the asset manager will charge a 20% performance fee on the additional 4% of returns.

Typically, the fee structure can vary from firm to firm. Still, an annual fee of one to two percent of the total value of assets managed is standard.

Annual Fee = 1% or 2% of Total Value of Assets Managed

The asset managers’ profitability is influenced by the following factors:

- The size of their client base

- The performance of the investments they manage

- The competitive landscape of the asset management industry

That’s why successful asset managers strive to deliver consistent returns and value to their clients, enhancing their reputation and attracting new investors.

Sounds intriguing? Let’s turn the pages to another vital aspect of investment banking and asset management careers.

Why Asset Management?

The importance of asset management is one of my favorite topics to talk about.

I get asked this question by individuals who want to follow asset management careers and businesses that don’t know why they should hire an asset manager or work with an AMC.

Here are some reasons broken down for you.

1. Helps companies track their assets

The asset management process makes it incredibly easy for companies to manage their fixed or liquid assets.

In this way, company owners know where their assets are, how they are being used, and how or if they are being changed.

As a result, any recovery of assets, if necessary, becomes far more accessible and efficient. This, in turn, leads to higher returns.

2. Guarantees accurate amortization rates

As all the assets are being checked regularly, the financial statements that come with them are also being updated.

3. Risk management becomes manageable

Risk management of assets is a big part of asset management, and you face it daily when dealing with asset management careers.

As a result, a company is prepared should something risky come its way.

4. Helps remove ghost assets from the inventory

Many instances exist where a company’s inventory still holds damaged, lost, or stolen assets.

However, when you have an asset management plan in place or a good asset manager, for that matter, the company can be aware of these ghost assets and remove them from their books.

Another question that I would like to answer in the next section is; why should you work in asset management?

Why Work in Asset Management?

Asset management has excellent reasons for folks like you. One perk is tracking your progress by meeting goals, keeping you driven.

Here’s why you should consider it:

- Exciting challenges: Asset management is a dynamic field where you’ll tackle daily market changes, perfect for finance enthusiasts.

- Making a difference: As an asset manager, you help clients achieve financial dreams, like retirement or business growth.

- Diverse teams: You’ll work with people from various backgrounds, fostering creativity and learning.

- Analytical skills: It sharpens your analytical and strategic thinking abilities.

- Rewards and growth: Asset management offers competitive pay and a path to higher positions.

- Global Exposure: You’ll connect with clients worldwide, expanding your horizons and network.

Let’s now move on to another aspect of this guide.

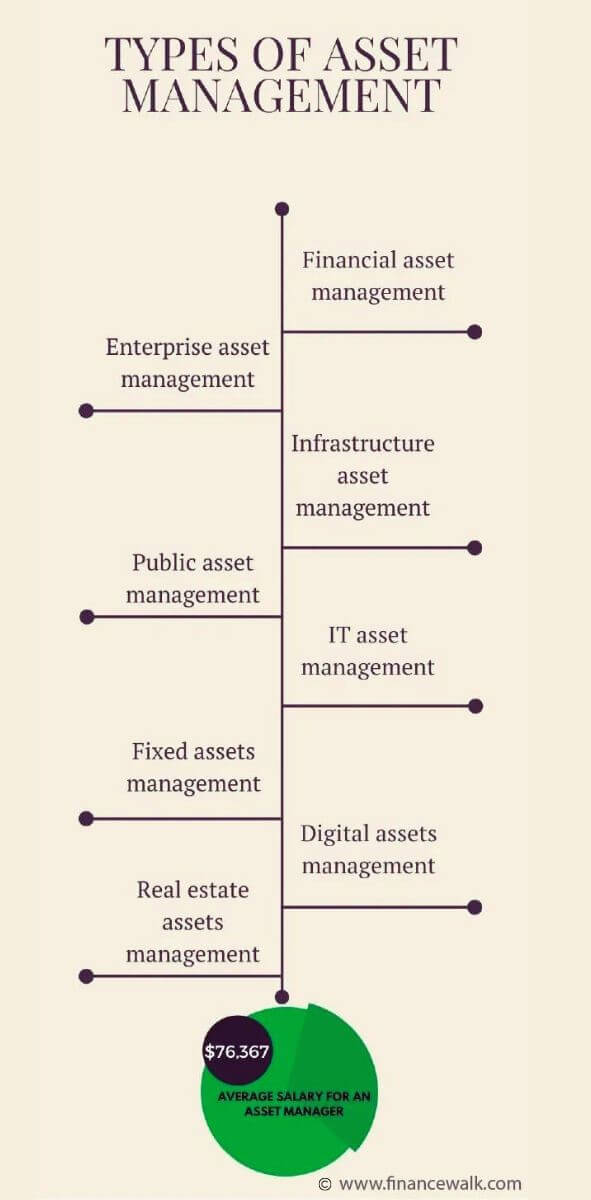

Types of Asset Management

Asset management is an extensive type of business management, which is crucial to understand, especially when discussing asset management careers.

As a result, it includes different industries and disciplines, as you can see below:

#1. Financial asset management

This is the classic type, often referred to as asset management. As noted above in length, it involves managing investment accounts as well as hedge funds for clients.

#2. Enterprise asset management

This branch involves managing the fixed assets of an organization. They include operation, acquisition, decommissioning, and maintenance.

We could also expand this definition to include intangible assets in it.

#3. Infrastructure asset management

As the name suggests, it refers to managing public infrastructure – bridges, roads, electric grids, and waterways.

The focus here will always be on the infrastructure’s rehabilitation, maintenance, and replacement.

#4. Public asset management

This branch is quite similar to the one above. Its goal is to manage public institutions such as schools, airports, parks, and all public spaces.

#5. IT asset management

Managing and accounting for all functions of IT assets, both software and hardware. This can mean maintenance, contract, and management.

#6. Fixed assets management

A branch that concerns itself with tracking and managing fixed assets. Its purpose is financial accounting, loss prevention, and maintenance.

#7. Digital assets management

Managing all the information a company owns, has the right to use, or controls in any way.

Out of all these possible asset management careers, there is one that, in the current climate, interests people the most.

So I’ve decided to dedicate a few words to it and give you some information that you will find helpful. So let’s talk in-depth about real estate asset management!

What Is Real Estate Asset Management?

First, you must know that real estate asset management is an umbrella term.

It’s a branch of asset management in which the asset manager gives investors who are interested in commercial real estate information about investment opportunities on the market or advice about their existing holdings in such a way as to maximize their value.

Some examples of this concept that I could give you would be professional recommendations that you, the real estate asset manager, make to your client, such as the following:

- Buying existing properties

- Developing new properties

- What to choose as an asset class between multi-family, office, retail, etc.

- Strategies will increase the value of your client’s real estate assets.

What Does a Real Estate Asset Manager Do?

The real estate asset manager job description is a very interesting one.

As a real estate asset manager, you are responsible for the financial performance of your client’s real estate assets.

But what does that mean? To put it as simply as possible, you will have to find the balance between gaining returns from investments and calculating risks, which will lead to the increased value of your client’s portfolio.

Here are some examples of how you can increase that value.

- Effective leasing

- Capital reinvestment

- Property management

- Development potential

- Balance sheet management

How to Become a Real Estate Asset Manager

You know what you need to do now. Once you get the job, I mean. But how do you get the job?

The real estate asset management career path depends very much on the category in which you plan to work.

That being said, like asset management, real estate asset management is also an umbrella term.

It encompasses many different categories and asset management careers that you can follow.

Here are the real estate asset management jobs you can choose from:

- Site manager – handling a residential property, condominium, group, or apartment. You are in charge of the site’s daily operations and are the medium between the owners and the tenants.

- Regional manager – you handle a network of properties across a vast geographic area that can be commercial and residential.

- Property manager – you must design plans for managing the property and ways to handle both tangible and intangible assets.

- Asset manager – you are the owner’s representative and make financial decisions on their behalf. As a result, you understand that all your decisions will affect the asset.

- Management executive – you handle the company more than the actual property and act as its manager.

Review this list and decide what branch of real estate asset management career you want to work in.

Once you do, focus on your education, training, and skills in the real estate industry.

Regarding education, you need a real estate bachelor’s degree.

However, you can also find jobs in this field if you have a related degree in finance or business administration.

Please be aware that most applicants for a job in real estate asset management also have training in machine repair and equipment handling!

Also, here is something that I am compelled to add to give you as much information as possible.

Unfortunately, it’s not very easy to get a degree in property management, as there aren’t many institutions or schools that offer such programs.

As a result, if you intend to work in this field, you will have to either find a private institution or try to apply for a job using an alternative degree. Which brings us to this.

Who will hire me as a real estate asset manager?

Here are some of the sectors you can find a job in:

- real estate asset management companies

- charitable and religious organizations

- real estate development companies

- commercial banks

- real estate investment trusts

- mortgage brokerage firms

How to Become an Asset Manager (Step-by-Step Plan)

Let’s talk about why you clicked on this article. How can you become an asset manager?

The internet is filled with advice on getting into asset management. But very few truly stand out as exceptional and helpful in this career.

I spent countless hours trying to handpick the right strategies and season them with real-time references to help you break into this career. Let’s get started.

Step 1: Self-assessment and goal setting

First, take some time for self-reflection and assess if a career in asset management aligns with your interests, skills, and long-term goals.

Consider your strengths in financial analysis, strategic thinking, and problem-solving. Think about the impact you want to make in the real estate industry.

Ask yourself questions like:

- Do I enjoy analyzing investment opportunities?

- Do I thrive in a fast-paced and dynamic environment?

After that, set clear career goals.

For example, you might aim to become a real estate asset manager at a reputable firm overseeing multi-million dollar portfolios within five years.

Setting specific goals will help you stay focused and motivated throughout your journey. With the guidance of Inner GPS, you can make informed decisions that align with your passions, strengths, and values.

I highly encourage you to explore our Inner GPS Career Coaching to discover how our expertise can support you in making the right career choices and achieving long-term fulfillment.

Step 2: Networking and internship

- Networking: Networking is essential in asset management, connecting with industry professionals, attending events, and joining associations. Building relationships with experts you meet can lead to valuable insights and internship opportunities.

- Internships: Consider internships at real estate firms, investment banks, or asset management companies. Focus on a specific area, like interning at a REIT or assisting a hedge fund and manager, to enhance your resume for an asset manager position. Remember the industry’s growing environmental focus and aim to gain relevant experience early on. These internships offer practical exposure and learning from seasoned professionals.

Step 3: Building a solid educational foundation

A vital education is critical to success as an asset manager. Get a bachelor’s in finance, economics, or business. Take courses in real estate finance, investment analysis, and financial modeling. Specialize based on your desired asset management path.

Let me give you an example.

- Suppose you are expected to handle assets that include heavy machinery in your future asset management career. In that case, you need a degree in industrial engineering.

- Or, if you will be handling intellectual property and patents in terms of assets, this is what you need to study.

- I advise you to look at The International Standard for Asset Management, more commonly known as ISO 55000, which I have linked here.

However, suppose you’re planning a career in managing financial assets. In that case, you are looking at a completely different set of skills and an educational background for which you must prepare.

For this, you need a finance or business degree.

- When you graduate, enroll in an advanced course, such as an MBA. When you graduate from that stage, you’re still not done.

- Consider obtaining advanced certifications such as the Chartered Financial Analyst (CFA) designation or the Chartered Alternative Investment Analyst (CAIA) designation.

- You can also look into the BIWS Training Program and Certification and ask me more questions! Are you done now? Not quite.

The purpose of obtaining these credentials is to demonstrate your expertise and commitment to the field, which will give you an upper hand in gaining practical experience and a leg up against the competition in the industry.

Step 4: Gaining practical experience

While education is essential, gaining practical experience is equally crucial.

- Look for opportunities to work on real estate projects or assist professionals in conducting market research, financial analysis, and property valuation.

- You can also consider joining real estate investment clubs such as ACRE of Pittsburgh, Inc., or participating in real estate development competitions to enhance your practical skills.

- Aim to work in different real estate industry sectors, such as residential, commercial, and industrial properties.

This diverse experience will provide a well-rounded understanding of the market and make you a versatile asset manager.

Step 5: Job search strategies and application process

Prepare for a career in asset management by creating a job search plan:

- Network with experienced professionals in the field and leverage your connections.

- Use online job platforms for real estate and asset management roles.

- Customize your resume and cover letter to emphasize relevant skills.

- Highlight financial analysis, risk management, and portfolio optimization expertise.

- In interviews, display industry knowledge, problem-solving skills, and potential contributions to employers.

That’s not all. In the subsequent sections, I’ll delve more into how you can navigate a job search and the right strategies to get you successful throughout any job application process.

Ready to learn? Let’s get right into it.

Asset Management Resume – Learn How to Shine

As an asset manager, you have a large number of options when it comes to your resume. This is fantastic news, considering we’re talking about asset management careers.

You can focus on your subjective skill sets (which you choose) or more quantifiable achievements (if you have them, considering you are not a beginner).

Let me give you an example.

- In your resume, state achievements such as saving X money by implementing changes to your design to existing contracts for properties managed by specific vendors.

- Make your resume concise and clear.

- If you want, you can add an asset management cover letter to make your intentions clear.

- Use bullet points to get all the information and attach a numerical value to them.

This will make it very easy for the employer to read your resume. Plus, it will be a simple talking point when you are eventually called for an interview. Which we will delve into in a moment, but first…

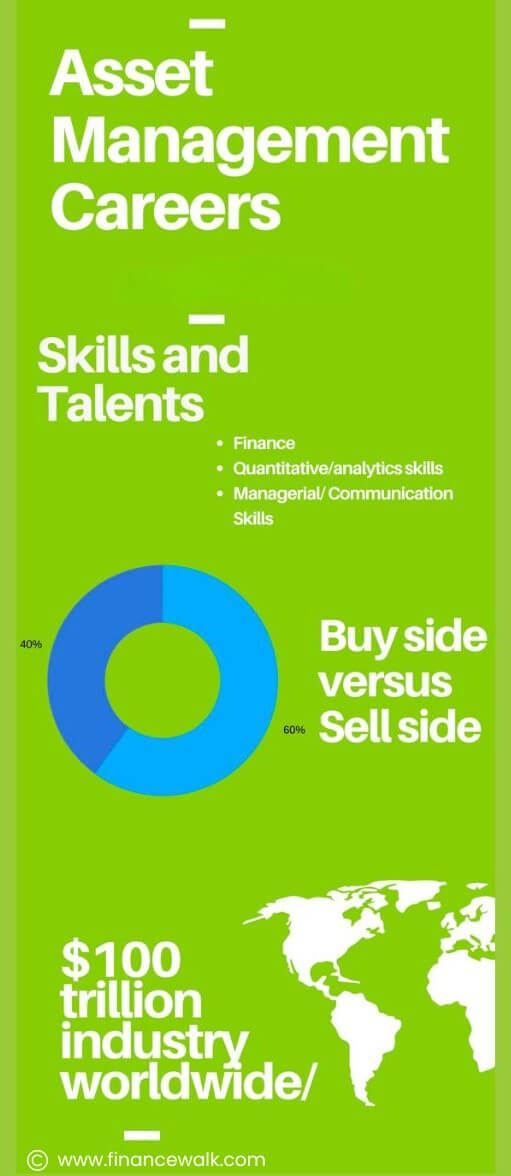

Asset Management Skills and Talents

To be able to work for an asset management company, you must possess specific skills and qualifications to succeed.

The following is a list of critical skills that would be required to get entry into an asset and mutual fund management firm:

#1. Academic background and degrees

This is the first and foremost requirement of any asset management firm.

- You need to have a proper graduate or postgraduate degree in finance to start a career as an asset manager.

- Most employers prefer candidates with bachelor’s degrees or higher in finance, economics, business administration, or a related field.

- This educational background provides a solid understanding of financial principles, investment strategies, and market dynamics.

For example, you might consider pursuing a Bachelor of Science in Finance or a Bachelor of Business Administration with a concentration in investments.

Preferably, the big companies would want specialized courses like CFA (Chartered Financial Analyst) for key positions and even an MBA (Master of Business Administration) specialized in finance.

These programs typically cover financial management, investment analysis, portfolio management, and risk assessment.

#2. Relevant courses and certifications

While a degree provides a broad knowledge base, it’s super important to supplement your education with relevant courses and certifications to enhance your asset management skills.

- Consider taking courses in financial modeling, investment analysis, real estate finance, and risk management.

- Additionally, earning industry-recognized certifications can demonstrate your expertise and dedication to the field.

For example, the Chartered Financial Analyst (CFA) designation is highly regarded in finance. It covers a wide range of investment-related topics.

Another valuable certification is the Certified Commercial Investment Member (CCIM), which focuses on commercial real estate and investment management.

#3. Technical skills

Asset management requires proficiency in various technical skills. Some essential technical skills include:

- Financial analysis: You should be adept at analyzing financial statements, evaluating investment opportunities, and conducting risk assessments. Proficiency in financial modeling and valuation techniques is crucial for making informed investment decisions.

- Data analysis: Strong data analysis skills enable you to extract insights from market data, identify trends, and assess the performance of real estate assets. Knowledge of statistical analysis tools and software, such asExcel, R, or Python, can be highly beneficial.

- Real estate market knowledge: To effectively manage real estate assets, you need a deep understanding of market dynamics, including factors influencing property values, rental, and occupancy rates. Stay updated on local and national real estate trends, economic indicators, and regulatory changes.

#4. Soft skills

In addition to technical expertise, asset management requires strong interpersonal and communication skills. Some essential soft skills include:

- Relationship building: Asset managers often work closely with clients, tenants, brokers, and other stakeholders. Building and maintaining positive relationships is crucial for successful asset management. Effective communication, negotiation skills, and collaboration with diverse teams are essential. As you move up the hierarchy in an asset management or firm’s size, you will be in charge of your own team to do a job, and therefore you need to know how to manage your resources.You would also be involved in front-end or client-facing activities as a manager. Therefore, interpersonal and communication skills become crucial for better performance. Also, in this position, you would be required to make many decisions resulting in big-time money-making or even loss. You need to be able to make fast decisions and own up to the responsibility for them at a later stage.

- Problem-solving: Asset managers encounter various challenges, such as market fluctuations, property maintenance issues, and tenant conflicts. Being a skilled problem solver allows you to address these issues proactively and find creative solutions.

- Time management: Asset managers handle multiple properties and tasks simultaneously. Strong time management skills help you prioritize tasks, meet deadlines, and effectively manage your workload. Please remember that time is crucial in decision-making as they famously say it is money.If you lose time making the right decision, you lose money, which you would not want to do as an asset manager.

- Adaptability: The real estate industry is dynamic, and asset managers must adapt to changing market conditions, emerging technologies, and evolving client needs. Being adaptable and open to continuous learning is vital for long-term success.

That’s it for your key skills and qualifications to break into asset management. In the next section, I’ll guide you on how to use the above key skills in your interview and convince the hiring managers to hire you.

Asset Management Interview Questions

Once again, I must tell you this at the risk of repeating myself because it’s essential.

There is no framework for the interview, just like no set framework for the resume or your education.

Your discussion with your potential employer depends significantly on the branch of asset management you are trying to enter.

That being said, you might be asked one of the following:

- To pitch a stock

- Give a few investment ideas

- Describe an experience where you negotiated some favorable terms for your client.

- How do you eliminate errors in your work? Do you have a method?

- How do you monitor market trends and asset performance?

Ultimately, it’s important to note that the above examples are just to guide you and are not all size fits all nor exhaustive.

Therefore, it’s vital to prepare well and answer any questions you will be asked with precision using the knowledge you gained while learning in college and experience from various internships I’ve advised you to undertake.

Let’s turn the pages to the next part of this guide.

Asset Management Career Paths

Under the umbrella of asset management careers, you can follow quite a large number of career paths.

This is excellent news for you!

However, here are the most common asset management exit opportunities that specialists in this field go for:

- Market Research Analyst

- Private Equity Specialist

- Credit Analyst

- NAV Fund Accountant

- Equity or Debt Dealer

As you can see, these are the traditional asset management roles. But you can apply for virtually anything that you are attracted to!

#1. Portfolio management

As a portfolio manager, your primary responsibility is to oversee and manage investment portfolios on behalf of clients or an organization.

A. Responsibilities and skills required

- Developing and implementing investment strategies: You will create strategies aligned with clients’ goals and risk tolerance. This involves analyzing market trends, identifying investment opportunities, and optimizing portfolio performance.

- Asset allocation and diversification: You will allocate investments across different asset classes (e.g., stocks, bonds, real estate) and diversify holdings to manage risk and enhance returns.

- Monitoring and rebalancing portfolios: Regularly monitoring portfolio performance, assessing risks, and rebalancing assets to maintain the desired asset allocation.

- Performance reporting: Providing regular reports to clients or stakeholders on portfolio performance, investment returns, and relevant market updates.

- Client relationship management: Building and maintaining solid relationships, understanding their financial objectives, and addressing their concerns.

- Financial analysis and research: Proficiency in analyzing financial data, evaluating investment opportunities, and conducting thorough research on various asset classes.

- Risk management: Ability to assess and manage risks associated with different investment options and implement strategies to mitigate potential losses.

- Investment knowledge: A strong understanding of financial markets, investment products, and industry trends to make informed decisions.

- Decision-making and problem-solving: Strong analytical skills and the ability to make sound investment decisions based on available data and market insights.

- Communication and presentation: Practical communication skills are needed to articulate investment strategies, explain complex financial concepts to clients, and present performance reports clearly and concisely.

B. Qualifications and certifications

- Educational background: A bachelor’s degree in finance, economics, business administration, or a related field is typically required. Some employers may prefer candidates with a master’s degree, especially for more senior positions.

- Professional certifications: Obtaining industry-recognized certifications can enhance your credibility and marketability as a portfolio manager. The Chartered Financial Analyst (CFA) designation is highly regarded in the investment industry. It covers a wide range of investment topics. Other certifications, such as the Chartered Alternative Investment Analyst (CAIA) or Certified Financial Planner(CFP), may also be beneficial depending on the focus of your portfolio management career.

- Licensing: Depending on the jurisdiction and specific responsibilities, you may need to obtain licenses such as Series 7 (for securities trading) or Series 65/66 (for investment advisory services). These licenses ensure compliance with regulatory requirements.

C. Advancement opportunities

- Senior portfolio manager: With experience and a successful portfolio management track record, you can advance to the role. In this position, you may oversee more extensive portfolios, manage high-net-worth clients, and have more decision-making authority.

- Team leadership or department head: As you gain more experience and demonstrate leadership capabilities, you may have the opportunity to lead a team of portfolio managers or head a portfolio management department within an investment firm or financial institution.

- Chief investment officer (CIO): In some organizations, experienced portfolio managers can advance to the role of Chief Investment Officer. As a CIO, you would be responsible for setting the investment strategy, managing a team of portfolio managers, and making high-level investment decisions for the entire organization.

Just a reminder. Building a solid track record of successful portfolio management, staying updated with industry trends, and pursuing additional financial certifications or advanced degrees can help you stand out and seize advancement opportunities.

#2. Investment analysis

As an investment analyst, your primary responsibility is to assess and analyze investment opportunities to provide recommendations to clients or an organization.

A. Responsibilities and skills required

- Conducting financial research: Analyzing financial statements, market trends, and economic indicators to evaluate companies’ or investment options’ financial health and performance.

- Performing valuation analysis: Assessing the intrinsic value of investments through various valuation techniques, such as discounted cash flow (DCF), price-to-earnings (P/E) ratio, or comparable company analysis.

- Risk assessment: Identifying and evaluating risks associated with investment options, including market, industry, and company-specific risks.

- Developing investment strategies: Utilizing research and analysis to recommend investment strategies and asset allocation to achieve clients’ financial objectives.

- Providing investment recommendations: Present clear and concise investment recommendations to clients or stakeholders supported by thorough analysis and research.

- Financial analysis: Proficiency in analyzing financial statements, understanding key financial ratios, and assessing companies’ financial health and performance.

- Research and data analysis: Strong research skills to gather and analyze relevant data from various sources, including financial reports, industry publications, and market data.

- Valuation techniques: Understanding and applying various valuation methods to determine the fair value of investments and assess their potential returns.

- Risk management: Ability to identify and assess risks associated with different investment options and implement risk mitigation strategies.

- Industry knowledge: Staying updated on industry trends, regulatory changes, and market dynamics to make informed investment decisions.

B. Qualifications and certifications

- Educational background: A bachelor’s degree in finance, economics, accounting, or a related field is typically required. Some employers may prefer candidates with a master’s degree, especially for more senior positions.

- Professional certifications: Obtaining industry-recognized certifications can demonstrate your expertise and dedication to investment analysis. The Chartered Financial Analyst (CFA) designation is highly regarded in the investment industry. It covers a wide range of investment-related topics. Other certifications, such as Financial Risk Manager (FRM) or Certified Investment Management Analyst (CIMA), may also be beneficial, depending on your specific area of focus.

C. Advancement opportunities

- Senior investment analyst: You can advance to a senior role with experience and a successful investment analysis path. In this position, you may have increased responsibilities, such as overseeing a team of analysts, conducting complex investment research, and providing strategic recommendations to clients or stakeholders.

- Portfolio manager: Building a solid foundation in investment analysis can lead to advancement into portfolio management roles. As a portfolio manager, you oversee investment portfolios and make investment decisions based on your analysis and market insights.

- Research director: With extensive experience and industry expertise, you may have the opportunity to become a research director, leading a team of analysts and setting the research agenda for an investment firm or financial institution.

#3. Risk management

As a risk manager, your primary responsibility is identifying, assessing, and mitigating risks within an organization or for clients.

A. Responsibilities and skills required

- Risk identification: Identifying potential risks impacting an organization’s objectives, projects, or investments. This involves analyzing internal and external factors, conducting risk assessments, and understanding the risks associated with different industries or markets.

- Risk assessment and analysis: Evaluating the likelihood and impact of identified risks, analyzing their consequences, and quantifying their potential financial or operational impact.

- Developing risk management strategies: Developing and implementing risk management strategies, policies, and procedures to mitigate, transfer, or accept risks. This may involve designing risk mitigation plans, selecting appropriate risk management techniques, and monitoring risk exposures.

- Monitoring and reporting: Regularly monitoring and reviewing the effectiveness of risk management measures, identifying emerging risks, and providing accurate and timely risk reports to stakeholders.

- Collaboration and communication: Collaborating with various stakeholders, including executives, project teams, and clients, to raise risk awareness, facilitate risk discussions, and ensure risk management practices are integrated into decision-making processes.

- Risk assessment and analysis: Strong analytical skills to identify and evaluate risks, assess their potential impact, and develop risk mitigation strategies.

- Industry knowledge: You need an understanding of industry-specific risks and regulations to effectively identify and manage risks within a particular sector.

- Quantitative skills: Proficiency in quantitative analysis and modeling to assess and quantify risks, such as using statistical techniques, financial models, or simulation methods.

B. Qualifications and certifications

- Educational background: A bachelor’s degree in finance, risk management, economics, business administration, or a related field is typically required. Some employers may prefer you to have a master’s degree, especially for more senior positions.

- Professional certifications: Obtaining industry-recognized certifications can demonstrate your expertise and commitment to risk management. The Financial Risk Manager (FRM) designation is widely recognized and covers various aspects of financial risk management. Other certifications, such as the Professional Risk Manager (PRM) or the Certificate in Risk Management Assurance (CRMA), may also be beneficial, depending on your area of specialization.

- Specialized training: Consider pursuing specialized training programs or courses focused on specific risk management areas, such as enterprise risk management, operational risk, or credit risk. These programs can deepen your knowledge and skills in specific areas of risk management.

B. Advancement opportunities

- Senior risk manager: With experience and a proven track record in risk management, you can advance to a senior risk manager role. In this position, you may have increased responsibilities, such as overseeing a team of risk professionals, developing enterprise-wide risk management strategies, and advising senior management on risk-related matters.

- Chief risk officer (CRO): You would be responsible for an organization’s risk management function as a CRO. This role involves setting risk management policies, leading risk assessments, and providing strategic guidance to senior executives.

- Risk consultant: Some professionals become risk management consultants, working with multiple clients or organizations to assess and manage risks. This allows for exposure to a wide range of industries and risk profiles.

- Risk governance or compliance: With a strong understanding of risk management, you may have opportunities to specialize in risk governance, compliance, or regulatory risk. These roles involve ensuring adherence to risk management frameworks, developing compliance strategies, and staying updated on regulatory requirements.

#4. Client relationship management

As a client relationship manager, your primary responsibility is to build and maintain strong relationships with clients, ensuring their satisfaction and serving as their main point of contact.

A.Responsibilities and skills required

- Building and nurturing client relationships: Develop a deep understanding of the client’s needs, goals, and preferences. Act as their trusted advisor and build strong rapport to foster long-term relationships.

- Providing personalized service: Tailor your approach to meet individual client requirements. Offer customized solutions, address concerns promptly, and provide exceptional customer service.

- Client retention and satisfaction: Proactively engage with clients to understand their satisfaction levels, identify areas for improvement, and take necessary actions to ensure their retention and loyalty.

- Cross-selling and upselling: Identify opportunities to expand the range of services provided to clients. Suggest additional products or services that align with their needs and goals.

- Conflict resolution: Address client issues or concerns promptly and professionally. Mediate conflicts and find mutually beneficial solutions to maintain positive client relationships.

- Communication and interpersonal skills: Excellent verbal and written communication skills to effectively engage and connect with clients. Active listening skills are essential to understand their needs and expectations.

- Relationship-building: Strong interpersonal skills to establish trust, build rapport, and maintain long-term client relationships.

- Problem-solving and negotiation: Ability to identify and resolve client issues or conflicts. Practical negotiation skills are valuable when addressing client concerns or discussing contract terms.

- Customer service orientation: A genuine passion for exceptional service and exceeding client expectations. Anticipating and proactively meeting client needs is crucial.

B. Qualifications and certifications

- Educational background: A bachelor’s degree in business administration, marketing, finance, or a related field is typically required. While not mandatory, a higher-level degree or specialization in customer relationship management (CRM) can be beneficial.

- Professional certifications: Consider obtaining certifications focusing on relationship management, customer service, or sales. Examples include the Certified Customer Experience Professional (CCXP) or the Certified Sales Professional (CSP) designation.

C. Advancement opportunities

- Senior Client Relationship Manager: You can advance to a senior client relationship manager role with experience and a successful client relationship management track record. You may have increased responsibilities in this position, such as overseeing a team of relationship managers, developing client retention strategies, and managing key accounts.

- Relationship Director or Vice President: As you gain more experience and demonstrate leadership capabilities, you may have the opportunity to become a relationship director or vice president. In these roles, you would oversee a portfolio of high-value clients, develop strategic plans for client engagement, and contribute to the organization’s overall growth.

Asset Management Jobs Description and Salary

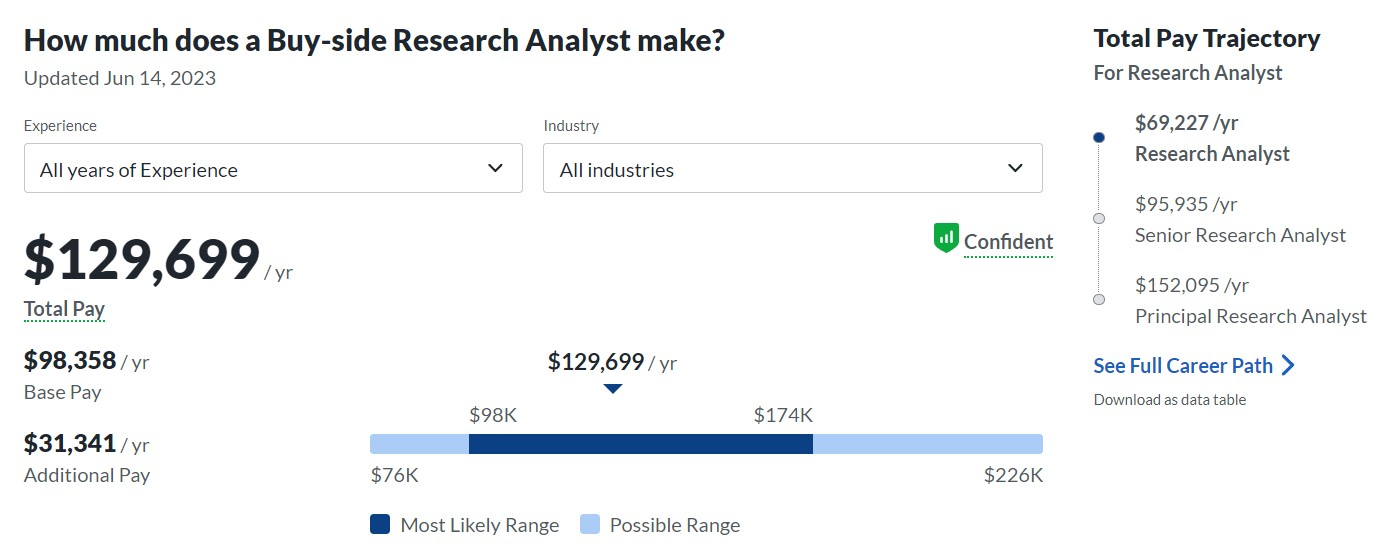

1. Buy-side research analyst

It is an inbound profile with very little interaction with clients.

Analysts in this role conduct financial and equity research in a team (team size may vary from 2-3 analysts to up to 15 analysts) for their fund manager.

Job description

- Your primary responsibility here is to collect data on a particular company or industry and analyze its financial strength.

- You must make reports and present your opinions on buying, selling, or holding decisions of a particular script or stock.

- In addition, you are expected to recommend to their managers to diversify the portfolios based on their research.

Salary and compensation

The estimated total pay for a Buy-side Research Analyst is $ 129,699 annually in the United States, with an average salary of $ 98,358 annually.

Source: Glassdoor

2. Sell-side research analyst

The work these sell-side equity research analysts do is quite similar to that of the buy-side research analysts, with a small yet significant difference.

Job description

- Cater to external clients instead of internal clients in the case of buy-side analysts.

- The profile is more outward and requires you to travel and interact extensively with the outer world.

- Whether it is client presentations or media interaction, as a sell-side research analyst, you have to have good communication and presentation skills.

- You must recommend investing your client’s money in a particular company or industry by presenting facts and analysis.

Salary and compensation

The salaries offered in this profile are similar to those of buy-side analysts, but the pressure is much greater.

3. Portfolio manager

This is a profile where you get to call the shots.

This is the ultimate profile within the asset management domain for an aspirant.

Job description

- Instead of recommending which stocks to include in your fund, here you get to create your own fund depending on your and your team’s analysis.

- As a portfolio manager, you will decide the composition of your fund in terms of which stocks to include and how much.

- This is a highly strategic profile and requires much analytical thinking to decide.

- You must work your way up to work efficiently in this profile.

- Also, you must work closely with your analysts to understand the research behind every decision you make.

Typically, 4-5 years of previous experience as an investment analyst, should get you into this position.

Read the detailed guide on how to start a successful private equity portfolio management career.

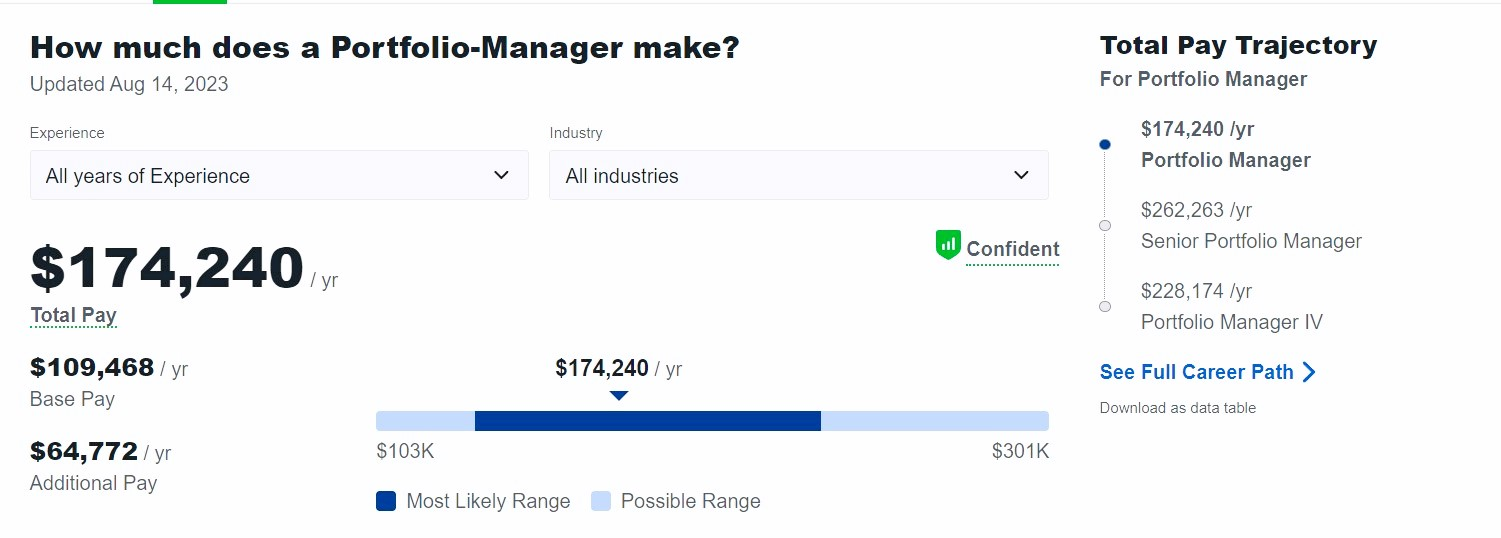

Salary and compensation

The total compensation amount offered in this profile is quite handsome. It can go up to millions of dollars worth of money.

The estimated total pay for a Portfolio-Manager is $172,240 annually in the United States, with an average salary of $109,468 annually.

Source: Glassdoor

4. Financial Advisor

This is more of a business development profile, where your primary task is acquiring more business or clients.

Job description

- Depending on your client’s requirements, you would sell a portfolio of investments to them.

- It can include many funds with different expected dividends.

This senior asset and wealth management profile requires at least 8-10 years of experience.

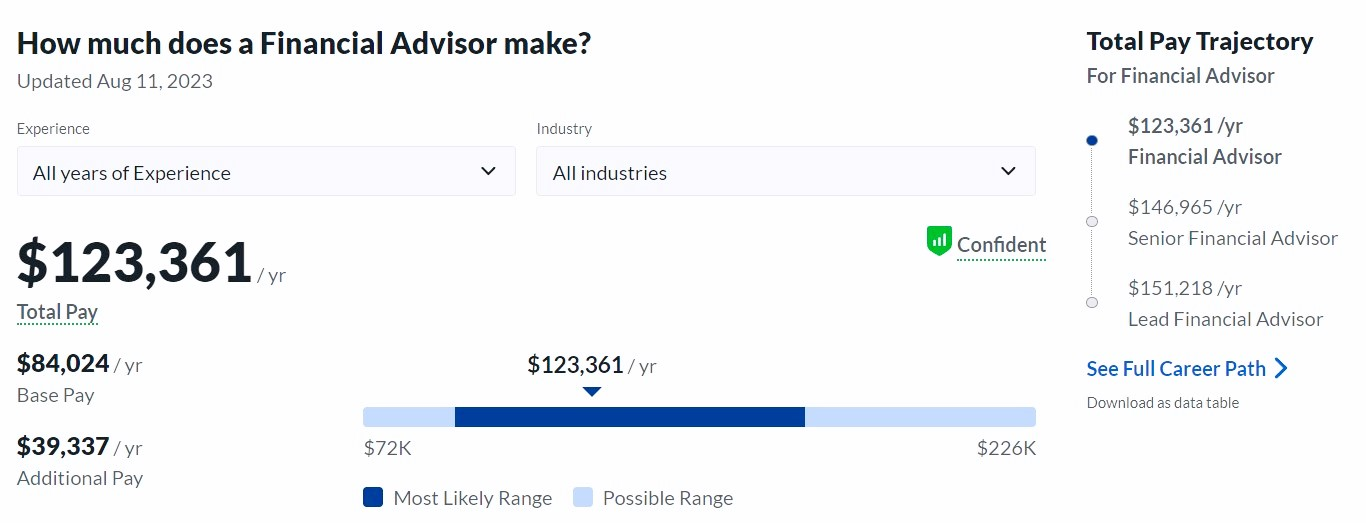

Salary and compensation

The total compensation is mainly incentive-based; a significant part of remuneration comes from clients’ commissions.

Firms usually have a base salary, which might seem too low, but the variable component is very high.

The estimated total pay for a Financial Advisor is $123,361 annually in the United States, with an average salary of $84,024 annually.

Source: Glassdoor

4. Relationship manager

This is a mid-level profile wherein you will handle a specific number of clients.

Job description

- As a relationship manager, you mediate between your client and your company.

- You must be at your client’s disposal at all times.

- Whether it is compliance, processes, or grievance handling, you must do all that for your clients.

- You will also be responsible for educating your clients on new products, services, and offerings your company might have and trying to expand the current relationship to get more business from the same client.

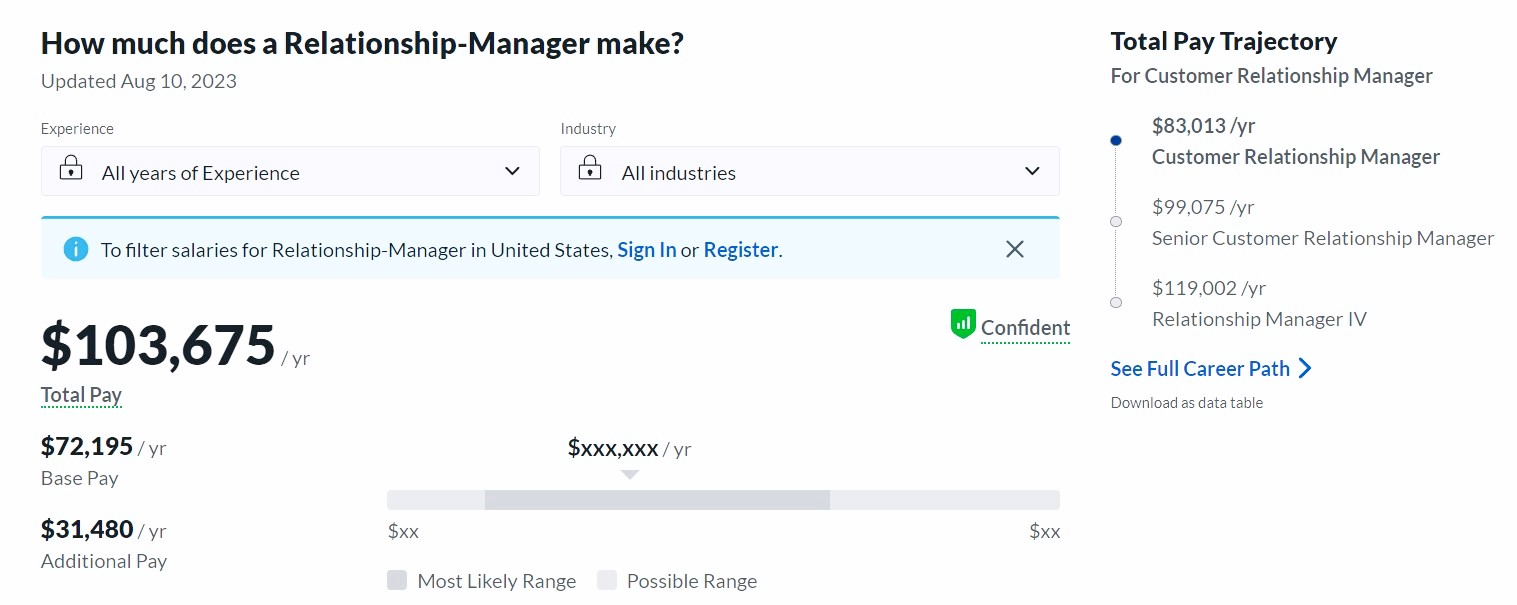

Salary and compensation

The estimated total pay for a Relationship-Manager is $103,675 annually in the United States, with an average salary of $72,195 annually.

Source: Glassdoor

5. Sales manager

In this profile, you will be operational in a particular geography.

Job description

- You must generate more business by acquiring new clients in that geography.

- You will be required to make a presentation to prospective clients and convince them to enter into a business relationship with your company.

- This back-end job involves identifying prospective clients and scheduling appointments for you.

- This profile requires a lot of traveling and networking.

If you are an introvert, this is probably not your correct profile. As much as 80% of your time could be spent out of the office in this profile.

As you wouldn’t be sitting in an office, you will have a support team to do the back-end work.

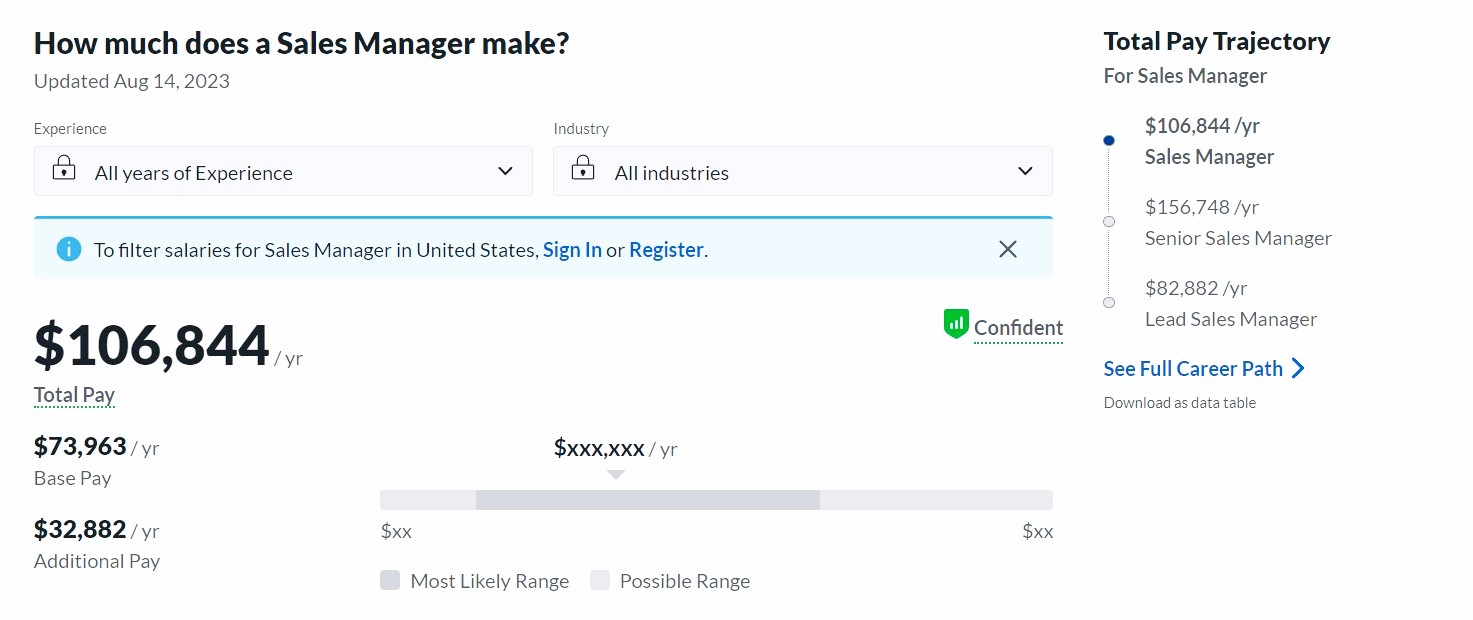

Salary and compensation

The estimated total pay for a Sales Manager is $106,844 annually in the United States, with an average salary of $73,963 annually.

Source: Glassdoor

Now that you’ve seen some of the roles in asset management available let’s turn the pages to some of the companies you can work for.

Best Asset Management Companies to Work for

In this section, I’ll take you through the top 5 asset management companies you can work with. On top of that, I’ll discuss the possibility of working from anywhere in these roles or others so that you can have control over your career.

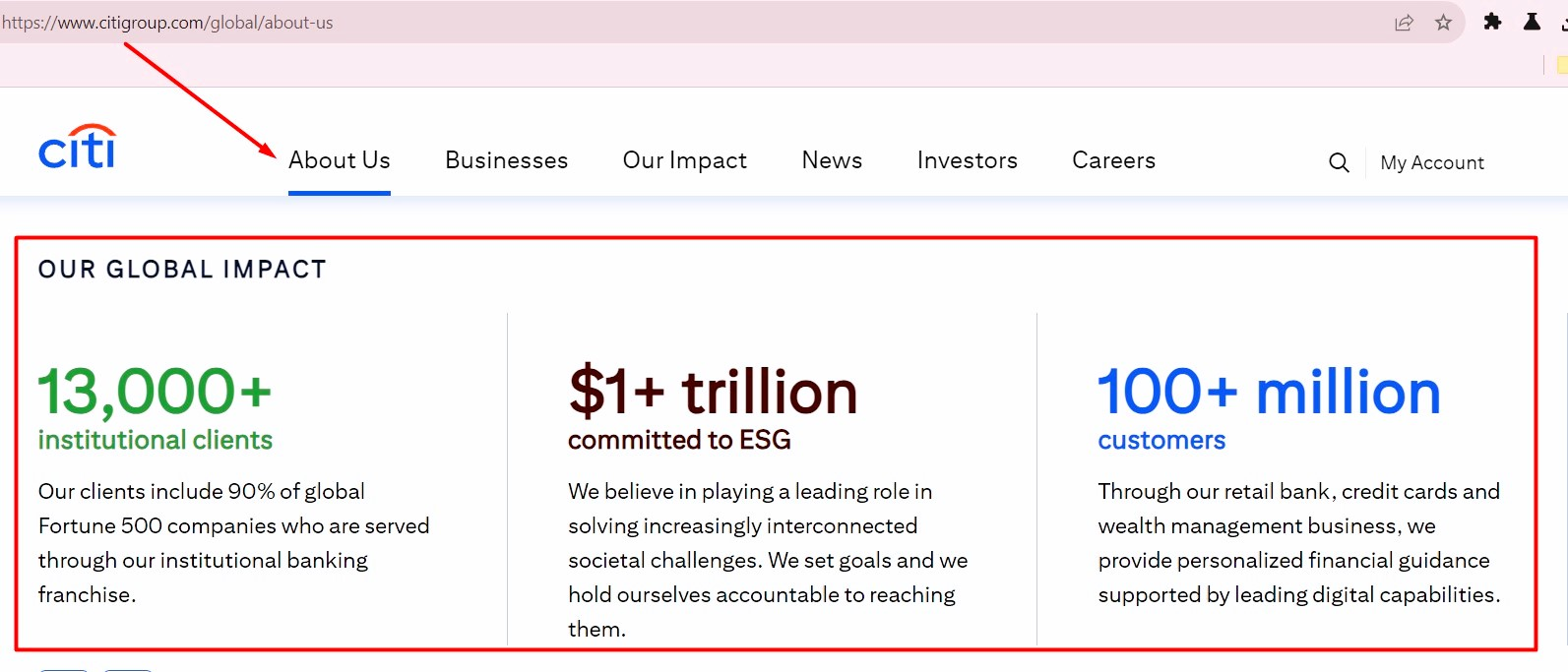

#1. Citi

Headquarters: New York, NY

Size: 10000+ Employees

Founded: 1812

Type: Company – Public (C)

Industry: Investment & Asset Management

Revenue: $10+ billion (USD)

Citi’s mission is to serve as a trusted partner to its clients by responsibly providing financial services that enable growth and economic progress.

Their core activities are safeguarding assets, lending money, making payments, and accessing the capital markets on behalf of their clients.

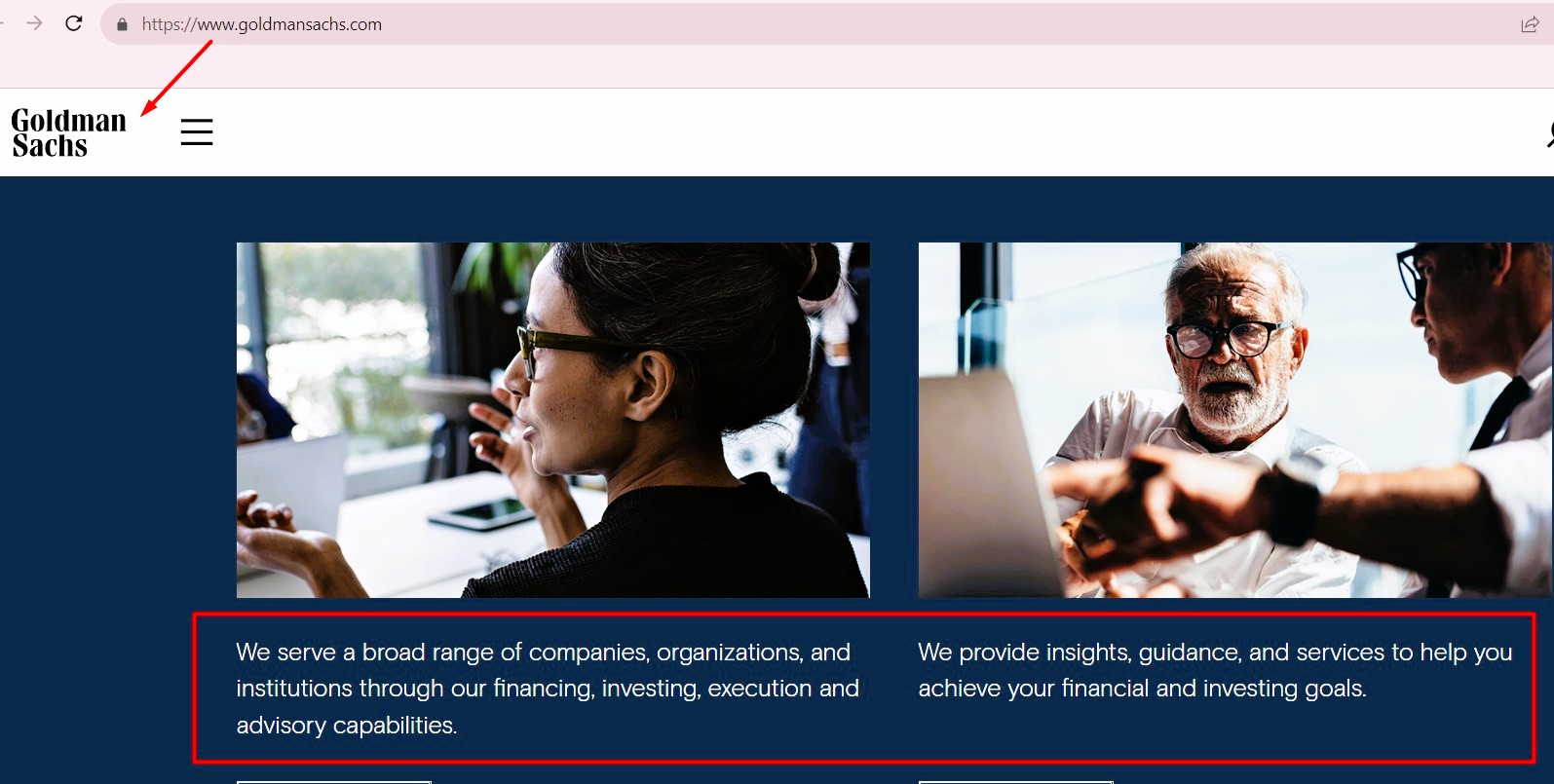

#2. Goldman Sachs

Headquarters: New York, NY

Size: 10000+ Employees

Founded: 1869

Type: Company – Public (GS)

Industry: Investment & Asset Management

Revenue: $10+ billion (USD)

The Goldman Sachs Group, Inc. is a leading global investment banking, securities, and investment management firm providing a wide range of financial services to a substantial and diversified client base, including corporations, financial institutions, governments, and high-net-worth individuals.

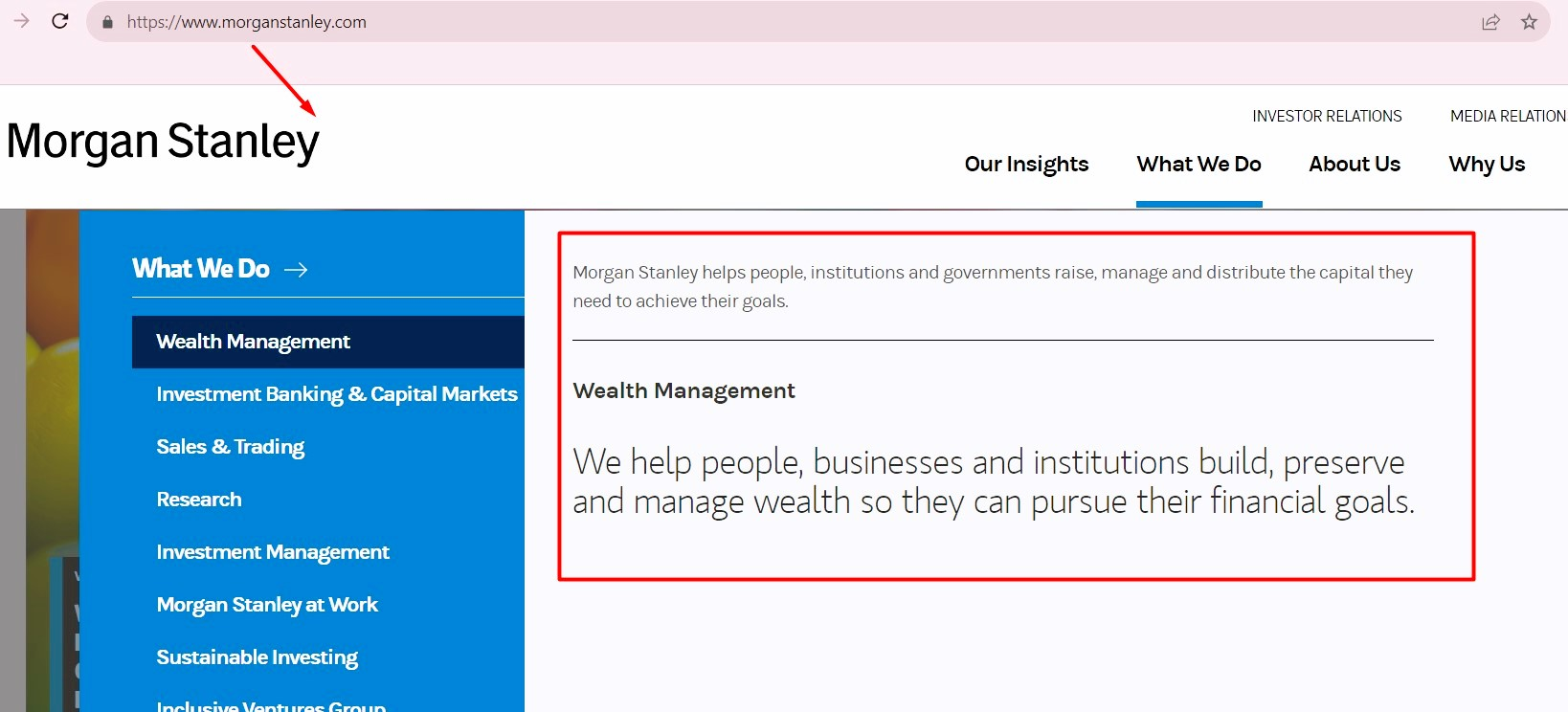

#3. Morgan Stanley

Headquarters: New York, NY

Size: 10000+ Employees

Founded: 1935

Type: Company – Public (MS)

Industry: Investment & Asset Management

Revenue: $10+ billion (USD)

Morgan Stanley mobilizes capital to help governments, corporations, institutions, and individuals worldwide achieve their financial goals. For over 85 years, the firm’s reputation for using innovative thinking to solve complex problems has been well-earned and rarely matched.

As a consistent industry leader throughout decades of dramatic change in modern finance, Morgan Stanley will continue to break new ground in advising, serving, and providing new opportunities for its clients.

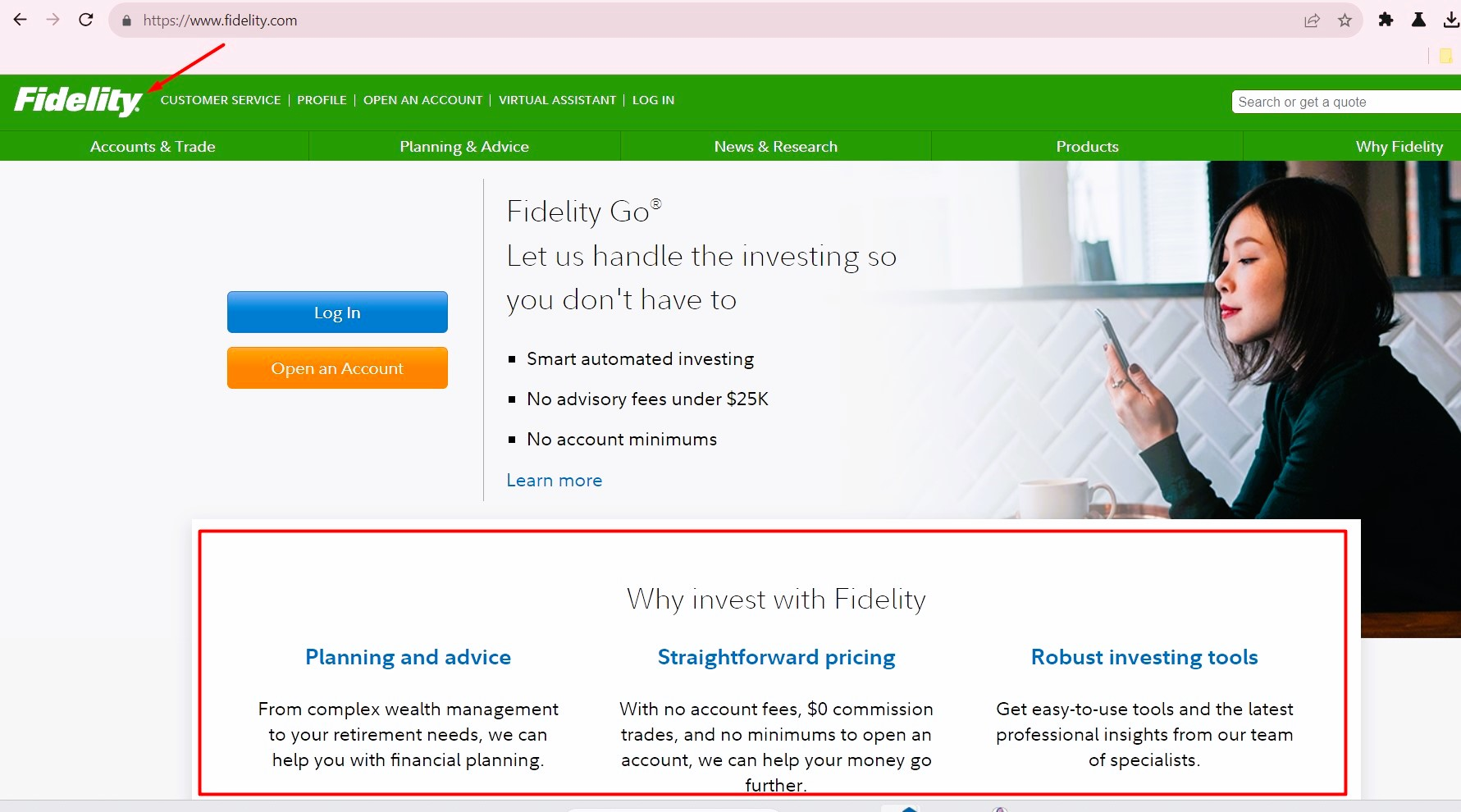

#4. Fidelity Investments

Headquarters: Boston, MA

Size: 10000+ Employees

Founded: 1946

Type: Company – Private

Industry: Investment & Asset Management

Revenue: $10+ billion (USD)

Fidelity Investments’ mission is building a better financial future— for everyone— is their mission.

From their origins in democratizing investing, and through the last 75+ years, their privately-held company has remained committed to supporting its clients throughout their lifelong financial journeys.

#5. J. P. Morgan

Headquarters: New York, NY

Size: 10000+ Employees

Founded: 1799

Type: Company – Public (JPM)

Industry: Investment & Asset Management

Revenue: $10+ billion (USD)

J.P. Morgan helps businesses, markets, and communities grow and develop in over 100 countries. Through their Corporate and Investment Bank, they provide banking, market and investor services, treasury services, and more for the world’s most important corporations, governments, and institutions.

Remote Work in Asset Management

The asset management industry has recently seen a significant shift towards remote work and the possibility of working from anywhere. Advancements in technology and digital tools have made it easier than ever to manage assets and investment portfolios remotely.

Let’s say you’re an investment analyst passionate about finance and travel. Lucky for you, your role as an investment analyst offers the perfect blend of flexibility and opportunity to adventure while working.

As an investment analyst, traveling opens doors to broader investment perspectives. While traveling, you can attend finance conferences, seminars, and industry events in various locations.

These gatherings present excellent networking opportunities, connecting you with like-minded professionals, industry experts, and potential collaborators.

Suppose you want to explore more opportunities to work from anywhere. In that case, I’ve prepared the following guide that I highly encourage you to read.

Work from Anywhere-Finance & Business Careers: Practical Actions Guide

This brings us to the next section I want to cover in this guide.

Asset Management Entry-Level Jobs

There are lots of entry-level jobs within the asset management industry that you can target. However, I will cover your top 4 entry-level jobs in this section. Let’s get started.

1. Fund accountant

This is a pure data-centric job wherein you must deal with ledger books and enter data into spreadsheets.

You will be required to record transactions and calculate the net asset value of various other hedge funds and mutual funds depending on their opening and closing values.

Any essential degree in accounting should be enough to get a job in this field.

2. Junior research analyst

This is usually the most common profile where most asset and portfolio managers start their careers.

In this profile, you would be like an assistant to the research analysts in the company and help them in their day-to-day activities.

Primary responsibilities include collecting data on a specific company or industry using secondary and primary techniques, creating small reports, and helping the analysts analyze.

This profile gives you immense knowledge of the industry and exposes you to all the facets of asset management.

3. Economist

This is a profile wherein you would feed analysts the macroeconomic parameters that could impact the hedge and mutual funds most.

It involves tracking monetary policies and determining their impact on specific industries and the economy as a whole.

They do not have direct involvement in creating a mutual fund itself. Still, the inputs provided by them are crucial and often aid the decision-making of the portfolio managers.

This is a generic profile and is not restricted to asset management.

The avenues for an economist are usually open beyond asset management.

4. Quantitative analysts

Again, this is a generic profile not only restricted to asset management.

Here, the analysts are required to create models and tools for analysis.

The quantitative analysts will understand the analysis requirements of the research analysts and develop a model that will help them smoothly do their analysis.

Typically, a quantitative analyst will have working knowledge of computing languages like C and Java, as they will be required to write syntaxes and prepare codes for generating new models.

Challenges and Opportunities in Asset Management Careers

Asset management careers present both challenges and opportunities.

Suppose you want to be successful in asset management. In that case, you must leverage these opportunities, adapt to changes, and continuously enhance your skills and knowledge to thrive in the dynamic industry.

Let’s explore some of them:

#1. Asset management: Facts and trends

The asset management industry constantly changes due to market shifts, regulations, and investor preferences. Staying updated on trends is vital for professionals. Knowing the latest strategies, markets, and client needs helps adapt and seize opportunities.

For instance, the Internet has made investing convenient, leading to more investors today. People prefer non-traditional investments because they offer higher returns than traditional options like insurance and government bonds.

Asset management firms will prosper with such a trend in the investment circle worldwide.

It means that they will need more people to work for them.

Every year, thousands of trainees are hired by firms like Wells Fargo, Merrill Lynch, and Goldman Sachs.

And this demand is going to increase in the future as well.

It is an opportune time to consider asset management as a lucrative career option.

#2. Technological advancements and their impact

Technology has revolutionized asset management, making processes more efficient. Adapting to new business tools and enhancing digital skills is crucial for success in this field, as technology can improve decision-making and client experiences.

#3. Globalization and international opportunities

Globalization in asset management offers international work chances, public markets and diverse investment options. Yet, it also means tackling regulatory differences and cultural gaps and staying updated on global economics and public markets. Success depends on embracing these opportunities and cultivating cross-cultural skills.

#4. Diversity and inclusion in asset management

The asset management industry now values diversity and inclusion as catalysts for innovation and improved decision-making. To enhance investment strategies, firms prioritize diversity across gender, race, and background, striving for inclusive workplaces and initiatives to attract and retain top talent.

Up to that point, we’ve covered everything you need to know when entering investment banking and asset management careers. But you need to know a few more things to make the best decision, as covered in the subsequent section.

Asset Management Exit Opportunities

In the fast-paced world of finance, your skills and experience open doors to a myriad of paths beyond asset management. This section lists some of the most thrilling options available.

- Private Equity

- Venture capital

- Master of mergers and acquisitions

- Financial consulting

- Entrepreneurial endeavor

Remember, these are just a glimpse of the exhilarating exit opportunities in asset management. The following section is somewhat strange (considering I’ve already taken you through the qualifications and requirements for asset management careers). Still, in a few minutes, you’ll realize why it was important that I cover it at this point.

Continuing Education and Professional Development

In the ever-evolving world of asset management, pursuing knowledge is a never-ending adventure.

Let’s delve into how continuing education and professional development can propel your career forward:

#1. Importance of lifelong learning

As the industry evolves, staying current with the latest trends, strategies, and regulations is crucial.

Lifelong learning enhances your knowledge and skills and keeps you agile and adaptable in changing market dynamics.

That’s why embracing the mindset of a perpetual student, always hungry for new insights and ready to push the boundaries of your expertise.

#2. Continuing education resources

The world of asset management offers a wealth of resources to support your continuing education journey.

Engage in specialized courses, workshops, and seminars by renowned educational institutions, industry associations, and professional organizations.

These resources provide in-depth knowledge, practical skills, and exposure to cutting-edge practices.

Leverage online platforms, webinars, and podcasts to access educational content conveniently. Stay curious, explore new areas of interest, and expand your horizons.

#3. Professional organizations and associations

Joining professional organizations and associations is a powerful way to enhance professional development. These communities offer networking opportunities, access to thought leaders, and industry events that foster knowledge-sharing and collaboration.

Engage in mentorship programs, participate in industry conferences, and contribute to relevant publications to establish your expertise and broaden your professional network.

These associations’ collective wisdom and support can fuel your growth and open doors to exciting opportunities.

Remember, continuing education and professional development are not merely checkboxes to tick. They are catalysts for your personal and professional growth.

By nurturing your thirst for knowledge and staying ahead of the curve, you’ll position yourself as a trusted expert and leader in the dynamic world of asset management.

Key Learning Points

As you navigate the world of asset management, here are the key learning points to take away:

- Embrace continuous learning for industry relevance, committing to ongoing development.

- Utilize diverse educational resources like courses and workshops for personal growth.

- Build a robust professional network through associations, conferences, and mentorship.

In your quest for success in asset management, you may encounter moments when you need guidance to make the right decisions. That’s where Inner GPS comes in.

Your inner GPS is your innate sense of intuition, wisdom, and self-awareness. It serves as your internal compass, guiding you toward the right path and helping you align your goals with your values and passions.

Inner GPS Coaching is a powerful tool that harnesses this inner guidance to support you in making informed decisions and charting your career trajectory.

Through Inner GPS Coaching, you can gain clarity, overcome obstacles, and tap into your full potential.

With Inner GPS Coaching, you can make empowered choices that align with your authentic self, ensuring a fulfilling and purpose-driven career in asset management.

Frequently Asked Questions and Answers- Asset management jobs.

#1. What are the top asset management firms?

I have ranked asset management firms according to their managed assets to answer this question. Please note that the values here are expressed in trillions of dollars.

- BlackRock (US) – 6.52

- Vanguard Group (US) – 5.6

- UBS (Switzerland) – 3.26

- State Street Global Advisors (US) – 2.8

- Fidelity Investments (US) – 2.7

- Allianz Group – 2.36

- J.P. Morgan Asset Management (US) – 2.1

- Capital Group (US) – 1.86

- Bank of New York Mellon (US) – 1.84

- PIMCO (US) – 1.76

#2. What is the difference between asset management vs wealth management?

As we’ve already seen, asset management refers to a company or a professional asset manager handling the assets of another company or individual.

They could include fixed income, private equity, global investments, real estate, etc.

Wealth management refers to overseeing a company’s or individual’s financial situation.

It usually includes taxes, assets, cash, estates, and everything in which they use money.

As a result, the difference between wealth management vs. asset management resides in the financial task you are handling.

Read the detailed guide on how to make a career in wealth and other investment banking and management.

#3. What is the difference between asset management vs investment banking?

While asset management refers to managing other people’s and companies’ money on their behalf, investment banking means raising money they wish they had but don’t. It’s as simple as I can make it.

The difference between having assets to manage and investing so you can gain assets.

#4. What is the difference between asset management vs investment management?

Both work with extremely wealthy individuals. Or companies. But that’s where the similarities stop.

Asset managers handle their client’s financial assets and make financial decisions.

While investment managers work on determining fantastic investments, financial advisors see opportunities for their clients and their assets.

This means evaluating economic factors and building reports that will lead to successful investments.

#5. What are the best asset management firms to work for?

Of course, this depends on the branch you want to specialize in.

As we’ve already seen, you can be an asset manager for an active company in any domain, from construction to art to the film industry.

Therefore, you must first choose an asset management branch and find the best companies.

However, on average, the best companies to work for when you’re interested in asset management careers are also the biggest ones I’ve listed above.

You might already know The Vanguard Group, BlackRock, Fidelity Investments, and Pacific Investment Management Company, LLC.

#6. What is the difference between asset management and hedge fund?

There is no reason to repeat myself and bore you with yet another definition of asset management, or AMCs—asset management companies.

Unlike other hedge funds without an AMC, these hedge fund and funds will seek to invest in the same class of securities as asset management companies.

However, they want to generate performance that will not be indexed to a singular market return.

#7. What is the difference between asset management vs private equity?

Whereas an asset manager virtually owns assets, at least on behalf of his client, and uses them to make the best financial decisions for his client, private equity firms have to raise the same capital if they want to invest in individual companies.

The question is legitimate since many believe a private equity firm is an asset management company. And they are right.

In a way, at least. They both work in similar fashions, the difference being that the private equity firm has to raise its investment funds from outside investors.

Whereas asset management companies simply manage funds for a client and decide whether to invest them in something.

My Exclusive Insights for You

Congratulations! You’ve begun a thrilling exploration into the world of asset management.

As you finish this guide, pause to envision the path ahead.

In this realm, passion and persistence form pathways to success. Embrace the unknown for growth and impact.

Asset management isn’t solely about money but about meaningful change and legacy.

You hold the power to innovate and reshape finance, transforming lives. Remember, the potential is vast, and success is reachable.

All the best.