Credit Rating Agencies we mean an agency providing a rating of “credit” taken by any company i.e. if any company wants to take any loan from the market they hire a credit rating agency to rate their loan so that the intended person providing the loan will have a fair idea about the risk associated with the loan they are providing to the company.

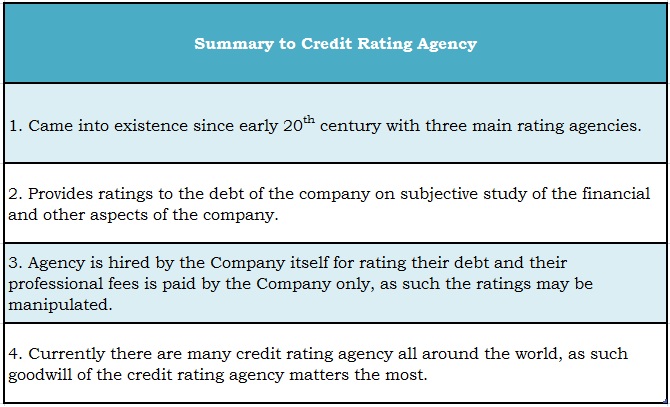

These credit-rating agencies came to use in the market from the early 20th Century when big three credit rating agencies were formed which are Standard & Poor’s (S&P), Fitch and Moody’s,and offer a great career in finance.

Later on, many more credit rating agencies came into existence.

In this article, we will cover a list of credit rating agencies sites in the world.

Credit rating is an important aspect of securities, especially bonds. There are several rating agencies in the world that analyze and give ratings to bonds and other securities. Let’s see the credit rating agencies listed as per their country.

The United States

- A.M. Best Company, Inc.

- Demotech, Inc.

- Egan-Jones Rating Company

- Fitch Ratings, Ltd.

- Kroll Bond Rating Agency, Inc.

- Moody’s Investors Service

- Realpoint, LLC

- Standard and Poors (S&P)

- TheStreet.com Ratings, Inc.

- Veribanc, Inc.

- DBRS Morningstar

Canada

- Equifax

The United Kingdom

Colombia

- BRC Investor Services S.A.

- Duff & Phelps de Colombia, S.A., S.C.V

China

- Chengxin International Credit Rating Co., Ltd.

- China Lianhe Credit Rating, Co. Ltd.

- Dagong Global Credit Rating Co., Ltd.

- Shanghai Credit Information Services Co., Ltd.

- Shanghai Far East Credit Rating Co., Ltd.

Turkey

- Istanbul International Rating Services, Inc.

- JCR Avrasya Derecelendime A.S.

- Kobirate Uluslararası Kredi Derecelendirme ve Kurumsal Yönetim Hizmetleri A.Ş.

- Saha Kurumsal Yönetim ve Kredi Derecelendirme Hizmetleri A.Ş

- TCR Kurumsal Yonetim ve Kredi Derecelendirme Hizmetleri A.S.

Nigeria

- Agusto & Co. Ltd.

- CMC International, Ltd.

Rating organizations in India

- Credit Analysis & Research Ltd (CARE)

- CRISIL, Ltd.

- Investment Information and Credit Rating Agency (ICRA)

- ONICRA Credit Rating Agency of India, Ltd.

- SME Rating Agency of India Limited (SMERA)

Mexico

- HR Ratings de Mexico, S.A. de C.V.

- Interfax Rating Agency (IRA)

Ecuador

- Bank Watch Ratings S.A.

- Ecuability, SA

Japan

- Japan Credit Rating Agency, Ltd. (JCR)

- Mikuni & Co., Ltd.

- Rating and Investment Information, Inc. (R&I)

Poland

Korea

- Korea Investors Service, Inc. (KIS)

- Korea Ratings Corporation

- National Information & Credit Evaluation, Inc. (NICE)

- Seoul Credit Rating & Information, Inc.

Peru

- Apoyo & Asociados Internacionales S.A.C.

- Class y Asociados S.A. Clasificadora de Riesgo

- Equilibrium Clasificadora de Riesgo

- Pacific Credit Rating (PCR)

This is a partial list. You may Google to find out rating organizations in other countries.

To sum up, in today’s date rating organizations play an important role in debt instruments, investors often decide on their investment decision based on the ratings provided by the credit rating agencies since it is a third party rating and an unbiased one.

At the same time it also has its limitations since the method of ratings are not universal rating agencies can have their methodology of ratings the debt of the company further, the company themselves appoint the agencies to rate their debt, and the payment is made by the company, so there are chances that the company manipulates the agencies to obtain a better credit rating.

So it’s up to the investors to decide on the ratings and as such the goodwill of the rating agencies matters the most.