After you get hired, it’s now time to face the equity research interviews.

Usually, it has four parts:

- First screening

- Interview with Human Resources

- Financial Modeling tests

- Interview with Equity Research Department

Usually, the fourth part is one of the difficult ones. I’m here to prepare you for it. Here are the 50 Equity Research interview questions you must get ready for.

Technical Equity Research Interview Questions and Answers

Q.1: What is contained in an Equity Research Report?

An equity research report is a recommendation to clients which convince them to either BUY, SELL or HOLD equity securities.

The preparer must justify each recommendation. As such, the following components must be found:

- Industry Overview – gives the reader a summary of the trends that affect the industry covering the company

- Company Financials and Ratio – Key metrics are shown here, example: liquidity, solvency, sales turnover and market share

- Valuations and Projections – based on the financial performance of the company, the research attempts to measure the future value of each share

- Management Overview – Who are the management team? Are they highly qualified to run the company?

- Recommendation – After a-d, the researcher will now recommend to either BUY, SELL or HOLD the security.

Q.2: What is the earnings season?

Earnings season is the time of the year, where companies declare the results of their operations. It is usually in the 2nd quarter of each year.

Q.3: Describe the Equity Research Hierarchy

The organizational chart of equity research looks like this:

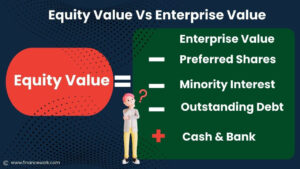

Q.4: What is the difference between Enterprise Value and Equity Value?

Equity value and enterprise value is essential when you are using valuations to find the fair value of stocks.

To compute Equity Value, we will add the following:

- Equity Value – is typically the total market value of the company’s equity shares.

- Enterprise Value – is Equity Value plus Net Debt.

Net Debt – is the total of short-term debt (including a portion of long-term debt), long-term debt, all non-controlling interest, preferred shares and then deduct cash and cash equivalents.

Q.5: What are the standard ratios used for company analysis?

Quick Assets Ratio – use to determine the ability of the company to pay its current liabilities using its highly liquid assets like cash, deposits and short-term investments.

- Solvency Ratios – these are ratios used to measure the company’s ability to pay its financial obligations.

- Current Ratio – current assets / current liabilities

- Current Liability to Inventory – current liabilities/ inventory

- Total liabilities to net worth – Total Liabilities / Equity

Turnover Ratios

- Accounts Payable Turnover

- Days Payable

- Cash Conversion Cycle

- Inventory Turnover

- Receivables Turnover

- Days Receivables

- Days Inventory

Operating Efficiency Ratios

- Equity Turnover

- Asset Turnover Ratio

- Net Fixed Asset Turnover

Operating Profitability Ratios

- Net Margin

- Return on Total Assets

- Return on Equity

- Dupont Model for Return on Equity

- Gross Profit Margin

- Operating Profit Margin

Financial Risk

- Debt Service Coverage Ratio

- Interest Coverage Ratio

- Debt to Equity Ratio

- Leverage Ratio

Q.6: What is Financial modeling in Financial Analysis?

Historical financial statements cannot give us the future value of the stocks.

Only through financial modeling that we will be able to take a glimpse of the estimated value of those shares.

The most common ways to value a company is Discounted Cash Flows and Comparable Companies analysis.

You’ll be able to find the fair value of the shares using these financial modeling techniques.

Compare those share values with the current market price to conclude.

If Market Value is lower than fair value, then BUY because the share prices are expected to go up.

Otherwise, the recommendation should be SELL or HOLD.

Q.7: How do you do a Discounted Cash Flow?

Discounted Cash Flow is a valuation method that values a company using its discounted future cash flows.

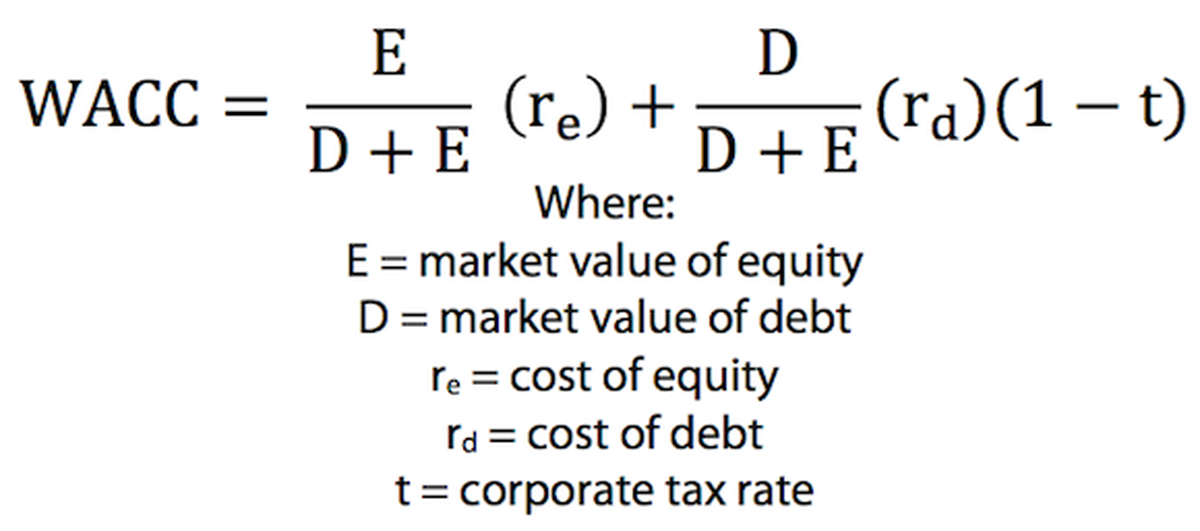

The discount rate used is the Weighted Average Cost of Capital.

Discounted Cash flows model is done generally in 6 steps:

- Computed the discount rate, which is the Weighted Average Cost of Capital

- Compute Free Cash Flows that is the discounted cash flows within the projected period.

- Compute Terminal Value; it is equal to the discounted cash flows outside the projected period.

- Computed the diluted number of shares

- Compute Equity Value and Enterprise Value

- Compare the estimated fair value and market value, then recommend either BUY, SELL or HOLD

Q.8: How do you do Comparable Companies Analysis?

Comparable companies’ analysis is comparing one share over other shares in the same industry using valuation multiples.

This method is being done generally on six steps.

- Collect financial information about the company. This is usually composed of the three primary financial statements.

- Project the income statements to 3 years, five years, or whatever length you deemed necessary.

- Compute the Equity and Enterprise Value

- Determine the total number of diluted shares

- Compute forecasts and valuation multiples

- Based on valuation multiples, compute the fair value of each share.

- Evaluate results and make recommendations.

Q.9: What is Free Cash Flows?

Free Cash Flows is the cash available to debt and equity security holders after deducting all outflows related to working capital and Capex.

To compute free cash flows:

- Start with the after-tax net income

- Add back all non-cash expenses (because they reduced income but not cash, e.g. depreciation)

- Deduct all non-cash income (because they increased income but not cash, e.g. accrued income)

- A decrease in assets must be deducted because they reduce cash but do not affect net income. The opposite happens when assets increase.

- An increase in payables decreases cash but does not affect net income, and so, we must deduct it. The opposite has the opposite effect.

Q.10: What is Free Cash Flow to Equity?

Free Cash Flows to Equity is the amount of cash that is available to equity shareholders after deducting all expenses related to capital outlays, debts and taxes.

Q.11: What is Sensitivity Analysis?

Sensitivity analysis is the technique to determine the effect of an independent variable on other dependent variables.

Q.12: What is the use of Sensitivity Analysis in Equity Research?

Sensitivity is used in Equity Research in a variety of ways. Instead of assuming a single scenario, a range of scenarios of factors is being investigated.

Independent variables that are often used are discount rates, growth rates or Sales.

Thus, the recommendations are not based on a single scenario but a range of scenarios that could happen considering their possibility ratios.

Sensitivity analysis is presented using a sensitivity analysis table through DATA tables in Excel.

Q.13: What are the common valuation multiples used in Equity Research?

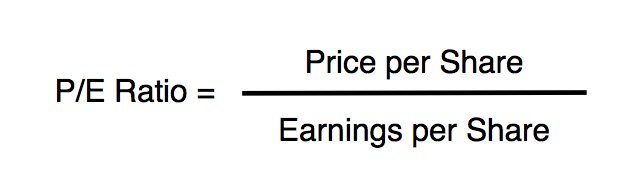

- Price Earnings Ratio

- EV/EBITDA

- EV/Sales

- EV/EBIT

- EV / Assets

- Price-Earnings Growth Ratio

- Price / Book Value

Q.14: How do you compute the Weighted Average Cost of Capital for Discounted Cash Flows?

Q.15: What is the difference between a Training PE and a Forward PE?

Trailing PE Ratio is computed using the financial figures of the past period (usually a year).

On the other hand, a forward PE is a ratio calculated using projected data (usually one year ahead).

Q.16: What is BETA?

Beta is the measure of a stock price’s sensitivity to changes in the stock market. This is derived using historical figures using regression analysis.

A beta of 1 means that it moves equally proportionated to the movement of the stock market.

A beta lower than one means that it is less volatile, or less movement than the stock market movement.

A beta is higher than 1 means that its price is more volatile than the market.

Q.17: Which is better between EBIT and EBITDA?

None.

The issue should be which one is more interesting to decision-makers.

The only difference between the two is that EBITDA is after depreciation and amortization, unlike EBIT.

If the depreciation and amortization are very significant, decision-makers most likely consider using EBITDA.

Q.18: What are the disadvantages of using the Price-Earnings Ratio?

a. It is too simple. Aside from current price and net income, it doesn’t take into account other factors that could affect the fair value of the company.

- Price-Earnings need other multiples to have meaning.

- PE Ratio does not take into account growth.

- PE Ratio doesn’t consider debt

Q.19: How does oil price changes affect our economy?

Oil and other petroleum products are the main inputs in most of our industries.

Increasing oil prices will increase the costs of producing products and services, especially in the manufacturing and transportation sectors.

On the micro-level, increases in oil prices decrease a household’s spending power.

It also dramatically reduces a company’s ability to pay, especially organizations that are heavily reliant on gasoline (e.g. bus companies)

On the macro level, oil price increases tend to reduce economic growth and increase inflation.

Q.20: Suppose your grandma’s broker told her to SELL already here Apple stocks, how would you react to this?

I’ll first ask my grandma to tell her broker to send her an equity research report.

I’ll explain to my grandma each part of that report (assuming she doesn’t know yet), and how it could affect her decision of buying, holding or selling stocks.

I’ll take a look at the equity research report, and if I see something off, I’m going to do further research on my own.

If time permits, I’ll even do comprehensive research for my grandma.

Q.21: How do you value a stock?

There are a lot of ways to value a stock. The most common is to use Discounted Cash Flows.

Discounted cash flows use the future cash flows of a company to determine the current fair value of a stock.

We can also use multiples to value a company.

We use relative valuation methods such as Comparable companies analysis and the Precedent transaction valuation method.

Q.22: If a company has a higher Price-Earnings ratio than another company, what could be the reason?

The formula for Price-Earnings ratio is:

Based on this formula, the PE ratio could go higher if the Price per share is high relative to earnings per share.

Price per share is high if investors assess that the growth potential of the company is high. As such, they will also value the shares higher in the market.

Q.23: What can you imply with a company that has a low PE multiple but a high EV/EBITDA multiples?

The difference between the two multiples is Net Debt.

Net Debt is the total of short-term debt (including a portion of long-term debt), long-term debt, all non-controlling interest, preferred shares and then deduct cash and cash equivalents.

As such, the difference in the multiples means that eh company has a significant amount of net debt.

Q.24: Why is it sometimes necessary to unlever a beta?

To unlever a beta means that to remove the effect of debt of the company to the movements of the stock’s price.

Unlevering data means that you only want stockholder’s equity to affect it.

Unlevered beta is assumed to be a more accurate measure of a stock’s volatility due to the removal of the effect of debt securities.

The beta you get from tools like Bloomberg is levered data.

Unlevered data is computed by:

Un-Levered Beta = Levered Beta / (1 + ((1 – Tax Rate) x (Total Debt/Equity)))

Q.25: Is it possible for a stock to have an Equity Value that is higher than its Enterprise Value?

Yes. Based on the formula Enterprise value = total equity market value + Gross Debt less Cash, Equity value is higher when it has no interest-bearing debt but have cash.

Q.26: What is the disadvantage of Discounted Cash Flows?

DCF cannot be used when the analyst cannot reliably forecast the cash flows of the company.

This usually happens when the company is just in the beginning, and do not have stable operations yet (e.g. Tech start-ups)

Q.27: Based on Warren Buffett, why are EBIT multiples more preferable than EBITDA multiples?

This is what Warrant Buffett says about EBIT vs EBITDA.

“Does management think the tooth fairy pays for capital expenditures?”

“It amazes me how widespread the use of EBITDA has become. People try to dress up financial statements with it.”

“We won’t buy into companies where someone’s talking about EBITDA.

If you look at all companies and split them into companies that use EBITDA as a metric and those that don’t, I suspect you’ll find a lot more fraud in the former group.

Look at conglomerates like Wal-Mart, GE, and Microsoft — they’ll never use EBITDA in their annual report.”

Including depreciation and amortization is a less accurate value of the company.

For example, the depreciation of an aging factory is not a factor in the current fair value of a stock.

Q.28: Why do we use 5-10 years as the projection period for Discounted Cash Flows?

The reason is that of the relevance and usability of the report. Less than five years is a relatively short measure of the future of the company.

It will be hard to look in the long-term if you are looking at less than five years’ projections.

On the other hand, the projection of more than ten years is already too far ahead.

There are already a lot of unseen factors that could affect the company in more than ten years.

Q.29: What is the discount rate used in Discounted Cash Flows?

The most common discount rate used in DCF is the Weighted Average Cost of Capital (WACC).

WACC is composed of Cost of Debt, Cost of Preferred Shares and Cost of Common Shares. As such, you will need to compute three items.

Q.30: How do you compute the terminal value in a Discounted Cash Flow?

Terminal value is the present value of all cash flows beyond the projected period. It is commonly computed using the Gordon growth model or using exit multiples.

Q.31: What is a mid-year convention in Discounted Cash Flows?

Midyear convention is DCF is used to reduce the effect of assuming cash flows are done at the end of the year.

Midyear convention assumes that cash flows are done in the middle of the year instead of at the end of the year.

As such, instead of using discount rates of 1 for the first year, 2 for the second year, etc., the analyst uses 1.5, 2.5 and so on and so forth.

Q.32: Pitch me a stock.

This is a sell-side pitch, meaning you want the person to buy the stocks. As such, you need to highlight the strengths so that he’ll buy them.

You’ll need to have the following in advance so that you can make a successful pitch during an interview:

- A company of your choice. You must completely agree that this company’s stock price is going up.

- An equity research report you made

- Valuations, Models, Ratios that will support your pitch

Q.33: Tell me about a company that you admire, and that makes you buy a significant amount of its stocks.

This is similar to “pitch me a stock”, so you’ll do the same.

Prepare in advance an equity research report you made along with all your justifications (valuations, etc.).

You might also want to highlight the strength of the management, the industry or the products of the company.

Q.34: Suppose you have USD$1M, how would you invest it?

This question has a very high chance of being asked, and so, you must be ready.

You can even prepare a portfolio mix through Excel, which you can show the interviewers.

Should you just include stocks? No. Include fixed income securities as well because your target is to diversify your assets.

Ideally, your portfolio mix is one that is considered quite risky. Why? Because you are a sophisticated investor given your advanced knowledge in financial instruments.

This kind of combination has stocks as the most significant percentage, followed by corporate bonds and then government bills.

Q.35: What is the difference between Fundamental Analysis and Technical Analysis?

Both are methods to analyze and project future prices of stocks.

Fundamental analysis uses extensive analysis of financial statements, non-financial data and external factors to determine the future price of the stock.

Technical analysis is merely analyzing the stock chart in an attempt to find trends and patterns that will determine the future value of the stock.

Now, below you will read about non-technical Equity Research Interview Questions

Non-Technical Research Analyst Interview Questions

Q.36: How much does money motivate you in your career?

The amount of money especially, the number of salaries motivate me in such a way that I can live comfortably with a higher wage, that’s why I went to finance, notably investment banking.

However, it’s not the one thing which composes the 100% of my motivation. In this early part of my career, I highly value having a company and a manager that will guide me and make me leap to the next level of my career.

Q.37: What keeps you motivated?

“New learnings and new experiences. I’m motivated that every I get to learn new things and that someday I’ll be respected equity research professional.”

Q.38: Do you consider leaving your job in the future to start your own company?

The employer wants you to hearsay NO to this question.

Say NO.

“I’m currently enjoying all that’s happening to my career right now.

I’m good with the fact that I am under the tutelage of experienced senior professionals.

At the same time, I am happy that I am under the wing of an established company.

I don’t have to think about the ‘operations’ side of things and focus only on equity research itself.

Q.39: In equity research, what is the difference between analysts and associate?

In a firm or department, analysts have higher positions than associates.

Analysts have the responsibility of checking and reviewing the work of associates, before submission to senior analysts or equity research head.

This is in contrast to investment banking where associates have higher roles than analysts.

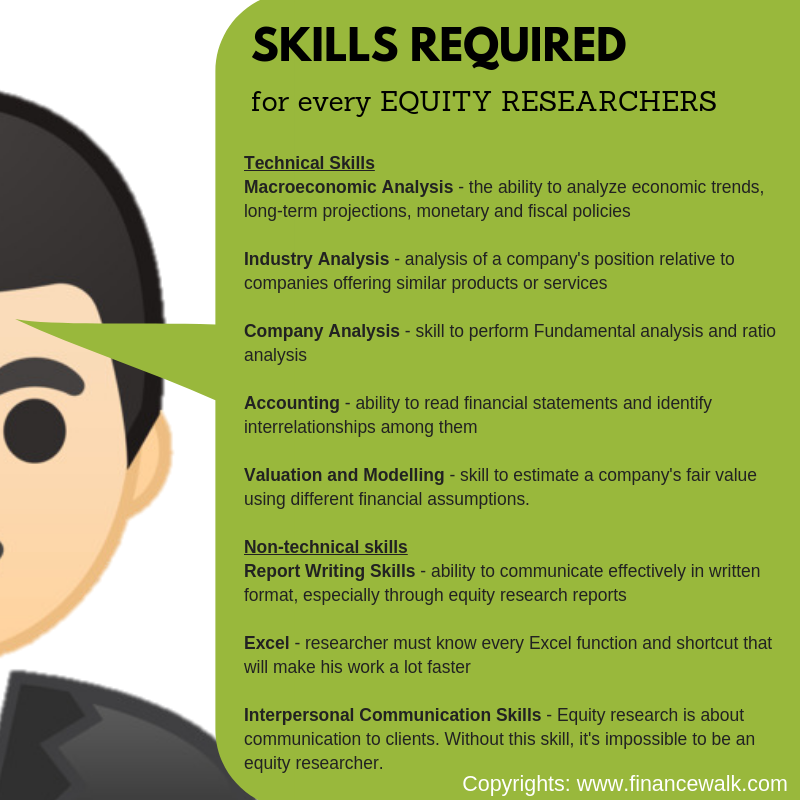

Q.40: What skills are needed in equity research?

Q.41: What is a restricted list in equity research?

The restricted list is a list of shares that the research firm is not allowed to report based to avoid conflicts of interest.

The most common basis of this is when the investment banking arm of the same company is working on an IPO of that company.

Q.42: How do you explain equity research to a 5-year old kid?

Equity research is a career where adults advise adults about whether it’s good to buy a goodie.

That goodie is good to buy when after some months that goodie is going to be worth higher.

For example, a goodie now is worth $1.

The equity researcher will do his work and then realizes that the goodie will be $2 after six months.

He will then tell other adults to buy that goodie for $1 now and then sell it after six months for $2.

And so, the adults will get $2 instead of having just$1.

To gain a deeper understanding, read this step-by-step guide on equity research career.

Q.43: What is the difference between sell-side and buy-side equity research?

Sell-side and equity side in research refers to the motives of clients for buying stocks.

Sell-side firms buy and sell shares to earn from fluctuations in stock prices.

Sell-side firms include investment banks, commercial banks, stockbrokers, market makers, and private firms.

Buy-side entities buy stocks to add to their investments. They earn by growing that company and then exiting when the share prices are already favourable.

Buy-side firms include asset management firms, hedge funds, institutional and retail investors.

Q.44: Why Equity Research and Are you prepared for stressful work?

YES.

Before I decided to be an equity researcher, I already knew that this is a very tough job.

I know for sure that there would be long working hours and various deadlines throughout the day.

To get me ready for it, I improved my skills so that I can work even faster.

For example, I memorized a lot of Excel shortcuts so that I can save time. I also make sure that I know the valuation methods by heart.

I also practised writing reports so that it would be easier for me when I’m already on the job.

I hope you’re enjoying this list of Equity Research Interview Questions?

Q.45: What does an Equity Research associate do?

They usually maintain files of companies under the sector they are assigned to.

They provide a fundamental analysis of those companies consistently. They develop financial models, industry analysis and sector databases.

They must always be in-the-loop in terms of news related to the industries and sectors they cover. This is very crucial as it is part of their fundamental analysis.

They assist the heads in publications of research reports.

Q.46: What does an Equity research Head do?

The head of equity research provides support and leadership to achieve goals and strategies set by the brokerage firm.

They ensure that all pricing is estimated based on best practices.

They supervise the publication of research reports, as well as recommendations for both internal and external use.

They also usually talk with other brokerage firms, research consultants, equity research analyst, portfolio manager, or fund managers.

Q.47:Some firms do have Senior Analysts, how do they support the Equity Research Head?

They coordinate research reports before releasing for publication.

As such, they provide notes, additional texts, comments, reports or edits to the research reports submitted by associates.

They are also the ones who coordinate or regulate the distribution of research products, ensuring that all legal or company policies are being followed.

Because of this, they must have a high level of knowledge of regulatory functions together with their finance knowledge.

Q.48: What is MiFID II?

What is MiFID II?

MiFID 2 (Markets Financial Instruments Derivative 2) is legislation by the European Union (EU) that will increase the integrity of European markets, protect investors from biased research reports and improve the competitiveness of the financial markets.

MiFID II affects different financial markets such as stock, fixed income, currency, futures and forwards and derivatives markets.

Q.49: How does MiFID II affect the equity research profession?

Like others, this question is also essential, so we included in our list of Equity Research Interview Questions

Among the provisions of MiFID II is the disallowance of giving free equity research reports.

Such reports are usually, technically, are paid as part of the brokerage fee. As a result, firms can only get paid if they can broker stocks.

There could be a tendency to create the report in such a way that it will entice the reader to buy.

This bias is what MiFID II is trying to avoid.

As such, research reports and brokerage fees would now be unbundled, meaning, paid separately.

Because of this change, this could significantly lower the number of clients of equity research, as a lot would not opt to pay for the reports. Some equity research firms are planning to cut employees.

There would be less working opportunities in equity research.

On the other hand, it could improve equity research reports because of the unbundling of services.

Q.50: What are some soft skills in Equity research that you think you’ll significantly need?

- Report Writing Skills

- Accounting Skills

- Excel Skills

- Financial Valuation and Modeling

I hope you find this guide helpful about Equity Research Interview Questions that includes 50 (Technical as well as Non-Technical equity research interview questions with complete answers).