Are you ready to learn how to do equity research? Here is the truth.

Whether you are a finance student, a career switcher, or an aspiring analyst, mastering equity research is your ticket to financial expertise and success.

How to do equity research?

To conduct an effective equity research:

Start by defining your investment objectives and risk tolerance.

Select stocks based on financial stability, competitive positioning, and management quality.

Analyze financial statements, industry dynamics, and market conditions, and use valuation methods like DCF and comparative analysis.

Finally, continuously monitor your portfolio and stay informed about market developments to make informed investment decisions.

In this guide, you will learn the actionable tips to do equity research.

But where do you start, and how do you navigate this complex field of equity research?

It does not happen overnight, and it demands dedication, effort, and, most importantly, a burning passion for what you are doing.

An equity research analyst’s job isn’t just about crunching numbers and dissecting financial statements.

It is about uncovering opportunities, managing risks, and ultimately making choices that can transform your financial future.

It is about taking control of your investments and not leaving your financial destiny to chance, and that’s what you will learn in this guide.

Ready to learn? Let’s get started!

Actionable Steps – How To Do Equity Research

Sell-side firms create equity research to assist investors and hedge fund managers in identifying market prospects and enabling them to make well-informed investment choices.

Investment analysts rely on equity research and financial modeling to assess the potential risks and returns associated with various investment opportunities in the stock market.

Follow the following specific tips and strategies for each stage of the equity research process.

Actionable Steps for Conducting Equity Research

| Steps | Actionable Tips |

| Step 1: Define your Objectives | Set clear investment goals Determine risk tolerance Decide on investment horizon |

| Step 2: Choose Your Stocks | Focus on financial stability Assess competitive positioning Evaluate management quality |

| Step 3: Gather Data | Utilize SEC filings Refer to financial news websites Visit company websites for reports |

| Step 4: Analyze Financials | Assess profitability, liquidity, and debt levels Analyze financial ratios Review financial statements |

| Step 5: Industry and Market Analysis | Compare the company to peers Analyze market and industry dynamicsEvaluate external factors |

| Step 6: Company Valuation | Use Discounted Cash Flow (DCF) analysis Conduct comparative analysis Consider earnings multiples |

| Step 7: Risk Assessment | Identify and mitigate investment risks Diversify your portfolio Analyze beta and volatility |

| Step 8: Make Recommendations | Based on your analysis, make buy, sell, or hold recommendations Support recommendations with reasoning |

| Step 9: Create a Portfolio | Diversify your investments Allocate funds based on research and risk tolerance |

| Step 10: Monitor and Adjust | Regularly review your portfolio Stay informed about market developments Rebalance as needed |

| Step 11: Learn and Evolve | Keep learning and adapting to market conditions Stay open to new investment ideas and opportunities |

These actionable insights will empower you to make informed decisions and excel in your own equity research firm and journey.

Step 1: Define your objectives

You need to start by defining your goals in order to stay on track. Here are a few of them:

What are you trying to achieve?

Are you seeking stocks for long-term growth, short-term gains, or dividend income?

Step 2: Choose your stocks

Begin by selecting the stocks you want to analyze. You can focus on a particular industry, market sector, or geographical region.

Criteria for selecting stocks

Financial stability: Look for companies with a strong financial foundation, including healthy balance sheets, consistent revenue growth, and manageable debt.

Competitive position: Identify firms with a competitive advantage, whether it is through innovative products, a strong brand, or dominant market share.

Management quality: Assess the leadership team’s track record and integrity. A skilled and ethical management team can significantly impact a company’s success.

Diversification is key; don’t put all your eggs in one basket. Let’s talk about how to identify industries and sectors of interest:

Follow your passion: Start with industries or sectors you are genuinely interested in. Your passion can be a powerful motivator for in-depth research.

Market trends: Keep an eye on emerging market trends and technologies. Invest in industries with long-term growth potential.

Step 3: Gather data

At this stage, your financial literacy and data sources come into play. Collect essential financial data on the selected companies, including their financial statements, earnings reports, and relevant market data.

Where to find reliable financial data and news sources

- SEC filings: The U.S. Securities and Exchange Commission’s EDGAR database is a goldmine for company filings and reports.

- Financial news websites: Reputable financial news websites like Bloomberg, CNBC, and Reuters provide up-to-date market news and analysis.

Company websites: Company websites often offer investor relations sections with financial reports and presentations.

Tools and resources for fundamental analysis

Stock screeners: Utilize stock screening tools to filter stocks based on specific criteria like market cap, P/E ratios, or dividend yield.

- Financial analysis software: Consider using software like Microsoft Excel or specialized financial analysis tools for in-depth number crunching.

Step 4: Analyze financials

Assess profitability, liquidity, debt levels, and cash flow. Look for trends, anomalies, and red flags. Financial ratios like P/E, P/B, and ROE are your tools for evaluation.

Key Ratios and Metrics

Price-to-Earnings (P/E) Ratio: Helps you gauge a stock’s relative value. A lower P/E may indicate an undervalued stock.

Return on Equity (ROE): Measures a company’s profitability in relation to shareholders’ equity. High ROE can signal efficient use of capital.

Debt-to-Equity Ratio: Assesses a company’s leverage. Lower debt ratios are generally preferable.

Analyzing financial statements

Income Statements: Focus on revenue trends, profit margins, and earnings growth.

Balance Sheets: Examine assets, liabilities, and equity to understand a company’s financial position.

Cash Flow Statements: Evaluate cash flow from operations, investing, and financing activities.

Step 5: Industry and market analysis

Zoom out and examine the broader industry and market dynamics.

How does the company compare to its peers?

Are there any sector-specific risks or opportunities?

How to evaluate a company’s management, competitive advantage, and industry position

Management assessment: Investigate the CEO’s vision, track record, and transparency. Good leadership can steer a company to success.

Competitive advantage: Identify what sets the company apart, whether it’s a unique product, strong brand, or cost leadership.

Industry position: Understand the company’s position within its industry and its growth prospects compared to peers.

How to assess external factors

PESTEL Analysis: Evaluate Political, Economic, Social, Technological, Environmental, and Legal factors that can impact the company’s performance.

SWOT Analysis: Assess the company’s Strengths, Weaknesses, Opportunities, and Threats to gain a holistic perspective.

Step 6: Company valuation

Now that earnings estimates are out, it’s time for senior analysts, fund managers, hedge fund managers, and institutional investors to get into equity research and determine the intrinsic value of the stocks.

Methods for determining intrinsic value

Discounted Cash Flow (DCF): Discounted Cash Flows estimate the present value of future cash flows, considering factors like growth rates and discount rates.

Comparative Analysis: Compare a company’s financial metrics to industry benchmarks or similar firms.

Earnings Multiples: Use P/E ratios, Price-to-Sales (P/S) ratios, or Price-to-Book (P/B) ratios to gauge relative value.

Step 7: Risk assessment

Assess the risks associated with each stock. Consider both company-specific risks (e.g., management issues) and market risks (e.g., economic downturns).

Your earlier definition of risk tolerance will guide you here.

How to identify and mitigate investment risks:

Diversification: Spread your investments across various asset classes and industries to reduce risk.

Beta and volatility: Understand a stock’s beta to gauge its sensitivity to market movements. Lower beta stocks tend to be less volatile.

Step 8: Make recommendations

Based on your analysis, make investment recommendations. Should you buy, sell, or hold each stock?

Back your recommendations with solid reasoning from your research reports.

Step 9: Create a portfolio

Diversify your investments in investment banks by creating a well-balanced portfolio of various securities research by investment banks.

Allocate your funds among the chosen stocks by the investment bank based on your research and risk tolerance by the investment banks.

Strategies for ongoing portfolio management

Regular check-ins: Review your portfolio periodically to ensure it aligns with your investment goals.

Stay informed: Keep up with company news, industry trends, and market conditions.

Rebalance as needed: Adjust your portfolio allocation as market conditions and your objectives evolve.

When to buy, hold, or sell stocks

Buy: When your research suggests a stock is undervalued and aligns with your investment strategy.

Hold: Maintain positions in fundamentally sound companies, even during market fluctuations.

Sell: If a stock no longer meets your criteria, consider selling to reallocate funds to more promising opportunities.

Step 10: Monitor and adjust

Your equity research journey does not end after you have made your initial investments. Continuously monitor your portfolio and the market.

Stay informed about a company’s stock price, news, economic changes, and industry developments. Be ready to adjust your portfolio as needed.

Step 11: Learn and evolve

Equity research is an ongoing process. Keep learning, refining your research skills, and adapting to changing market conditions.

Stay curious and open to new investment ideas and opportunities.

By breaking down the equity research process and conducting it as illustrated in the above stages, you will not only make the journey less daunting but also increase your chances of making informed, successful investment decisions.

How To Do Equity Research – A Brief Outline

Now that you have learned the steps to do equity research, have an overview of the fundamentals of equity research to gain confidence with the process.

So, what’s the deal with the private equity and research firms, and why should you care? Let’s break it down.

What is Equity Research?

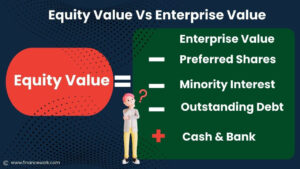

Equity Research is the art and science of digging deep into publicly traded companies, their financial health, and the overall market to make informed investment decisions.

Equity Research in Financial Analysis- Role

Think of equity research as the guiding light in financial data.

Analysts examine everything from a company’s financial statements, industry trends, and competitive landscape to predict how well a stock might perform.

They are like the weather forecasters of the stock market, helping investors navigate the stormy seas and seize sunny opportunities.

For instance, let’s say you are considering investing in a tech giant like Apple.

Equity research would involve scrutinizing Apple’s financial reports, assessing its market share, and examining the latest innovations in the tech industry.

By doing so, analysts can recommend whether it’s a golden apple worth biting into or one that might leave a sour taste.

What Does an Equity Research Analyst Do?

As an equity research analyst, your primary responsibilities will involve conducting comprehensive financial analysis, studying company performance, and monitoring market conditions.

Buy-side analysts

A buy-side firm include a wealth management firm, a pension fund firm’s investment managers, or a hedge fund.

An equity research analyst supplies information and recommendations to the firm’s investment and portfolio managers themselves, who oversee client investment portfolios and make final decisions about what securities to hold.

Buy-side equity researchers and analysts study and build financial research on companies.

Sell-side analysts

In a sell-side firm, an equity research analyst provides research and analysis on various stocks and companies to help the sell-side analyst and sell-side equity research firm’s clients, institutional investors, make informed investment decisions.

Sell-side brokerage firms’ equity research analysts monitor market data, publish research reports, make recommendations, and often engage in interactions with clients to provide insights and guidance related to equity investments.

You will use this information to generate insightful research reports and provide investment recommendations to assist clients or your firm in making informed decisions about buying, selling, or holding stocks.

Effective communication and staying up-to-date with industry developments are key aspects of success in this role.

Do you know how investment bankers design and lay out equity research?

Investment bankers work closely with equity research analysts to design and layout equity research reports.

- They aim to create a visually appealing and easily digestible document that presents the research findings effectively.

- This involves organizing the content logically, using charts and graphs to illustrate key points, and ensuring the report aligns with the firm’s branding guidelines to enhance its professionalism and readability.

Why should Equity Research Analysts care about Equity Research?

Now, let’s shift our focus to the equity researchers and why this matters for you and your clients.

Think of yourself as the tour guide for your clients on their financial planning journey.

Just like planning a cross-country road trip, would you lead your clients down unfamiliar paths without checking the map, weather forecast, or road conditions? Probably not.

Your clients entrust you with their hard-earned money, their financial dreams, and aspirations. They rely on your expertise to navigate the complex terrain of the financial world.

Equity research equips you with the tools to make informed decisions, choose the right investment destinations, know when to accelerate or hit the brakes, and steer clear of financial storms.

It is about safeguarding their financial future so they are not left vulnerable to the unpredictable winds of the market.

By conducting thorough equity research, you empower yourself to be the best possible guide for your clients, helping them navigate the intricate landscape of investments with confidence and precision.

It is not just about your success; it’s about securing theirs.

Let’s now talk about how to set up your company management and industry research report foundation in Equity Research.

Foundation to Effective Equity Research

Before you explore headfirst into the world of equity research, ensure you have got the essentials in place.

1. Financial literacy

Before you even think about analyzing stocks or assessing market trends, you must have a solid grasp of financial concepts.

It is like learning the rules of the road before you start driving. You would not have navigate unfamiliar roads without understanding traffic signs, right?

Similarly, financial literacy is your roadmap through the world of numbers, financial statements, and economic indicators.

2. Data sources

In the digital age, data is gold. Equity research relies heavily on accurate, up-to-date information, and there are numerous sources at your disposal:

- Financial statements: A top company management’s financial reports reveal its past, present, and potential future. Learning how to interpret income statements, balance sheets, and cash flow statements is fundamental.

Market data: Stock exchanges provide real-time data on stock prices, trading volumes, and more. Websites, financial analysts, news outlets, and specialized software are also valuable sources.

Economic indicators: Keeping an eye on broader economic indicators, like GDP growth, inflation rates, and unemployment figures, can give you insights into the overall market direction.

3. Defining investment goals and risk tolerance

Ask yourself:

What are your financial objectives?

Are you aiming for long-term wealth accumulation, retirement planning, or short-term gains?

How much risk are you willing to take?

By setting clear goals and understanding your risk tolerance, you’re essentially choosing your financial destination and the path you will take to get there.

So, now that you have learned the essentials let me take you through the Equity Research Report and Framework, where you will learn about the tools and strategies to navigate the world of stocks, analyze companies, and make informed investment decisions.

Equity Research Report

An equity research report is a detailed document prepared by equity research analysts.

Equity reports provide an in-depth analysis of a specific stock or company’s share price move, typically for the purpose of investment decision-making.

Information: It offers comprehensive data and insights into a company’s financial health, industry trends, and competitive positioning.

Investment recommendations: Analysts often buy, sell, or hold recommendations based on their analysis, aiding investors in making informed choices.

Risk assessment: This helps investors assess the risks associated with a particular investment, including factors like volatility and market conditions.

Transparency: Promotes transparency in financial markets by sharing research findings with investors, enabling them to understand the basis for investment decisions.

Market insights: Provides valuable market insights and can influence market sentiment and trading activity.

Regulatory compliance: In some cases, equity research reports are required by regulatory bodies to ensure fair and accurate information dissemination.

Investor confidence: Builds investor confidence by offering credible and expert analysis, which can attract potential investors.

Overall, equity research reports serve as a critical tool for investors, financial institutions, and the broader market to make informed investment decisions and manage risk.

Common Pitfalls to Avoid in Equity Research

While equity research can be highly rewarding, it is essential to steer clear of common pitfalls that can hinder your success.

Here are some pitfalls to watch out for and guidance on avoiding them:

1. Overconfidence bias

Pitfall: Overestimating your abilities and underestimating the risks involved.

Guidance: Stay humble and recognize that the financial markets are complex and unpredictable. Seek diverse perspectives and continuously educate yourself.

2. Neglecting qualitative factors

Pitfall: Focusing solely on numbers and ignoring qualitative aspects like asset management, quality, and industry trends.

Guidance: Incorporate qualitative analysis and industry research into your research.

Assess top company management’s leadership, financial model, competitive positioning, financial models, and the firm’s investment in asset managers and the broader industry landscape.

3. Confirmation bias

Pitfall: Seeking information that confirms pre-existing beliefs and ignoring contradictory evidence.

Guidance: Be open to challenging your assumptions. Encourage dissenting opinions in your research process to avoid confirmation bias.

4. Overlooking risk assessment

Pitfall: Neglecting to thoroughly assess and manage risks in your portfolio.

Guidance: Prioritize risk assessment. Understand the risks associated with each investment and develop strategies to mitigate them.

5. Herd mentality

Pitfall: Blindly following the crowd or popular investment trends.

Guidance: Conduct independent research and base your decisions on your analysis rather than market sentiment. Herd behavior can lead to bubbles and market crashes.

6. Lack of diversification

Pitfall: Concentrating your investments in a single stock or industry exposes your portfolio to higher risk.

Guidance: Diversify your investments across different asset classes and industries to spread risk and enhance portfolio stability.

7. Short-term focus

Pitfall: Chasing short-term gains and interest income while neglecting long-term investment strategies.

Guidance: Stay committed to your long-term investment goals and avoid making impulsive decisions based on short-term market fluctuations.

By being aware of these common pitfalls and following the guidance provided, you can navigate the world of equity research with greater confidence and increase your chances of making informed and successful investment decisions.

Frequently Asked Questions

How can I gain practical experience in equity research?

You can start by seeking internships with financial institutions or research firms that offer hands-on experience in corporate finance or equity research.

You can network with professionals in the field, attend industry events, join finance-related clubs or organizations, and connect with alumni for guidance and opportunities.

Consider participating in stock pitch competitions or managing a personal investment portfolio to develop your skills further.

What are some of the common challenges equity research analysts face, and how can I overcome them?

Common challenges for both equity analysts and research analysts include dealing with information overload, maintaining objectivity, and staying updated with rapidly changing market conditions.

To overcome these challenges:

Focus on developing efficient research processes that help you filter relevant information.

Equity research analysts meet the management of the companies they cover so as to get the most timely information in order to update their earnings estimates and reports.

Regularly review and adjust your own investment thesis or theses, and seek input from colleagues to gain different perspectives, which can enhance your analysis and objectivity.

My Exclusive Insights for You

Congratulations! you have now come to the end of this guide on how to do equity research.

Let’s recap the crucial lessons that can fuel your journey to becoming a proficient private equity analyst and researcher:

Start with a strong foundation of financial literacy to make a mark in the investment banking business.

The choices you make in selecting stocks, defining goals, and assessing risks are at the heart of your equity research journey.

Equity research is a blend of quantitative and qualitative analysis, including understanding markets, industries, management quality, and more.

Stay hungry for knowledge, embrace continuous learning, and adapt to new technologies, market trends, and investment strategies.

Now, the most important step is to apply what you have learned. Take action!