Are you driven by the desire to enter the dynamic world of venture capital as a career?

Whether you are seeking guidance on a venture capital career, securing venture capital investment for your startup, or simply looking to expand your knowledge about this fascinating VC industry, I am here to help you.

I assure you that you are at the right place at the right time because your Inner GPS (intuition) landed you here for a greater purpose- “Your professional career growth in venture capital.”

Let me answer your question directly first:

How to get into venture capital?

To be a venture capitalist, you should get started with what you have.

Consider earning an MBA or CFA with your bachelor’s degree to enhance your qualifications and actively seek opportunities at venture capital firms or angel investor groups.

Build a strong startup and tech industry network to get into venture capital.

Gain relevant experience through roles in finance, startups, or consulting.

Venture capitalists need various skills, including financial modeling and analysis, strategic thinking, networking, negotiation, and communication.

As a venture capitalist, you will make money by investing in startups, nurturing their growth, and realizing returns when these companies achieve significant milestones or are acquired by larger firms.

Your success depends on your ability to pick promising startups and support them effectively.

Now that I have your attention, keep reading this guide to discover what it takes to enter the venture capital field. After reading this actionable guide, I assure you that:

You will get absolute clarity on how to get into venture capital

You will be equipped enough to take real action based on your goal

In this guide, you will learn the practical action plan to get into venture capital, including educational foundations, relevant industry experience, and reasonable steps to achieve your career goals.

How to Get Into Venture Capital- Smart Actionable Steps

A venture capitalist (VC) is someone who puts money into new companies in the hopes of making a profit.

The primary objective is to aid new businesses in their early stages.

Like any other field, both venture capitalism and capital investing offer opportunities for you willing to take advantage of them.

VCs are shaping the future leaders of the global economy, and you could be one of them.

Getting into the venture capital business is not a walk in the park, but possible. Still, you should have a strong reason to get into venture capital.

Why should I get into venture capital?

The potential for significant returns on investment is a compelling reason for you to pursue a career in venture capital.

Venture capital offers the opportunity to invest in early-stage startups with high growth potential.

Suppose you have a keen eye for promising companies and can provide valuable mentorship and resources to help them succeed.

In that case, you can benefit from substantial financial gains when these startups achieve successful exits, such as through acquisitions or initial public offerings (IPOs).

So, educate yourself with the facts about the VC firms and industry expertise.

However, as you will find in the guidelines below, you need your wits, a solid educational background, and an entrepreneurial spirit to succeed.

What is venture capital?

Venture capital is a type of private equity investment where investors provide funding to early-stage and high-potential companies in exchange for ownership equity.

It is often associated with startups and aims to support innovation and growth, with the expectation of profitable exits through methods like IPOs or acquisitions.

Here are the practical, actionable steps at a glance on how to break into the field of venture capital:

How to Get into Venture Capital- Actionable Steps

| Step 1 | Educational Qualifications | Obtain a relevant undergraduate degree in fields like finance, business, or economics and consider advanced degrees, MBA or specialized programs. |

| Step 2 | Gain practical industry experience | Work in related fields like technology, consultancy, corporate finance, or startups to build expertise. |

| Step 3 | Develop your investment knowledge | Learn about valuation, financial modeling, and risk assessment through courses, workshops, and reading. |

| Step 4 | Get the must-have skills | Develop skills like investment accuracy, determination, teaching, business and economic understanding, emotional intelligence, and creativity. |

| Step 5 | Cultivate your online/Social media presence | Build an online presence on platforms like LinkedIn and Twitter, share industry insights, and stay updated on VC blogs and tech news sites. |

| Step 6 | Immerse yourself in startups | Gain hands-on experience by working directly with startups to understand their challenges and business models. |

| Step 7 | Start angel investing | Begin by making small investments in startups to learn the art of evaluating early-stage companies. |

| Step 8 | Construct a strong investment portfolio | Build a portfolio of successful angel investments to demonstrate your ability to identify promising startups. |

| Step 9 | Explore venture capitalist internships | Consider applying for internships at VC firms, even if they are unpaid, to gain insights into the industry. |

| Step 10 | Master due diligence | Learn how to evaluate startups thoroughly, including financials, market potential, and team dynamics. |

| Step 11 | Network | Actively engage in industry events, conferences, and networking opportunities to build connections. |

| Step 12 | Prepare for VC interviews | Research VC firms, practice common interview questions, and understand their investment strategies. |

| Step 13 | Venture Capital Career Path – options | Explore various paths like becoming an angel investor, entrepreneur, investment banker, or joining VC firms. |

| Step 14 | Company hierarchy for venture capital firm | Understand the typical hierarchy in VC firms, from Analyst to General Partner. |

| Step 15 | Showcase your value | Highlight your experience, network, and successful track record as an angel investor during interviews. |

| Step 16 | Stay persistent | Don’t let rejection discourage you; keep networking, learning, and refining your approach. |

| Step 17 | Attend demo days | Participate in startup accelerator demo days to discover promising startups. |

| Step 18 | Investor syndicates | Collaborate with other investors through syndicates or investment clubs to pool resources. |

| Step 19 | Understand legal aspects | Familiarize yourself with the legal aspects of VC deals using resources like NVCA. |

| Step 20 | Diversity and inclusion | Advocate for diversity and inclusion in startups and investment firms, exploring organizations like Diversity VC. |

| Step 21 | Create a personal brand | Build a personal brand as a knowledgeable and trustworthy investor through platforms like LinkedIn and Medium. |

Top 11 Platforms to Break Into VC Firms in the US

To make your journey easier, I am sharing some examples of venture capital firms, organizations, and platforms in the United States where you can apply for internships, jobs or enrich yourself for the venture capital career path:

1. LinkedIn

While not a specific company, you can use LinkedIn to connect with professionals at various venture capital firms across the United States.

2. Internship websites

Websites like Internships.com and Glassdoor often list venture capital internship opportunities from companies nationwide.

3. University career services

Your university’s career services office can connect you with local or national venture capital internship opportunities. For example, like the University of Houston or the University of Texas at Dallas, you can search in your university for similar career services.

4. Venture capital firms’ websites

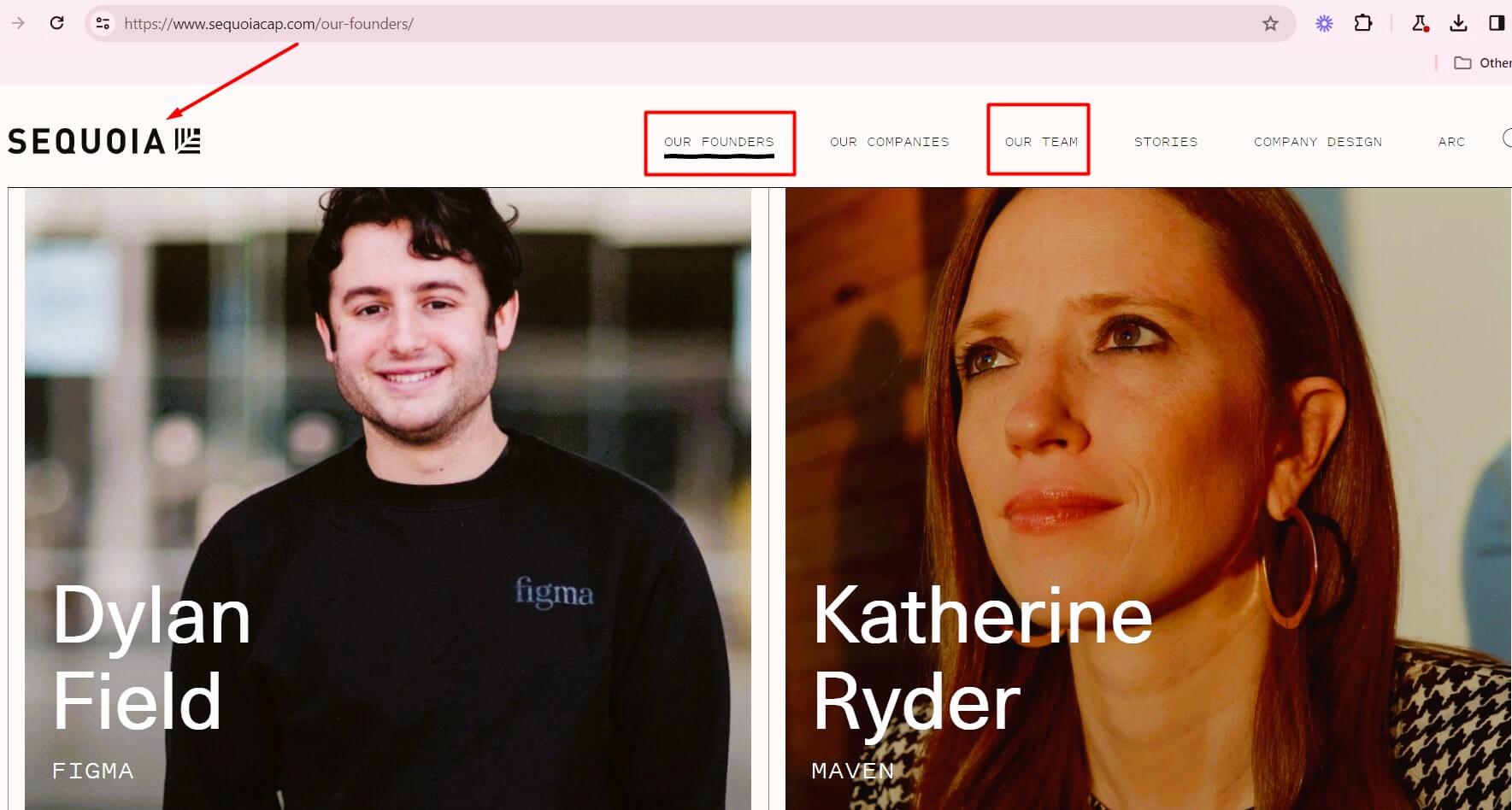

Check the career or jobs sections of well-known venture capital firms like Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins for internship listings. These investors also get help from investment bankers when it is time to take companies public.

5. AngelList

AngelList features startup and venture capital job listings from various US cities, including tech hubs like Silicon Valley and New York City.

6. Venture Capital Associations

The National Venture Capital Association (NVCA) may have internship listings on its website, representing the broader VC industry.

7. Networking events

Attend industry-specific events like the Silicon Valley Open Doors Conference or New York Venture Summit to connect with venture capital professionals.

8. Alumni networks

Contact your university’s alumni network to see if any former students work at VC firms across the US. For example, you can get an idea from and join College Consensus, INSEAD Alumni Association USA.

9. Online job boards

Explore websites like Foundit, CareerBuilder, and SimplyHired that list venture capital internship opportunities nationwide.

10. Startup incubators and accelerators

Consider organizations like Y Combinator in Silicon Valley or Techstars in various US cities, which often offer internship programs.

11. Cold outreach

If you have a specific firm in mind, reach out directly to express your interest in interning with them. For example, you could target firms like Accel Partners in Palo Alto or Union Square Ventures in New York City.

Note: The availability of internship opportunities may vary by location and time, so regularly check these sources and tailor your applications to match the specific firms or regions you are interested in.

Now that you are equipped with the arsenal to get into the venture capital career, you can get ready to prepare yourself through the practical steps I have shared in detail in the following sections.

21 Practical Steps to Get Into a Venture Capital Career

When you explore the practical steps, you will know why venture capital is one of the most competitive financial industries, and getting professional experience is critical.

To succeed as a venture capitalist, you need to cultivate the following qualifications and qualities:

Step 1. Educational qualifications

1. Bachelor’s degree

Get a bachelor’s degree in a relevant field, such as finance, business, economics, engineering or a related discipline, which is usually the starting point.

2. Advanced degrees

While not always required, many venture capitalists hold advanced degrees like Master of Business Administration (MBA) from respected business schools, which can provide a serious competitive advantage or edge.

Fact: Over half of VCs have an MBA; many of those degrees were earned at elite institutions like Harvard and Stanford.

3. Relevant courses

Consider taking courses in finance, accounting, entrepreneurship, and investment analysis as part of your undergraduate or graduate education to build a strong educational foundation.

4. Specialized programs

Some universities offer specialized programs or concentrations in venture capital and entrepreneurship within their business schools, which can be advantageous.

5. Certifications

Although not mandatory, certifications like the Chartered Financial Analyst (CFA) can demonstrate your finance and investment analysis expertise.

This educational background will provide a solid foundation for your venture and get into venture capital.

Step 2. Gain practical/ professional industry experience

Professional expertise is essential in the competitive world of venture capital investing. With industry expertise and a solid track record of financial performance, you will only go far in the venture capital industry.

Working for a respected business in technology, consultancy, corporate finance, media, or a startup is necessary. It helps if you have experience in a particular technology field.

Step 3. Develop your investment knowledge

Dive into the world of investment and finance fundamentals. Building knowledge necessitates reading newsletters and books or even enrolling in a course, but ensure the education program you choose should be geared toward venture capital.

Invest time reading books, enrolling in online courses, or attending workshops to grasp valuation, financial modeling, and risk assessment concepts.

“Routine is everything.”

If you want to make a career out of venture capital, you need to get off to a good start every morning.

Get familiar with the appropriate online and print media.

Select the periodicals that feature articles about investable leads.

Check out the articles discussing the latest innovations in marketable products and startup companies.

Discuss crucial investment affairs with venture capital partners and other members.

It is best to explore websites that cater to that field to improve on that particular expertise.

In addition, many venture capitalists focus on various publications that provide data financial analysis on potential investments and startups.

Everything you read and learn could come in handy someday.

Maintain consistent communication with other businesses and hold meetings over meals.

Get together with aspiring top business school owners after a long workday and learn about various business school industry trends.

Get a grasp on the endeavors and a feel for their viability.

Step 4. Get the must-have skills to succeed in venture capital

Here are some essential skills that you are expected to have in venture capital growth and private equity and industry:

1. Investment accuracy

You must know how to choose a firm to invest in and how much money to provide them.

Careers in venture capital may benefit significantly from making well-calculated investments in startups that pay off private equity investors handsomely.

In hiring new staff, VC firms seek out candidates who are quick to act and have the business acumen to determine whether or not a particular startup is worth funding.

2. Determination

You need the determination to make it as a venture capitalist because it demonstrates to potential employers that you are serious about the profession and will work hard if hired.

You can improve the accuracy of your investments, both of which require a high sense of determination, by:

Actively seeking out new opportunities.

Conducting an in-depth financial analysis of business proposals

3. Teaching

Sharing your extensive business and investment expertise with your colleagues and new companies may be helpful.

Having the capacity to educate requires sharing your own experience and knowledge in a readily understandable manner.

With this ability, you can provide vital feedback to young businesses, increasing the likelihood of their success and growth.

You and your coworkers may benefit from enhanced communication and skill development, and your company will reap the rewards.

4. Business and economic understanding

Understanding the business and economics of the venture capital recruiting process and deals will help you make better investment decisions and evaluate identifying potential investment opportunities and offers in the venture capital market.

Taking into account the state of the market and the results of previous endeavors by pension funds with similar goals is one way to make an investment thesis and assess the potential danger of an investment.

You will handle venture capital funds for various other tech companies and software companies here as a venture capitalist.

Have a high level of economic understanding to increase profits for the who and how to get into venture capital and firms.

5. Emotional intelligence

Emotional intelligence is another quality you should have as you will have the upper hand over less emotionally intelligent venture capitalists.

One of the most reliable indicators of success in the workplace is emotional intelligence.

It is the capacity to control one’s emotions and those of peers and superiors.

6. Creativity

One of the most significant abilities you can possess as a venture capitalist is the capacity to be a brand developer.

You must be diligent in establishing a reputation and a network that attracts and retains portfolio firms.

To build a successful brand, you must clearly state your portfolio company’s purpose and values and what sets you apart from the competition.

Step 5. Cultivate your online/ social media presence

Building a solid online presence on sites like LinkedIn and Twitter can help you meet influential people in your field.

Also, keeping tabs on VC blogs and tech news sites is essential.

Share your expertise by posting relevant industry insights articles and participating in discussions to showcase your knowledge.

Step 6: Immerse yourself in startups

Get hands-on experience by working directly with startups.

Understand their challenges, growth strategies, and business models.

This firsthand exposure is invaluable for your future VC career.

Step 7: Start angel investing

Begin your journey as an angel investor by making small investments in startups. This practical experience will teach you the art of evaluating and using early-stage companies and investing in first-stage companies and provide valuable lessons from successes and failures.

- Gain experience managing your funds and investments before taking this on as a full-time professional.

- Gaining investment banking experience is the best preparation for a venture capital career.

Create a diversified portfolio of multiple investments and put money into new business investment ideas.

Experts can also advise you on where to find the ideal starting resources.

Step 8: Construct a strong investment portfolio

Build a portfolio of successful angel investments early stage startups to demonstrate your ability to identify promising startups and generate returns.

This track record will speak volumes about your potential as a VC.

Step 9: Explore venture capitalist internships

Consider applying for internships at VC firms, even if they are unpaid.

These roles offer a glimpse into the inner workings of VC and provide valuable exposure.

If you enter the venture capital world, you must learn what’s expected of you.

You require a solid track record and related work experience. It is the most straightforward approach to outshining other businesses.

The path to becoming a venture capitalist is a long and tough one. To get the necessary experience, working for a well-known company can also be worthwhile.

Step 10: Master due diligence

Learn the art of due diligence when evaluating startups.

It involves a deep analysis of financials, market potential, team dynamics, and more, enabling you to make informed investment decisions.

Step 11: Leverage your network

Actively engage in industry events, conferences, and networking opportunities. Forge meaningful relationships with entrepreneurs, angel investors, and fellow venture capitalists who can provide valuable insights and opportunities.

Leverage your connections to uncover job openings in VC firms. Reach out to mentors, industry contacts, and fellow investors for introductions and recommendations.

Network with the right people in the venture capital industry.

The startup industry is in high demand among angel investors actively seeking new hires.

Visit local startup events to meet entrepreneurs in your neighborhood to build connections.

You may find startup events by browsing the appropriate websites if you need help knowing where to begin.

The competition for venture firms for capital is fierce. Venture capitalists often recruit persons who have previously assisted them. It’s possible to intern for a venture capital firm.

Participating in events where venture capitalists want to invest could be a good move.

Invite them to speak at your events or share their thoughts with your audience.

The venture capitalists are your target audience, so you should secure as many opportunities to engage with them as possible.

Step 12: Tailor your resume and prepare for interviews

1. Resume

Customize your resume and cover letter to highlight your relevant experience, skills, and passion for Venture Capital. Showcase what makes you uniquely qualified for the field.

Venture Capital Recruiting Process

| Steps | Stage | Description |

| Step 1 | Resume/Application | Submit your resume and application online. |

| Step 2 | Resume Screening | HR or recruiters review resumes for qualifications. |

| Step 3 | Initial Phone Screening | Initial phone interview to assess fit and aspirations. |

| Step 4 | First Round Interview | Assess knowledge, investment thesis, and analysis skills. |

| Step 5 | Second Round Interview | In-depth discussions, meet with team members, case studies. |

| Step 6 | Case Study/Presentation | Prepare a case study or investment pitch. |

| Step 7 | Reference Checks | Verify qualifications and gather insights from references. |

| Step 8 | Final Interview | Meeting with senior partners or decision-makers, cultural fit assessment. |

| Step 9 | Job Offer | Receive an offer with details on compensation and benefits. |

| Step 10 | Onboarding and Training | Begin onboarding process and receive necessary training. |

2. Interview preparation

Thoroughly research VC firms, understand their investment strategies, and practice your responses to common interview questions about investments and startups.

10 Most Asked Venture Capital Interview Questions

| S.No. | Venture Capital Interview Questions | Suggestions – How to Answer |

| 1. | Can you walk me through your investment thesis? | Explain your investment strategy, focus areas, and criteria for selecting startups to invest in. |

| 2. | How do you source potential investment opportunities? | Discuss your approach to finding and evaluating startups, including networking, industry research, and referrals. |

| 3. | What factors do you consider when evaluating a startup for investment? | Highlight the key criteria you use to assess the viability and potential of a startup, such as team, market, technology, and competitive landscape. |

| 4. | Tell me about a successful investment you’ve made. | Share a specific investment case study, emphasizing your role in identifying, investing in, and helping the startup succeed. |

| 5. | How do you assess the market size and growth potential? | Explain your methodology for estimating market size and growth and how it informs investment decisions. |

| 6. | What’s your approach to due diligence? | Describe the steps you take during due diligence, including legal, financial, and operational assessments of potential investments. |

| 7. | How do you add value to portfolio companies post-investment? | Detail how you support and guide startups in your portfolio, including mentorship, connections, and strategic advice. |

| 8. | Can you discuss a deal that didn’t go well and what you learned from it? | Share a story about a less successful investment, highlighting the lessons you gleaned from the experience. |

| 9. | What current trends or industries excite you in the venture capital landscape? | Demonstrate your awareness of the latest industry trends and emerging opportunities in the startup ecosystem. |

| 10. | How do you handle risk and uncertainty in your investment decisions? | Explain your risk management approach and how you assess and mitigate potential investment risks. |

Step 13: Venture capital career path- different options

As you work to become a venture capitalist, you can use several ways to join and get into venture capital capitalism.

Option 1. Angel investor

Venture capitalists invest in good industries and emerging companies with potential growth. You will support your own fund of money in small firms or early-stage companies.

In this case, you put a significant amount of your money in as growth equity into other small companies and get a return on invested capital investment. For example, to understand how to be an angel investor, you can visit Upcounsel.com.

Option 2. Entrepreneur or investment banker

Become an entrepreneur or an investment banking banker or banker can become a venture capitalist. The careers need high-quality skills that enable you to succeed in the venture capital investment banking industry.

Option 3. Join VC firms

Suppose you are a financial advisor, research analyst, technical business processor, or academic. In that case, you can finesse your skills and see how to get into venture capital by joining a VC firm.

You can enter the financial industry if you have worked in private equity or venture capital interviews or have corporate finance experience.

Option 4. Freelancer venture capital consultant

To become a Freelancer Venture Capital Consultant, follow these steps:

Build expertise: Start by gaining in-depth knowledge of venture capital, startup funding, and investment strategies. You can take online courses, read books, or follow industry blogs to stay updated.

Create a portfolio: Before landing your first freelance gig, showcase your knowledge and previous work. You can write articles or create case studies about successful investments or startups you’ve advised.

- Join freelancing platforms: Sign up on popular websites like Toptal, Upwork, and Freelancer. Create a compelling profile highlighting your venture capital consulting expertise and experience.

Bid on projects: Search for venture capital consulting projects on these platforms and submit well-crafted proposals. Mention your portfolio, relevant skills, and how to add value to potential clients.

Network: Join startup and venture capital communities on LinkedIn and other social platforms. Connect with potential clients, other consultants, and industry professionals to expand your network.

Deliver high-quality work: Once you secure a project, deliver exceptional results to build a positive reputation. Happy clients may lead to repeat business and referrals.

Market yourself: Continuously market your services by sharing industry insights, success stories, and testimonials on your website or social media profiles. Consider starting a blog or podcast to establish yourself as an industry thought leader.

Freelancer Venture Capital Consultant Success Story

“Jeffrey is a seasoned professional with a Harvard University degree, specializing in investment banking for startups and funds. Alongside his freelance CFO work, he has served as an interim CFO for over 300 companies and funds. His diverse career also includes partnerships with a venture capital fund, roles at prestigious institutions like Morgan Stanley and HSBC, and even co-founding a successful real estate brokerage.

Like Jeffrey, you too can become a “freelancer venture capitalists consultant” and get success as a VC professional.

Suppose you are considering a career as a freelancer. In that case, I suggest you read my following guides to help you in this direction:

- Work From Anywhere: Finance and Business Careers Guide

- Work from Anywhere-Finance & Business Careers: Practical Actions Guide

Building a freelance career takes time and persistence. Be patient and continue honing your skills to become a successful freelancer venture capital consultant.

Step 14: Company hierarchy for venture capital firm

It would help if you remembered that the company hierarchy in the venture capital fund business needs to be standardized.

While some businesses have a relatively flat structure consisting solely of Partners and Administrative personnel, others have a much more traditional, hierarchical organization.

Companies may mix the Principal and VP positions, while others may have a clear delineation between the two titles.

In addition, some businesses have just one tier of Partners, while others have two or even three.

The typical hierarchy of venture capital career looks like this:

Level 1. Analyst

Level 2. Pre-MBA / Associate

Level 3. Post-MBA / Senior associate

Level 4. Principal or VP

Level 5. Partner / Junior Partner

Level 6. General Partner / Senior Partner

Level 1. Analyst

As an analyst, you will be responsible for various administrative tasks, including data entry, research, and supporting Associates with tasks like due diligence and internal procedures.

- You may gain experience in various financial models, financial modeling, and market analysis. Still, you won’t be the one to push deals forward, as Associates and Principals will. Even if you help with sourcing, you probably won’t be the company’s first point of contact.

Level 2. Pre-MBA / Associate

- Following the analyst is the pre-MBA Associate position, which you get after years of experience in a related field, such as management consulting, investment banking, business development, product management, or sales.

You will serve as the company’s first line of action in vetting potential companies and recommending only the most promising ones to the company’s Principals and Partners.

Level 3. Post-MBA / Senior associate

This position is often awarded if you have earned a Master of Business Administration (MBA) degree. At the same time, straight promotions are possible in certain situations.

Daily tasks are similar to pre-MBA Associates, but as a post-MBA Associate, you have more opportunities to represent the firm and more influence with the firm’s principals and partners.

Level 4. Principal or V.P.

As the principal, you must understand the company’s technology/science and the business case.

You will be the most often senior executive or investment team member directly engaged in transaction execution and contract negotiation.

In the position of Principal or VP, you will have additional responsibility with existing other portfolio management businesses and the opportunity to sit on the various other portfolio management company management and company management boards, privileges that Associates do not have.

Level 5. Partner / Junior Partner

Your duties and salary as a Junior Partner will fall between those of a Principal and General Partner (GPs). You will be expected to participate on boards and visit portfolio firms but to a lesser extent than the GPs.

Deals can be closed with your help, but unlike General Partners, you lack ultimate discretion over whether investments are approved. With this experience, you might be asked to join the VC fund at a more senior level (e.g., partner, executive in residence, or operating partner)

Level 6. General Partner / Senior Partner

To be a General Partner, you must have proven experience as an entrepreneur or senior executive or have worked in the VC industry for several years and been promoted. Your duties will include:

Fundraising

Public relations

Final investment decisions

Being part of board seating

Having a say in human resources

Step 15: Showcase your value

During interviews, emphasize how your experience, network, and successful track record as an angel investor can bring significant value to the VC firm. Display your enthusiasm for the industry and its trends.

Step 16: Stay persistent

Breaking into Venture Capital can be competitive, but do not let rejection discourage you. Maintain your dedication, keep networking, continue learning, and refine your approach until you

Secure your dream VC role or

Begin your career as an entrepreneur, angel investor, or freelancer venture capital consultant.

You can begin your startup as a venture capitalist with all the insights you have gained.

So, I have shared those insights with you as well in the next steps.

Step 17. Attend demo days

Startup accelerator demo days are events where early-stage startups showcase their products and pitch to potential investors. Attending these events is a great way to discover promising startups. Websites like TechCrunch and Eventbrite often list demo days and startup pitching events in various locations.

Step 18. Investor syndicates

Collaborating with other investors through syndicates or investment clubs can help you pool resources and expertise. AngelList is a platform that facilitates syndicate investments, allowing you to join established investors in backing startups.

Step 19. Understand legal aspects

To navigate the legal aspects of venture capital deals, you can refer to resources like the National Venture Capital Association (NVCA), which provides insights into equity agreements and regulatory compliance in the venture capital industry.

Steps 20. Diversity and inclusion

Advocating for diversity and inclusion in startups and investment firms is essential for ethical and business reasons. To learn more and get involved, you can explore organizations like Diversity VC or the Female Founders Alliance.

Step 21. Create a personal brand

Building a personal brand as a knowledgeable and trustworthy investor can help you attract opportunities.

- Platforms like LinkedIn and Medium are excellent for sharing your insights and experiences in the venture capital field, allowing you to connect with entrepreneurs and fellow investors.

Additionally, consider starting a personal blog or website to showcase your expertise and investments.

- The venture capital landscape is dynamic, so staying updated through industry news websites like Crunchbase and VentureBeat is also crucial for you looking to enter this field.

As a venture capitalist, you should know that you’ll spend most of your days doing the following:

Due diligence

Meeting with founders

Supporting portfolio companies

Researching marketing opportunities

Like any other business venture or professional career, money is the reward of your risk-taking ability. Suppose you have chosen an unconventional career as a venture capitalist. In that case, you must be interested in knowing how much money venture capitalists make.

How Do Venture Capitalists Make Money?

Venture capitalists (VCs) make money primarily through a combination of equity ownership and successful exits from their investments. Here’s how it typically works:

Method 1. Investing capital

VCs raise funds from limited partners (LPs), which can include institutional investors, high-net-worth individuals, and even corporations. They use these funds to invest in startups and early-stage companies.

For example:

Sequoia Capital is known for raising substantial funds from various LPs and investing in numerous successful startups, including Apple, Google, and Airbnb.

Method 2. Equity ownership

In exchange for their investment, VCs receive equity (ownership shares) in the companies they back. This ownership stake gives them the potential for significant returns if the company succeeds and its value increases.

For example:

Andreessen Horowitz VC firm, led by Marc Andreessen and Ben Horowitz, has a notable portfolio with significant equity stakes in companies like Facebook (now Meta), Airbnb, and Lyft.

Method 3. Value addition

VCs often provide more than just capital. They offer guidance, mentorship, and access to their network to help the startups grow. This can increase the chances of success and enhance the value of their investments.

Method 4. Exit strategies

VCs typically aim for “exits,” which are events that allow them to realize their returns. Common exit strategies include initial public offerings (IPOs), where the startup goes public, or acquisitions by larger companies. When these events occur, the VCs sell their equity at a higher valuation than their initial investment.

For example:

Benchmark Capital played a pivotal role in the successful exit of Uber through its early investment. The firm also had stakes in eBay and Snapchat, both of which went public.

Method 5. Profit from exits

The profit from these exits, after deducting the initial investment and any expenses, is where VCsmake their money. They share the returns with their LPs according to pre-agreed terms, often taking a percentage of the profits as management fees.

For example:

Sequoia Capital saw significant returns from its investment in WhatsApp when Facebook acquired the messaging app for $19 billion, showcasing how VCs profit from exits.

Method 6. Portfolio diversification

VCs invest in a portfolio of startups, knowing that not all will succeed. They spread their risk across multiple companies, hoping that the successes will outweigh the failures, ultimately generating substantial returns.

For example:

500 Startups is known for investing in a large number of startups across various industries, spreading risk. While only some of its investments succeed, its approach has yielded successes like Canva and Udemy.

Salary and Compensation – How Much Do Venture Capitalists Make?

Venture capitalists’ salary and compensation can vary widely depending on factors such as their experience, the size and success of their investments, and their specific role within a venture capital (VC) firm. Here’s a general breakdown:

Venture Capitalists’ Salary and Compensation

| Salary and Compensation | Description |

| 1. Base Salary | VC professionals typically receive a base salary, which can range from $100,000 to $250,000 or more per year. |

| More experienced and senior professionals may command higher base salaries. | |

| 2. Bonus | VCs often receive performance-based bonuses, which can be a significant portion of their overall compensation. |

| These bonuses are tied to the success of the investments they make and can range from a few percentage points to a substantial share of the profits generated. | |

| 3. Carry or Profit Share | The bulk of a venture capitalist’s earnings often comes from their share of the profits, known as “carry.” Carry typically ranges from 20% to 30% of the profits generated by successful investments. |

| Carry typically ranges from 20% to 30% of the profits generated by successful investments. | |

| This can result in substantial income if the VC firm has a track record of successful exits | |

| 4. Management Fees | ome VC firms also charge management fees to their investors, and a portion of these fees may be allocated to the compensation of the VC professionals. |

| The specific amounts vary by firm. | |

| 5. Equity Stake | Venture capitalists may receive an equity stake in the startups they invest in, which can become valuable if the startups succeed and are acquired or go public. |

While some venture capitalists can earn substantial incomes, the industry is highly competitive, and success is far from guaranteed.

Many VCs invest in numerous startups, and the majority of these may provide little returns.

Additionally, the compensation structure is often tied to the long-term success of investments, which can take years to materialize.

The specific earnings of venture capitalists can vary widely based on their individual performance and the performance of the VC firm they work for.

Successful VCs who have a track record of picking winners can earn millions of dollars annually. In contrast, others may earn more modest incomes.

Here’s an overview of what you can earn as a venture capitalist at various levels in a VC firm:

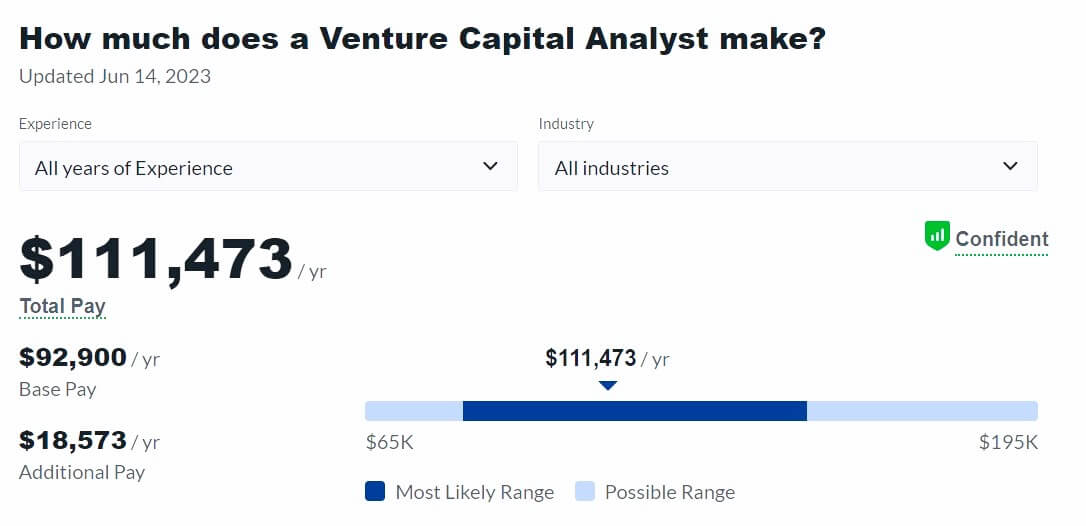

Level 1. Analyst

The estimated total pay for a Venture Capital Analyst is $111,473 annually in the United States, with an average salary of $92,900 annually.

Level 2 and 3. Pre-MBA Associate/ Post-MBA Senior Associate

The estimated total pay for a Venture Capital Associate is $156,668 annually in the United States area, with an average salary of $106,894 annually.

Level 4. Principal or VP

The estimated total pay for a Venture Principal is $283,354 annually in the United States area, with an average salary of $157,042 annually.

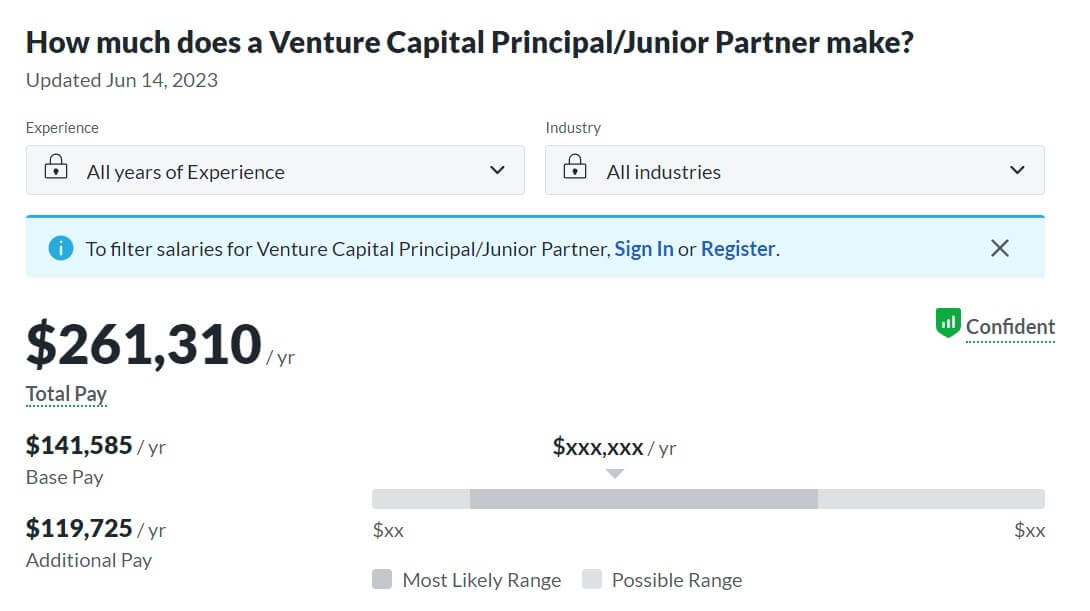

Level 5. Partner / Junior Partner

The estimated total pay for a Venture Capital Principal/Junior Partner is $261,310 annually in the United States area, with an average salary of $141,585 annually.

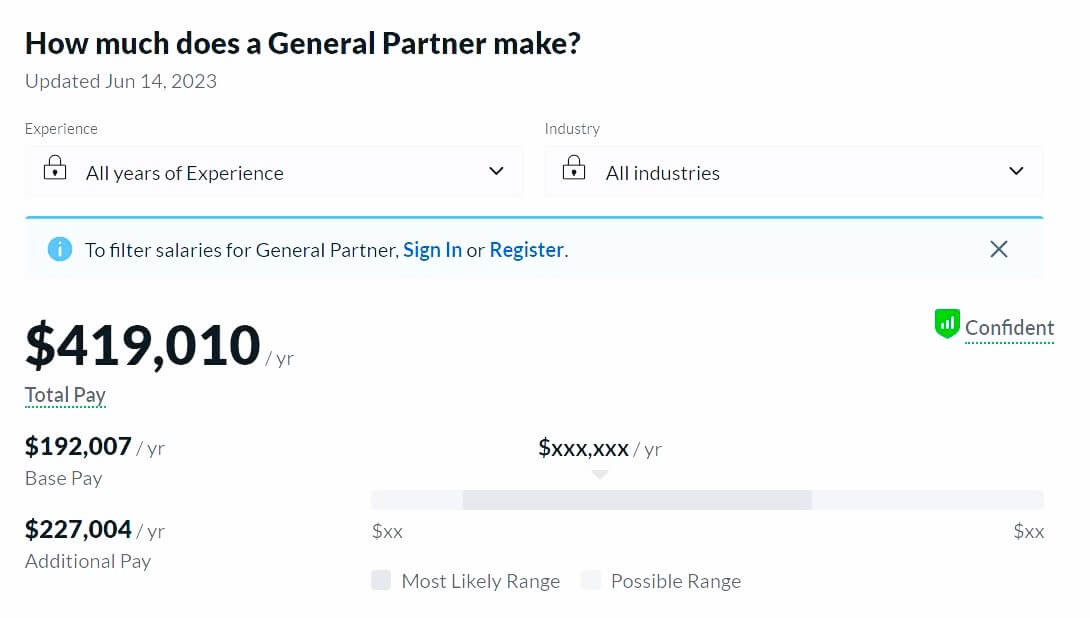

Level 6. General Partner / Senior Partner

The estimated total pay for a General Partner is $419,010 annually in the United States area, with an average salary of $192,007 annually.

Let’s explore some of the successful venture capital firms to draw some inspirations.

Successful Venture Capital Firms- Are You Inspired?

You can draw your inspiration from the following successful VC firms that started small:

1. Sequoia Capital

Founded by Don Valentine in 1972, Sequoia Capital is one of the world’s oldest and most successful venture capital organizations, investing in business-winning companies such as Google, Apple, and Oracle.

2. Founders Fund

Established in 2005 by Peter Thiel, Ken Howery, and Luke Nosek, Founders Fund is now one of Silicon Valley’s most successful venture capital organizations, investing in businesses including SpaceX, Airbnb, and Stripe.

3. Andreessen Horowitz

Founded in 2009 by Marc Andreessen and Ben Horowitz, Andreessen Horowitz has since become a key player in the venture capital market, investing in businesses such as Slack, Coinbase, and Instacart.

4. First Round Capital

Josh Kopelman founded First Round Capital in 2004. It is now a well-established venture capital company investing in firms such as Uber, Square, and Warby Parker.

5. Accel Partners

Founded in 1983 by Jim Swartz, Accel Partners has grown to become a renowned venture capital company, investing in firms such as Facebook, Slack, and Dropbox, among other firms.

6. National Enterprise Associates

C. Richard Kramlich founded National Enterprise Associates (NEA) in 1977. It is now one of the biggest and most successful venture capital organizations, including investments in businesses such as Box, AppDynamics, and Tableau Software.

In the following top venture capital firms globally, you can explore opportunities for internships, jobs, or partnerships:

20 Best Venture Capital Firms You Can Work in 2023

| 20 Best | Venture | Capital | Firms |

| 1. Sequoia Capital | 6. Benchmark Capital | 11. NEA (New Enterprise Associates) | 16. Battery Ventures |

| 2. Andreessen Horowitz | 7. Greylock Partners | 12. Founders Fund | 17. Redpoint Ventures |

| 3. Kleiner Perkins | 8. Index Ventures | 13. GGV Capital | 18. Menlo Ventures |

| 4. Accel Partners | 9. General Catalyst | 14. 500 Startups | 19. Canaan Partners |

| 5. Bessemer Venture Partners | 10. Lightspeed Venture Partners | 15. Khosla Ventures | 20. Union Square Ventures |

Note: The internship and job opportunities at these firms may vary and may be subject to change, so it's a good idea to visit their respective websites or reach out to their HR departments for the most up-to-date information on available positions or partnership opportunities.

Venture Capital Job Platforms

You can look for venture capital job opportunities globally on the following platforms.

20 Top Venture Capital Job Platforms

| 20 Top | Venture | Capital | Platforms |

|---|---|---|---|

| 1. LinkedIn | 6. VentureLoop | 11. 500 Startups | 16. Hired |

| 2. AngelList | 7. CB Insights | 12. Y Combinator Jobs | 17. Financial Times Jobs |

| 3. Crunchbase | 8. The Muse | 13. Built In | 18. Private Equity International |

| 4. Indeed | 9. SimplyHired | 14. eFinancialCareers | 19. CareerBuilder |

| 5. Glassdoor | 10. StartUpHire | 15. The Ladders | 20. Monster |

Note: The availability of jobs may change over time, so it's a good idea to regularly check these websites.

5 Platforms- Freelancing Venture Capital Possibilities

Suppose you are interested in finding freelance opportunities related to venture capital, you can explore the following platforms:

1. Upwork

Upwork offers a wide range of freelance opportunities, including consulting and research roles related to venture capital. They provide opportunities for venture capitalist consultants.

2. Freelancer

Similar to Upwork, Freelancer.com allows you to browse and bid on projects related to venture capital finance, business consulting, and market research.

3. Guru

Guru has a variety of freelance gigs, including those in financial analysis and consulting, which can be relevant to venture capital work. They hire freelancers for venture capital.

4. Toptal

Toptal specializes in connecting top venture capital freelancers with clients looking for high-quality talent in various fields, including finance and consulting.

5. Fiverr

Fiverr offers a platform for expert freelancers to showcase their skills, and you can find opportunities to provide services related to business analysis, financial modeling, and market research.

Frequently Asked Questions (FAQs)

Is venture capital a stressful job?

Venture capital can be a stressful job. As a VC professional, you will often face the pressure of making high-stakes investment decisions, managing portfolio companies, and dealing with the uncertainty of startup success. Additionally, the fast-paced and competitive nature of the industry can contribute to your stress levels in this field.

What are the challenges newcomers like me face to break into venture capital?

Breaking into venture capital can be challenging due to the competitive nature of the industry. Common challenges include building a relevant network of institutional investors, gaining practical experience, and convincing firms of your value. It’s essential to be persistent and continuously refine your approach.

Do I need to be an accredited investor to become a venture capitalist?

While being an accredited investor can provide more opportunities to invest in startups, working in VC firms is not always a strict requirement. However, having the financial means to make investments can be advantageous in this field.

What role does a venture capitalist play in the growth of a startup beyond providing funding?

Venture capitalists provide capital, guidance, mentorship, and connections to help startups succeed. They often sit on the boards of portfolio companies, providing strategic advice and assisting with business development.

Which specific industry sectors/niches within Venture Capital are promising for newcomers like me?

The attractiveness of industry sectors can vary over time. However, technology-related sectors like fintech, biotech, and software have traditionally been popular for venture capital investments. It’s essential to stay updated on emerging trends and opportunities.

What are some alternative paths to VC if I cannot find immediate opportunities at VC firms?

If you need help to break into VC directly, consider roles in related fields like angel investing, corporate and business development, or startup consulting. These roles provide valuable experience and connections that may eventually lead to a career in venture capital.

My Exclusive Insights for You- Is a Venture Capital Career Right for Me?

Working in your own venture capital firm is quite rewarding. If you aspire to enter the field, you still need the correct information, abilities, and attitude to achieve your goals.

The venture capital firm recruiting process is not structured. I advise people to create strong networks that will earn referrals.

Becoming a venture capitalist is more complex than most people imagine.

Achieving your goals requires a systematic, patient approach requiring substantial resources, capital, connections, and time investment.

You must be constantly alert and have a talent for seeing untapped profit potential to succeed in venture capital.

Suppose you want to know whether a "Venture Capital Career" is in your Inner GPS.

In that case, I suggest you sign up for our Inner GPS Career Coaching, where IGG Sanju Coach will help you clarify your inner calling. She will enable you to access your internal guidance system to gain insights into your professional inclinations.

Valuable tips:

It would be best to have a long-term plan and a vision for the future to succeed in the venture capital industry.

Many resources are required to start, including your own money, contacts, and time.

Get excited about meeting new individuals and exploring new profit potential.

The payoff will be substantial if you succeed in your first venture capital job.

I hope this guide added value to you in unlimited ways in the VC career insights. Begin taking actions, it works!

Keep investing in learning.

All the best!