Are you interested in public finance investment banking, and what you can do there?

Well, you have found your luck because in this comprehensive guide, I will cover everything you need to know about public finance investment banking.

Stick till the end and I will leave you with some top public investment banks that you can explore. Cheers!

Key Takeaways of Public Finance Investment Banking

Here is a quick summary of the key points in this guide:

- Public finance investment banking involves advising government entities on financial matters, issuing bonds, and managing public funds for infrastructure projects.

- Roles of a public finance investment banker: As a public finance investment banker, you must be proficient in debt and credit analysis. Also, you will be a financial advisor to the government – directing them on the best ways to manage public funds.

- Pros of Public Finance Investment Banking: The benefits of public finance investment banking include stable income from government demand, exposure to diverse government projects, and long-term relationship building.

- Cons of public finance investment banking: Cons of public finance investment banking include limited innovation due to bureaucracy, dependency on government policies, and susceptibility to economic downturns.

- How to get into public finance investment banking: Get into public finance investment banking by studying finance or a related field, gaining experience, obtaining relevant certifications, and applying for entry-level positions.

What Is Public Finance Investment Banking?

Public Finance Investment Banking

So, let us get down to business. As a public finance investment banker, you work closely with government agencies to structure and execute financial transactions.

This can include both revenue bonds or the issuance of municipal bonds to fund public infrastructure projects like schools, highways, or water treatment facilities.

You will also play an important role in managing the debt portfolios of the public sector entities, helping them to optimize their financial strategies for profit, and achieve fiscal sustainability.

In all, think of it as providing crucial money advice to the government – helping them make smart financial moves. Stick with me to the next section as I explore the roles and responsibilities of a public investment banker.

Public Finance Investment Bankers- What Do They do?

A public finance investment banker wears many hats, and some of them include:

1. Financial Advisor

As a public investment banker, you will assume the role of a financial advisor to state and local governments and private and public sector clients, and you will work closely with government bodies.

Now what kind of advice can you offer?

- Well, you can offer your two cents when it comes to budgeting, revenue generation, and overall financial planning.

- Also, you can offer advice on investment strategies and financial policies that align with the long-term objectives of the government.

So do you think you are up for this role?

It is a role that demands a deep understanding of public finance team the ins and outs of public finance and the ability to navigate the unique challenges associated with governmental financial management.

If that sounds like something you can handle, then go for it. I am cheering you on to greatness!

2. Bond issuance expert

When you work as a public investment banker, you will be an important voice when it comes to raising funds for public projects.

- You will be responsible for structuring and overseeing the issuance of bonds— which are essentially loans that investors provide to the government.

- As you know, the funds will be budgeted for the execution of public projects so you want to avoid the misallocation of funds.

- To avoid this, you will need to carefully study and fully understand the financial market, interest rates, and risk management.

- You must also assess the funding needs of the government to determine the appropriate type of bonds to issue, and ensure that the terms are favorable for both the government and the investors.

The key point to note is that if you want to be successful as a public investment banker, you need to plan strategically, communicate effectively with stakeholders, and have a keen awareness of economic conditions that might impact the financial and capital markets themselves.

3. Debt manager

You will also be tasked with overseeing debt issuance and optimizing the debt portfolios of government entities. Interesting, right?

So, how will you go about debt management?

- It involves a careful balancing act – ensuring that the government has access to the necessary funds for its operations and projects while also managing debt levels responsibly to maintain fiscal health.

- You will work to structure debt in such a way that minimizes costs, taking into consideration factors like interest rates and repayment terms. You might also explore refinancing options or debt restructuring to improve the overall financial picture.

- You must also keep a close eye on credit ratings. The aim of this is to maintain or improve the creditworthiness of the government.

Have it at the back of your mind that successful debt management contributes to long-term financial sustainability and helps the government to fund essential initiatives without compromising its financial stability.

4. Strategic financial consultant

As a strategic financial consultant, you will be tasked with providing invaluable advice to improve the success of public projects and initiatives.

- This role goes beyond mere number crunching; it involves a deep understanding of the goals, and priorities of the government as well as the current economic situation.

- You will have to work closely with government officials to align financial strategies with broader objectives.

- Also, you will assess the feasibility and financial implications of proposed projects and offer recommendations on funding sources and optimal budget allocations.

- Your insights contribute to creating a roadmap for sustainable financial success, ensuring that public funds are allocated wisely to maximize the impact of each project.

- By acting as a strategic financial consultant, you help the government make informed decisions that not only address immediate financial needs but also contribute to long-term economic growth and community well-being.

5. Credit analyst

Aside from debt management, you will also be responsible for evaluating risks associated with lending or investing in government-issued securities.

- You will be assessing the financial health and creditworthiness of municipalities and government entities.

- This examination involves a detailed examination of financial statements, economic indicators, and other relevant factors to determine if the government will be able to meet its financial obligations.

- This assessment influences decisions related to interest rates on bonds and other financial instruments.

- By providing insights into creditworthiness, you contribute to the ability of the government to secure funding at favorable terms, minimizing costs and maximizing financial efficiency.

In a nutshell, your role is to strike a balance between securing necessary funds and ensuring responsible financial management of investment bank.

Pros Of Public Finance Investment Banking

Here are some advantages of being a public investment banker:

1. Stable income streams

Yes, public finance investment banking is a very lucrative job, and you can be sure of a stable and steady source of income.

But how is this possible?

Well, the government is always in search of financial services related to government operations.

- The government regularly requires assistance in managing its finances, issuing bonds, and executing complex financial transactions.

- Unlike other sectors of investment banking that may be influenced by market fluctuations, public finance is anchored in the ongoing needs of the government, ensuring a more predictable stream of income.

So, if what you seek in the public finance ib and industry is a stable job, consider being a public finance investment banker.

2. Government project exposure

Working as a public financial investment banker will open your eyes to a lot of government opportunities.

- You will be working closely with government agencies at various levels to finance and manage projects that serve the public interest.

- This can include infrastructure projects like building bridges, highways, and public facilities, as well as funding for education, healthcare, and environmental initiatives.

3. Long-term relationships

When you work with the government for quite some time, you will gain their trust.

Establishing and maintaining such relationships will not only contribute to a stable client base for you but also create a foundation for continued business opportunities.

Cons of Public Finance Investment Banking

Here are some downsides to pursuing a career as a finance or investment banking analyst or banker:

1. Limited innovation

You might face issues with fostering financial innovation due to the bureaucratic nature of government processes.

The problem is that public finance bankers for government projects often stick to traditional financing structures, and this hinders the public and project finance and banking industry from adopting more agile and innovative financial solutions.

2. Dependency on government policies

The public finance investment banking industry is completely dependent on government decisions and policies.

Changes in political landscapes or shifts in priorities can impact project funding and financial strategies.

This nature of the industry introduces a level of uncertainty that may affect the predictability of business opportunities, making it challenging for you to navigate sudden policy changes and their consequences.

3. Cyclical nature

Public finance investment banking is subject to the cyclical nature of economies.

During economic downturns, the government may reduce budgets, leading to a decrease in funding for projects.

How to Get Into Public Finance Investment Banking?

Want to build a career in public finance investment banking? Here are some credentials you need to have:

1. Educational background

Pursue a relevant degree in Finance, Economics, Business, or a related field. Consider additional coursework in Public Finance, Government Finance, or Financial Management to build specialized knowledge.

2. Gain relevant experience

Seek internships or entry-level positions in finance, particularly those related to government or public and private sector, finance. Also, look for opportunities to work with financial institutions that handle municipal bonds, private equity or public project financing.

3. Certifications

Consider obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) or Certified Public Finance Officer (CPFO), to enhance your credibility.

4. Apply for positions

Look for entry-level positions or analyst roles in public finance investment banking. Tailor your resume and cover letter to highlight any relevant coursework, internships, or experiences.

Salaries & Compensations for Public Finance Investment Banking

Salaries & Compensations for Public Finance Investment Banking

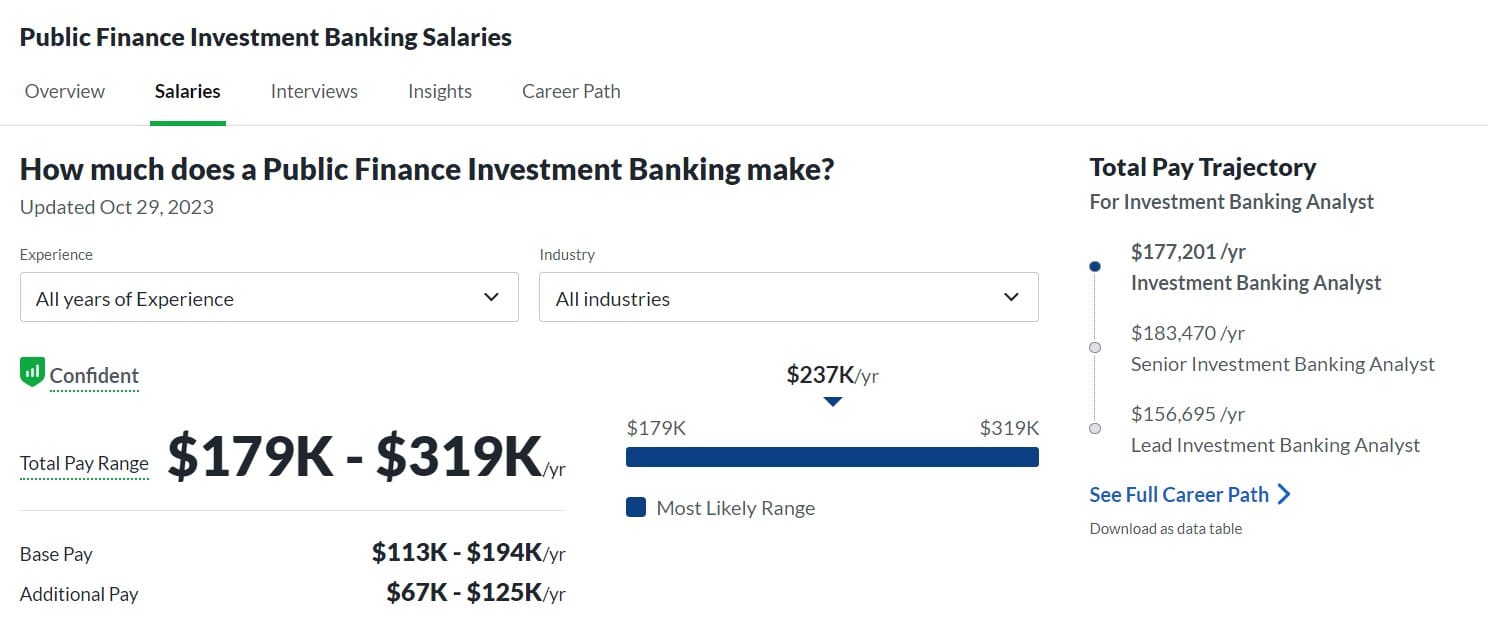

According to Glassdoor, Public Finance Investment Bankers in the United States earn an estimated total compensation of $236,840 annually, which comprises an average base salary of $147,900 and additional pay totaling $88,940 per year.

If you need a comprehensive salary breakdown, check out my guide where I talk about the salary of an investment banker.

Top Public Finance Investment Banking Firms

Check out some of the most popular public finance investment banking firms:

- Goldman Sachs

- Morgan Stanley

- JPMorgan

- Bank of America

- Citigroup

- PJT Partners

- Barclays

- UBS

- Oppenheimer

- Hilltop

- Piper Sandler

- Evercore

- Jefferies

- Centerview Partners

- Perella Weinberg

My Exclusive Insights For You

Public finance investment banking is a lucrative venture if you would dedicate time to learning the ropes.

However, you should understand that as lucrative as it may seem, it is not a walk in the park.

In this guide, I have dedicated time to put together everything you need to know about the field. If you are unclear of anything, do not hesitate to reach out to me in the comment box below and I will reply with answers to set you up.

Good luck!