It’s no coincidence that you clicked on this article right now. Just like it’s no coincidence that I chose to write it at this very moment.

Almost overnight, risk management careers have become one of the most important jobs in the world, and that’s not an understatement or a euphemism on my part.

The reason? The global pandemic which has caused an immense job growth.

Because of the unfortunate events that the entire planet has gone through in the past few months, we have noticed one thing.

Companies around the world have rushed to create risk committees and pushed job growth. As they should.

These risk committees are focused on situations such as planning for a crisis and dealing with employees working from home, data security, and financial stress. This is where the risk managers come into play. It’s their time to shine.

Think about it this way – who else can a factory turn to if, for example, they have had to close down for a month for obvious reasons? The risk managers.

They are the financial officers who can understand the company’s balance sheet, how much money will be lost, and how to deal with the situation in general.

As a result, the global pandemic has now brought risk management careers back into the spotlight, maybe like never before.

Therefore, it’s the best of times to talk about risk management careers, how to break into risk management, what kind of education you need, what type of certification, how to prepare for an interview, and more. Let’s get started!

What Is Risk Management and Why Is it Important?

The simplest way to define risk management would be to see it as having a company’s best interest in mind. Or looking after a company.

But how do you do that?

By looking at risk factors. Risk management is all about identifying, analyzing, and responding to any risk factors that surround a company.

When done correctly, risk management can almost ‘predict’ and even control future outcomes proactively.

This means that the company has an outstanding chance of ‘foreseeing’ if you will, what might happen to it from a financial point of view, and take measures to secure itself against any possible mishaps before they occur.

As opposed to letting them happen and then reacting to them.

This is also where the importance of risk management comes into play. It has the potential of reducing, if not eliminating as much as possible any outstanding threats or risks to a company.

By doing so, it also eliminates their impact on the company from a financial and insurance point of view.

It’s as simple as this. When you know the risk, it’s a lot easier to prepare for it. Look at it this way – let’s say you’re getting ready for bungee jumping. If you didn’t know the risks involved, you would jump without the cord.

But since you’re prepared, you are at a far lower risk of something bad happening to you than before.

The importance of risk management lies in identifying the risk before it happens. As a result, the purpose of risk management is to make risk easier to deal with.

What Is Enterprise Risk Management?

Now that you know what risk management is by definition, it’s very important to be able to tell the difference between this concept and that of Enterprise Risk Management or ERM.

When a company dives into ERM, it wants to know about three types of risks:

- Regulatory risks

- Financial risks

- Operational risks

These categories can mean anything and they depend on the type of company since ERM means they have to reach company-wide.

For example, ERM poses questions such as: what happens if one of our warehouses floods, what happens if our new type of chocolate doesn’t receive approval, or, like in this very real situation we have seen in the past few months – what happens if we have to send tens to hundreds of employees on leave all at once?

The risk manager has to calculate the potential financial impact any one of these situations might have on the enterprise.

This also includes cybersecurity, which is a rather new branch of ERM, but a very important one nonetheless. Which brings us to this.

Types of Risk Management

Once you delve into the world of risk management to learn as much as you can to jumpstart your risk management career, you will see that classifying risk management is not so easy.

The giants of the financial world have deconstructed risk management and then put it back together in more ways than I care to count.

Still, here are the nine major types of risk management we can talk about.

1. Strategic

A company resolves to this type of risk management when its place on the market is being threatened by a competitor.

As a result, the company in question needs to reduce the impact the competitor is making.

2. Compliance

It refers to new laws and regulations that might change the way a company operates. As a result, a risk manager is brought in to resolve the new issue.

3. Financial

Financial risk management has to do with accounts, insurance, assets, mergers, and everything in between.

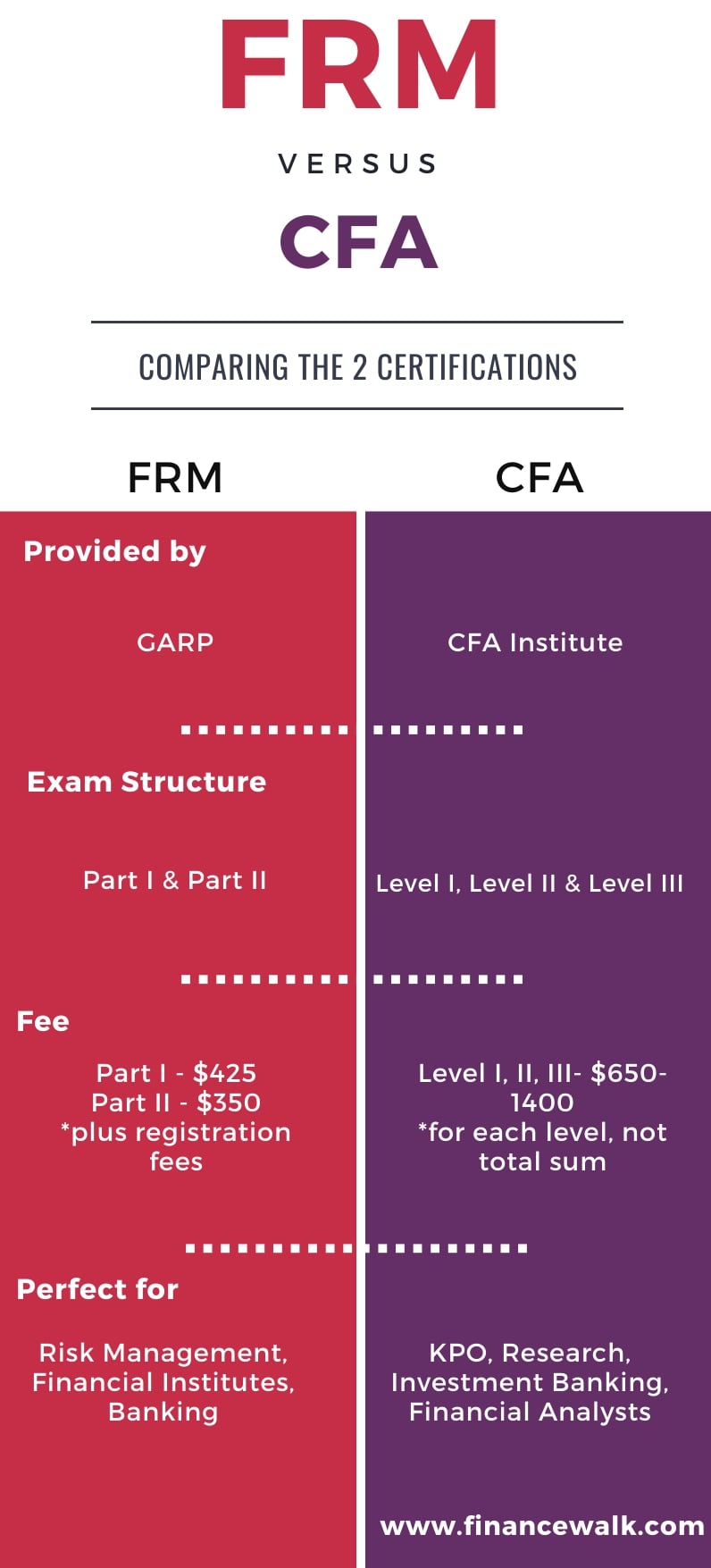

A coveted but very difficult position, business management is one of the most known and sought after jobs when it comes to risk management careers. You can choose between FRM and CFA for this career.

4. Operational

This type of risk management oversees any business operations problems such as machinery breaking down, power cuts, loss of employees, or primary materials to work with.

5. Environmental

As the name suggests, it’s the type of risk management that deals with natural disaster scenarios, as well as making sure your business is environmentally friendly.

6. Employee

Working with people is not easy, everyone knows that.

Of course, you already have the human resources department, but a company, especially a large one, also needs employee risk managers in case something unforeseen happens.

This includes stolen assets, fraud, and violent behavior.

7. Political

This type of risk management is not common, but it exists. For example, there are companies situated right on the border between two states that need to handle their situation extremely carefully, using a zip code and an email address.

8. Society

In recent years, societal risk management has become of the most important branches of the trade.

Therefore, if you are considering any risk management careers in business, why not look into this one?

There have been so many changes to our global society which include equal rights for the LGBTQ community, for women, for black people, as well as the free trade movement, veganism, legalization of some substances in the US, and so much more.

The job risk manager society wise is now a large branch that deals with all of this.

9. Cybersecurity

This is yet another branch of risk management that has taken flight in the past few years.

Extremely important and alarming issues such as stolen personal data off social media websites and the release of deep fake technology at large have made cybersecurity risk management more important than ever before.

Although not classified exactly as a traditional type of risk management, we can also talk about the benefits of a few other non-official categories:

- real estate risk management/insurance industry

- hedge fund risk management for business units

When talking about types and categories, these are just the basics or fundamentals of risk management.

For more details, here is a PDF of Paul Hopkins’ famous book by the same name.

You can also delight yourself with a great history of risk by reading Peter L. Bernstein’s Against the Gods: The Remarkable Story of Risk. You’ll love it!

Steps in the Risk Management Process

No matter what field or industry you might be working in, as a risk manager, you will have to follow the same general process to deal with the risks a company is involved in.

I have outlined that process for you here.

1. Identify any potential risks

Depending on the nature of the risk – scroll back up and go quickly through the types of risk I have laid out for you – you have to perform a lot of research and engage in as much brainstorming as you possibly can when you have this job risk management wise.

This is what will allow you to identify any source of potential risk.

Once you have done that, arrange them according to priority.

Understand that you will never be able to deal with all potential risks at once, so you need a hierarchy that will allow you to deal with the most pressing matters first.

2. Find the cause of the risk

The idea here is that, if you find the cause, it will be all the easier to solve it, instead of trying to fix the problem. Think about it this way – if a building is on fire, it’s a lot easier to find the source of the fire and put it out then to open a window.

3. Devise a solution to the problem

Once you have discovered both the problem and its source, take the appropriate measures to fix it.

But that’s not all. As risk managers or risk management professionals, you will also have to find a way to prevent that same problem as well as others from ever occurring again.

You can also view it as a type of insurance.

4. Come up to preventative plans

Contingency or preventative plans are the bread and butter, so to say, when it comes to risk management careers.

This is what a risk manager does. Of course, it’s great if you can solve the problems that come along, but the real reason you’re there is to prevent them from happening in the first place!

So how do you do that as risk management professionals?

Risk Management Tools and Techniques

To talk about tools and techniques, we need to view risk management as a methodology. As a risk manager, you will use one, several, or sometimes all of the following strategies.

Brainstorming

Already mentioned above, brainstorming begins with research, project documentation, similar situations from the past, online articles that could help, and everything that might be useful in your given situation.

Root cause analysis

This is a technique often used in risk management in project management. It’s a way for you to get to the essence of a problem or identify the fundamentals at stake in the project. If you can master this tool, you will become a fantastic risk manager that can prevent as well as solve.

SWOT

As you may or may not already know, SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

The simplest way to apply this technique is to just go through the letters one by one.

You can even lay them down in a table and write each one in a square. It will help you visualize things a lot better.

Risk register

This tool depends on the industry you’re working in or the type of risk management you are performing as risk management professionals.

As a result, it can be as basic as an Excel spreadsheet you have created yourself. Or as intricate as a piece of software that helps you out.

Either way, the risk register is there to identify the risks and explain what type of impact they might have on the company.

It will allow you to stay organized, prioritize your risks, and communicate them to the rest of the organization.

Risk Management Best Practices

Based on my experience, I have outlined five risk management best practices for you below that you will find useful:

Always involve the stakeholders

Remember the risk management process I detailed for you above? When you start that process, always involve the stakeholders.

That can mean the managers of the company, the employees, the clients, and everyone you see fit.

Never work alone!

They are all key players within the organization and they have an experience that will help you see the process and the company itself through their eyes and bring a fresh perspective on risk that you might not have seen, to begin with.

Risk management should be company culture

In other words, as a risk analyst, ask everyone within the company to understand that risk management is not your concern alone.

Instead, it should be one of the company’s core values. Everyone in the hierarchy – from the CEO to the first tier employees – needs to act responsibly and be in a constant state of awareness.

Keep communication going

This is not directed at you, the risk management professionals, but at everyone else. Make them understand that you cannot micromanage their departments.

As a result, if they spot something potentially risky within their department, they should communicate it to you right away.

Never stop monitoring

Just because you, the risk management professionals, have solved one problem, that doesn’t mean you can take a break. Proper risk management goes around the clock.

Always be on your toes and monitor everything that is going on within the business.

What Does a Risk Manager Do?

Since I’ve detailed all the different types of risk management for you above, the risk management job description as well as risk management opportunities will vary based on that.

The same goes for careers in risk management or as a risk analyst. It all depends on the branch you choose to work in when it comes to jobs in risk management.

However, if we were to talk in general terms, I could tell you that as a risk analyst, you will have to identify any potential risk that might affect a business.

You will also have to measure and evaluate it.

At the same time, as a risk analyst, you will have to devise the proper strategies that will help prevent or, otherwise, eliminate the risk.

As a result, you will need a keen eye for detail, people skills, business skills as well as outstanding analytical skills.

Not to mention that you will have to master the industry you will be working in.

Risk Manager Job Titles

Once again, as I stated above, depending on the type of risk management careers you want to go for, financial risk management jobs and their titles come in the tens if not the hundreds.

This usually depends mostly on the industry you are working in. The logic here is simple – a different industry means a different job title.

But here are some general risk manager job titles to aim for.

Risk Management Analyst

You will have a very wide range of responsibilities which include assessing strategies for investments, insurance, reducing risk, evaluating the level of risk on different investment projects, and more.

Associate in Risk Management

Also known as an ARM, this position will allow you to assist the process of making risk decisions within a company.

You will have to be qualified and have experience in risk control, risk assessment, and risk financing.

Risk Management Consulting Services

As a consultant, you may have the opportunity to work directly with clients and use your expertise in financial risk to advise them on different financial decisions.

You will have to develop strategies for your clients that will minimize their financial risk. As far as these risk management careers go, you can specialize in casualty, health, life, insurance, real estate industry, or more.

Risk Management Manager

You will most likely work for a company or a consultancy firm.

While in this position, you will have to create and develop risk models regarding operational risks as well as credit, finances, analytical support, and communicate them in an efficient way to your team.

Since this is an exhaustive guide, here is some additional information that you may find useful on this topic, from my experience.

Risk Assessment vs Risk Management

We’ve already seen at large what risk management is. But I often get this question – is it the same as risk assessment?

No, not.

Here is an easy way to understand this. Risk assessment is merely a part of risk management.

A crucial one, of course, but just one of the stages of the process which you need to follow when performing your duties as a risk manager.

As I noted above, risk management has a clearly defined process and some of it concerns itself with identifying and then analyzing any potential risks a business might go through.

Risk Management Career Path

Alright. Let’s talk about your career path.

How do I get a job in risk management?

Remember what I said at the beginning of the article about risk management going through the roof almost overnight because of the global pandemic situation?

While that’s true, this trend has been on an ascending trajectory for years now. What does that mean for you?

Well, it’s both good news and bad news.

It’s good news because it means that, all of a sudden, a risk management career has become one of the most wanted jobs on the planet. Yeeey you!

However, it also means bad news as far as the career path goes.

As you might have imagined, your career has to begin with education. The minimum educational requirement for a risk manager position is a Bachelor’s degree in finance, accounting, or any related field.

However, at this very moment, there are approximately 75 schools in the US alone that offer risk management as both a minor and a major.

This is a gigantic number! There is absolutely no way that all the students who graduate from those courses can ever find a job in the field of risk management, in a company, or even when it comes to risk management in banks or insurance.

There simply are not enough companies out there.

Therefore, after you graduate, try to find a job with a broker, a consultant, or an insurer as far as entry-level risk management jobs go.

In the long run, you might even get an offer from a client to be the risk manager at their own business.

Risk Management in Banks

Risk Management Certification

Financial risk management certification is crucial if you want to handle your career path correctly.

Here are the best risk management certification institutions you can apply to both in the US and internationally as well as the risk management certificate programs they offer:

- Frankfurt School of Finance & Management offers the CEMI or Certified Expert in Microinsurance. They also offer a Bachelor’s degree and a risk management program.

- Utica College Online offers the Organizational Risk Assessment and Management Certificate if you’re interested in a risk management certification online.

- Cambridge offers the Professional Program Certificate in Credit Risk and Credit Analysis as risk management training.

- The Institute of Risk Management in London, England offers the Digital Risk Management Certificate, again online certifications.

You can also sign up for the Bionic Turtle FRM Course that will help you study with plenty of notes, PDFs, and practice questions for your FRM Certification. Speaking of interview questions, they are here…

Risk Management Interview Questions

Here is a compilation of interview questions you might get during a risk management interview.

They will help you prepare for an upcoming meeting with a potential employer.

- How do you perform risk identification?

- What do you think a company’s blind spots are when it comes to risk?

- How do you prepare to respond to extreme events?

- Who is responsible for ERM?

- Do you have a strategy when it comes to risk management?

- What are, in your opinion, the top 10 risks?

- Do you include risk management in personal performance plans?

- Should all employees be trained when it comes to identifying and then reporting potential risks?

- What are correlated risks?

- Can you give an example of a disaster recovery plan?

Risk Management Careers – FAQs

Risk management is a very broad subject and yet I won’t deny that most of the people who approach me about it always seem to come round to the same few questions. So here they are.

Is risk management a good job?

Do you like apples? Of course, this is a very subjective thing to ask. However, I think the answer is in this very article if you’ve read it carefully since the beginning.

At the current moment, a risk management career is a fantastic way to go seeing the general state of unrest we find ourselves globally.

Companies have rushed to hire risk managers left and right to fix the insurance problems that have arisen out of nowhere.

Predictions also say that everything that has happened functioned as a bit of a lesson.

In the sense that companies will continue to hire risk managers should something like this ever happen again?

Do risk managers make good money?

Yes, risk managers are considered to make a fairly good salary as long as they have the right degrees. Reports show that, on average, a risk manager in the US makes approximately $117, 000 per year.

Apart from that, you will also receive bonuses and packages such as a flexible spending account, health, dental, and vision insurance, as well as relocation assistance if you need it as compensation or pay.

What is project risk management?

All risk management activities that can be attached to project management. This definition can be used in the world of finance but also in any other line of work where project management is involved.

What is credit risk management?

In the field of banking, credit risk management is seen as identifying, analyzing, and measuring risk levels when it comes to credit activities.

The idea is to eliminate all risks related to the credit process.

A final word for you

As we’ve seen, risk management careers are on the rise as we speak and the job growth is huge.

Not just because of the sad situation the world has had to face, but also because what we went through has taught us all a valuable lesson.

Risk comes in all shapes and sizes, companies can lose money, assets, and employees overnight for reasons you might have not even thought about a mere few months ago.

As a result, it is the risk manager’s job to keep the ship floating. Good luck!