The “effect of uncertainty of objects” makes a company suffer. Without prior knowledge of possible risks and ways to mitigate them, companies and organisations often incur losses.

These risks could be legal risks, credit risks, risks from natural calamities, attacks from adversaries and many others.

In order to have a profound understanding of these risks and identify them beforehand, the business of “risk management” comes into existence.

Risk management is simply identification, assessment and mitigation of possible risk factors, and to ascertain them, highly qualified, skilled and trained individuals are needed.

What risk management certification does is develop and build upon the existing risk management aptitude of professionals.

So, if you want to be a successful risk management professional, you need to have the required education, knowledge, and, experience.

Most of the courses outlined below can be pursued while holding on to a job and a fair timeline is given to complete them.

This guide is created to give the readers, YOU, a brief but concise understanding of the top risk management courses in the world in terms of what they mean, their eligibility factors, pass percentage, average salary and career scopes.

We hope you enjoy reading it.

What is the Best Risk Management Certification?

Let’s find out from these risk management certifications as to which certification or education is best.

1) Chartered Enterprise Risk Analyst® (CERA)

A CERA professional is a person who offers a 360-degree view of risks. The person blends both qualitative and quantitative aptitudes to analyse risks and takes integral actions.

The CERA credential is offered by the Society of Actuaries (SOA) and over the past decades, the portfolio of a CERA professional has evolved from helping clients to understand risks to actively working with organisations’ risk management policies.

CERA professionals work in high-risk competitive business environments to offer a holistic understanding of the risk profile.

Such professionals have strong ERM knowledge, ethics and leadership skills to don multiple roles in the organisation.

In the CERA course, the person learns;

- Qualitative aptitude

- Quantitative aptitude

- ERM – practical and theoretical

- Understanding the actuarial approach to risk

- General risk management

A maximum of 4 years period is there to complete CERA.

CERA Eligibility

Unlike other finance certifications, CERA is a little less strict. People with degrees in Finance, Mathematics, Economics and Business have higher chances of clearing CERA.

There are certain skills required:

- Keen business sense and knowledge of Economics, Finance and Accounting

- Good written and oral communication skills

- Familiarity with spreadsheets, word processing, databases and programmed statistics

- Problem-solving and analytical skills

CERA can be pursued on-the-job and with a dedicated focus, CERA can be attainted with self-study too.

Why Pursue CERA?

Every risk management course has its benefits.

Employers hire CERA professionals to receive comprehensive outlook towards enterprise risk management.

It helps them to strengthen internal ERM programs and enhance the output of human capital.

Sometimes CERA professionals are instrumental behind setting up ERM programs and the company benefits in the form of strong financial assessment skills.

If we talk about the risk management professional ecosystem as a whole, a CERA on-board helps the company to maintain strong financial control and reporting.

They are able to identify and assess security issues, identify business volatility and undertake rectifying measures.

CERAs help companies to maintain global competitiveness.

There isn’t much clear data on what CERA professionals earn but going by the statistics available on SimplyHired.com which pins the average salary as 89,000 USD in the US, with Illinois and Chicago being popular cities.

According to Payscale.com, the average pay package is 185,250 USD with 80% of CERA certification holding possessing 1-9 years of experience and 20% with 20+ years of experience.

2) Certified Risk Manager (CRM)

The National Alliance for Insurance Education and Research grants the CRM status to qualified individuals.

An individual with CRM certification is equipped to handle risks and exposures.

It makes the person aware of operational risks (identifying, controlling and administering), catastrophic exposures, political risks, fiduciary exposures, legal risks and others.

The job of the CRM/ Certified Risk Management Professional is to realise the occurrence of such risks and protect the company against it.

CRM Eligibility

Active risk managers are eligible to join the CRM certification course.

Anyone else associated with the risk management professional industry such as insurance professionals, legal experts, accountants and loss control professionals can join too.

An individual whose current career can benefit from CRM certification is encouraged to apply.

There are 5 CRM courses and each of the courses has to be cleared to achieve the CRM designation.

- Principles of Risk Management – testing the overall knowledge of the participant about risk management.

- Analysis of Risk – is about analysing and measuring risk, along with possible loss of data.

- Control of Risk – is about managing risks with crisis management policies, safety proficiency, dispute resolution and Employment Practices Liability

- Financing of Risk – is about finding various financing options to ensure minimisation of operational losses.

- The practice of Risk Management – is about strategizing and implementing the risk management professional process within the organisation.

Mastering all of the above CRM courses makes the individual a qualified professional to handle risks.

Each of the 5 courses is separate yet they sync to give the person a complete understanding of the risk management business.

They are rigorous in nature and as such, only if the person has 2-3 years’ experience in the risk management field is urged to apply.

The course can be pursued through classroom training, online training and in-house training.

The average salary of a Certified Risk Manager is 63,000 USD, according to SimplyHired.com.

But, if the designation of a ‘Risk Manager’ is considered in general, the salary packages vary between 80,000 USD – 111,000 USD (source).

Why Pursue CRM?

Once a person becomes CRM certified, the designation changes to “Planners, Protectors and Guardians” of a company.

It’s a professional stamp enabling the person to manage risk exposure and hazards, and equipping the professional to conform to excruciatingly demanding performance heights.

With an in-depth knowledge of priorities defining today’s companies, the CRM certification gives skills to become a proactive value addition to the organisation.

The new industry knowledge and practical skills are instantly implementable.

The professional comes across cutting-edge information and new ideas beneficial for the company.

The certification improves career and earning potential by leaps and bounds. Even though there is stiff market competition, there is strengthened job security.

All these benefits make the CRM certified professional an asset to the company, which in turn, works towards improving the reputation and profitability of the company.

3) Financial Risk Manager (FRM)

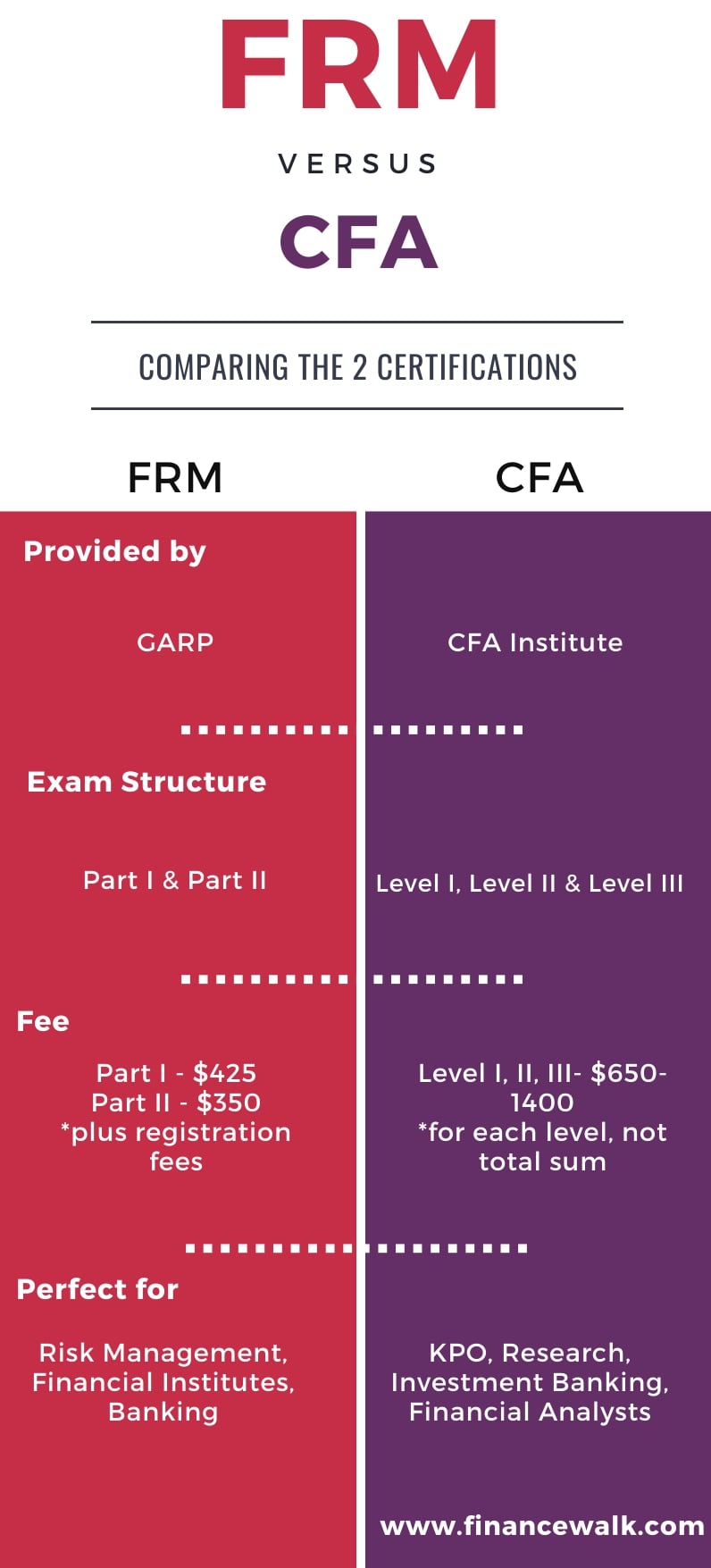

The Global Association of Risk Professionals (GARP) grants the FRM certification to candidates on becoming specialists in financial risk management.

The professionals handle market risks (liquidity risks, credit risks) and event non-market financial risks.

The first FRM designation was given in 1997 and presently, FRM professionals belong from Asia, Europe and USA.

The elite GARP network is 30,000 members strong.

FRM Eligibility

The exam measures the ability of an individual to recognise, analyse and manage risks.

This is a paper-based exam, which happens on the third Saturday of May and November every year, in a single sitting.

There are multiple-choice questions and the format is practical-oriented.

The professional needs to devote at least 150 hours on each paper to clear the exam.

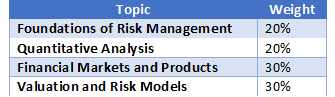

The Part I exam consists testing of core areas of risk management such as financial markets, risk modelling and quantitative analysis.

There are 100 multiple choice questions to be answered over a 4-hour period. The weightage given to each section is as follows.

The Part II exam tests the practical implementation of concepts, tests knowledge of market and operation risks.

There are 80 multiple choice questions to be answered over a timeline of 4 hours. The weightage given to each section is as follows.

Examinees need at least 46% in Part I and 52% in Part II to get the certification.

Why Pursue FRM?

The certification gives the person a competitive advantage over peers.

The world is increasingly becoming risk-centric, thereby increasing the demand for risk professionals, and the certification is a part of this.

As a certified professional, he/she able to distinguish himself/herself from other professionals.

For the employer, it translates into seriousness to handling risk management tasks.

According to “Wikipedia: The World’s Largest Banks”, the certified professionals find takers in the top 10 brackets of companies and banks.

The top 10 companies with the highest number of certified working professionals are:

- Industrial and Commercial Bank of China

- Bank of China

- HSBC

- Agricultural Bank of China

- Citigroup

- KPMG

- Deutsche Bank

- Credit Suisse

- UBS

- PwC

The top 10 banks employing the highest number of certified working professionals are:

- ICBC

- China Construction Bank

- Agricultural Bank of China

- Bank of China

- JP Morgan Chase

- Wells Fargo

- HSBC Holdings

- Citigroup

- Bank of America

- Banco Santander

The person works under massive pressure and handles high-value transactions.

Joining one of the elite groups of the world is an added incentive.

Leadership skills, high reputation, more opportunities and a distinctive edge over other risk professionals are a given benefit.

Every top employer in the world recognises the value of this certification.

In terms of salary, 900,000 INR is the average salary of Risk Manager in India and in the US, it is between 100,000 USD – 250,000 USD.

Take a look at the recommended career path of certified professionals in India.

Source: Payscale.com

There are varied career prospects after getting certified such as Analytics Client Consultant, Risk Qualification Manager, Corporate Risk Director, Risk Management Analytics Consultant, Credit Risk Specialists, Operational Risk Analysts, Regulatory Risk Analysts, Enterprise Risk Manager, Risk Quantification Manager and Large Enterprise Commercial Risk Manager.

Become a FRM Professional with this Course!

4) Professional Risk Manager (PRM)

The Professional Risk Managers’ International Association (PRMIA) grants the PRM certification.

It’s similar to FRM in many respects.

The choice between either of these courses will depend on exam flexibility, geographical location, career focus and market understanding.

The first PRM designation was awarded in 2004 and since then the PRMIA community has evolved magnanimously.

Both the PRM and the FRM are considered as two “definitive risk management” designations of the risk management industry.

PRM Eligibility

PRMIA brought a lot of changes in PRM eligibility in 2014.

A professional with Bachelors’ degree needs 2 years of experience whereas, without Bachelors’ degree, 4 years of experience is mandatory.

Moreover, someone with professional designations like CAIA, CFA and CQF doesn’t need any experience.

Unlike earlier where exams can be taken “on-demand”, there are fixed exam timelines now.

Here is a tabular representation of the exam schedule.

The passing percentage is 60%. All the questions are multiple-choice questions and a candidate needs to pass all the four exams – PRM I, PRM II, PRM III, PRM IV- in a span of 2 years.

PRM I covers three modules – financial markets, financial instruments and finance theory.

This module is devoted to basic financial concepts like Futures, Value of Money, Interest rates, Bonds and so on.

There are a total of 36 questions to be answered in 2 hours.

PRM II covers the mathematical foundation and statistical analysis aptitude.

PRM III module is all about risk management practices such as market risk, operational risk, capital adequacy, economic capital and regulatory capital.

Again, there are a total of 36 questions to be answered within 1.5 hours.

PRM IV modules are on case studies and testing the professional’s understanding PRMIA code of ethics, conduct and bylaws.

Why Pursue PRM?

A person pursues PRM most for the same reasons why FRM is pursued.

90% of the syllabus is the same and in terms of future prospects, a person with PRM can go into senior risk analyst, predictive analyst, investment risk manager jobs.

5) Risk and Insurance Management Society Fellow (RIMS Fellow)

The Risk and Insurance Management Society (RIMS) confers the Fellowship to any professional of the risk management industry willing to enhance skills and industry knowledge, along with demonstrating a high ethical behaviour.

The RIMS Fellow gives the professional competitive advantage over other colleagues and places the person in a position of leadership.

Upon completion of the RIMS Fellow, the person can add ‘RF’ next to the name and it works like a ‘stamp of approval’ indicating that the person has adequate tools and skills to manage external, operational and financial risks.

RIMS Fellow Eligibility

There are educational and experience criteria to follow.

On the educational side, the person needs to complete at least 3 courses – Risk Financing, Risk Assessment and Risk Control – in college.

On the other hand, a person with Associate in Risk Management (ARM), ALARYS Certificate, Certified Risk Manager (CRM) and Canadian Risk Management (CRM) credentials are automatically eligible for RIMS Fellow application. Lastly, 5 years of industry experience is mandatory.

Surprisingly, for RIMS Fellow, we couldn’t find any salary or pass percentage indication.

Now that we have covered all the popular risk management courses, here’s a lowdown on the popular communities associated with them.

Risk Management Communities

In the previous section, we covered the topmost risk certification courses and certifications in the world.

This section is about communities.

When these courses are pursued, you’re enrolled in specific societies that are active communities to network and engage with similar professionals.

For instance, with CERA you join the SOA community.

Here is a brief on some of the relevant societies.

1) Society of Actuaries (SOA)

SOA is the result of the merger between the American Institute of Actuaries (AIA) and the Actuarial Society of America (ASA).

Initially, memberships were based on “by invitation” mode only but now, qualified professionals are automatically inducted.

The CERA, Associate of Society of Actuaries (ASA) and Fellow of the Society of Actuaries (FSA) are the three available designations.

Interested members have to clear actuarial exams which include subjects such as Economics, Mathematics, Insurance, Finance, Interest theory, Actuarial sciences and Life models.

Currently, the CERA is a network of over 23,000 actuaries with SOA.

2) Global Association of Risk Professionals (GARP)

Headquartered in New Jersey, the GARP is a not-for-profit membership organisation for risk professionals from over 195 countries and 150,000 members strong.

It grants the Financial Risk Manager (FRM) and Energy Risk Professional (ERP) certifications and the only organisation to do so.

GARP members are often employed by investment banks, government agencies, management firms, central banks, commercial banks and academic institutions.

The GARP community supports its members to improve their risk management career opportunities, worldwide.

It also offers some risk education programs which are the International Certificate in Banking Risk and Regulation (ICBRR) and Foundations of Banking Risk (FBR) Program.

The GARP community consists of thousands of professionals, FRMs, ERPs, staff and practitioners.

The GARP community is deeply connected with the core industries.

There are 3 kinds of memberships available – Affiliate, Student and Individual.

Every year, GARP presents the ‘Risk Manager of the Year Award’ to either a group of individuals or an individual who has shown stupendous progress in the profession of financial risk.

In 2013, the Partner and Chairman of the Risk Committee and Advisory Panel of Kepos Capital LP, Robert B. Litterman, received the award.

3) Professional Risk Managers’ International Association (PRMIA)

PRMIA is a non-profit organisation founded in 2002 which focuses on the “promotion of sound risk management standards and practices globally”.

Apart from PRM certification, there are other educational programs conducted by them, which is the Associate PRM and the Operational Risk Manager (ORM) certification.

PRMIA offers membership of three kinds – Individual Membership, C-Suite Membership and Corporate Membership.

In the Individual Membership, the person is given access to all certification programs, risk management practices, an active community and a big scope for continued networking.

In the C-Suite Membership, advanced professionals participate to discuss risk-related issues in the open forum.

The programs are matched to meet the requirements of the C-Suite professional.

The membership includes invites to C-Suite events to share their thought leadership.

Lastly, members are selected on the basis of responsibility, experience and company size.

In the Corporate Membership, PRMIA offers a professional solution to corporate members in terms of front-line staff, back-end support, risk resources, networking, educational resources and mentoring.

4) The Risk and Insurance Management Society (RIMS)

Founded in 1950 and headquartered in Manhattan, the RIMS is a professional association devoted to the risk management industry.

Getting the RIMS Fellow status automatically inducts you into the active community of 10,000+ globally located risk management professionals.

RIMS is associated with more than 3500 charitable, services, non-profit, industrial and government entities.

The RIMS membership is open to anyone handling risk responsibilities. The professionals get access to high-end resources and learning opportunities.

Takeaway

Which of these risk management courses should be pursued completely depends on career goals.

Suggested Read: You can read our financial analyst job description guide.

On the look of it, there may not seem much difference in job prospects and benefits but there are, and the best way to know more in detail is to talk to professionals from these industries.

Find and read online interviews, network with them on professional websites like LinkedIn or simply join the communities listed above to network and know.